Demystifying Loan Payments: A Comprehensive Guide to NPER in Excel

What is the NPER Function?

Imagine you’re applying for a loan and need to estimate how many monthly payments you’ll make. The NPER function steps in! It calculates the number of payment periods required to repay a loan based on a constant payment amount and interest rate.

Table of Contents

nper in excel

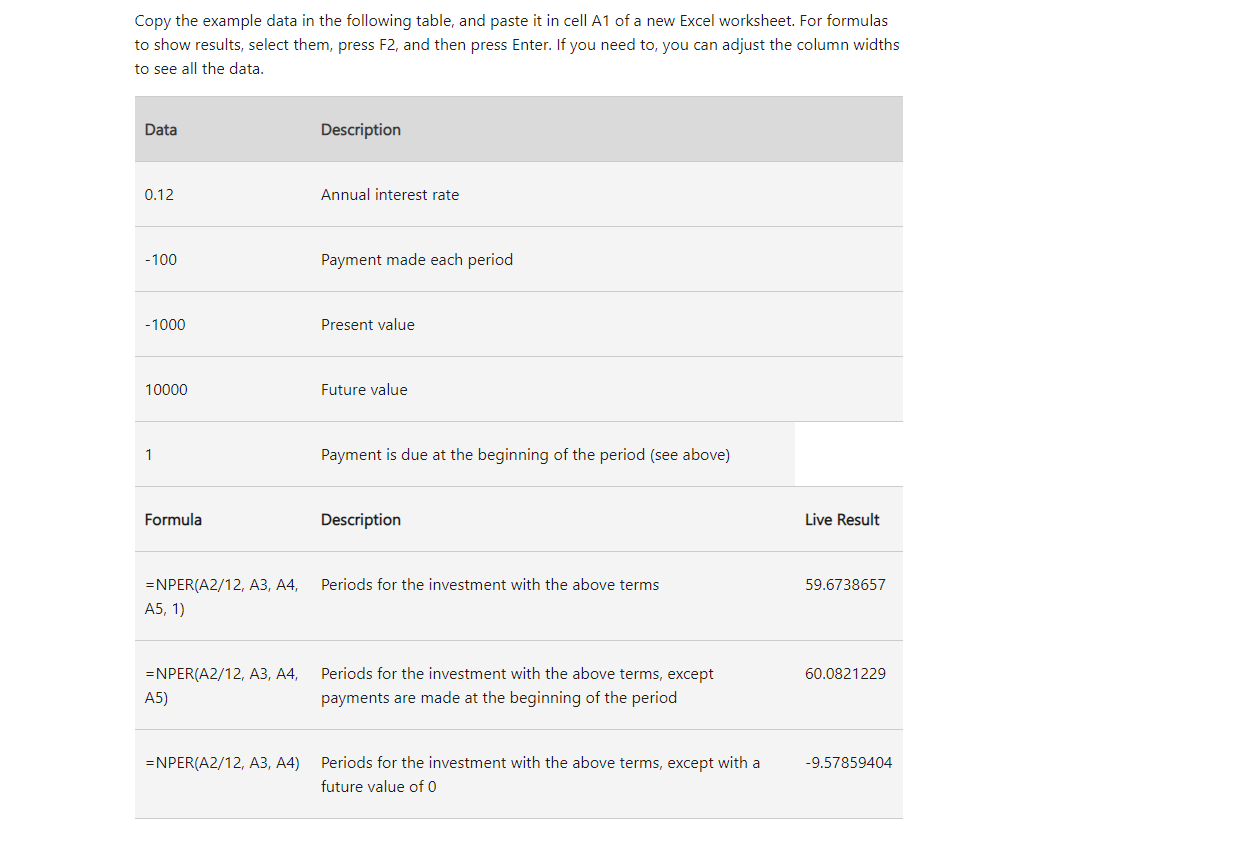

Here’s the formula breakdown:

=NPER(rate, pmt, pv, [fv], [type])

- rate: The interest rate per period (e.g., monthly interest rate for a monthly payment loan).

- pmt: The fixed periodic payment amount you make towards the loan.

- pv: The present value, which is the total amount you borrow initially.

- [fv] (optional): The future value, which is the balance you want remaining after the final payment (usually 0 for fully repaid loans).

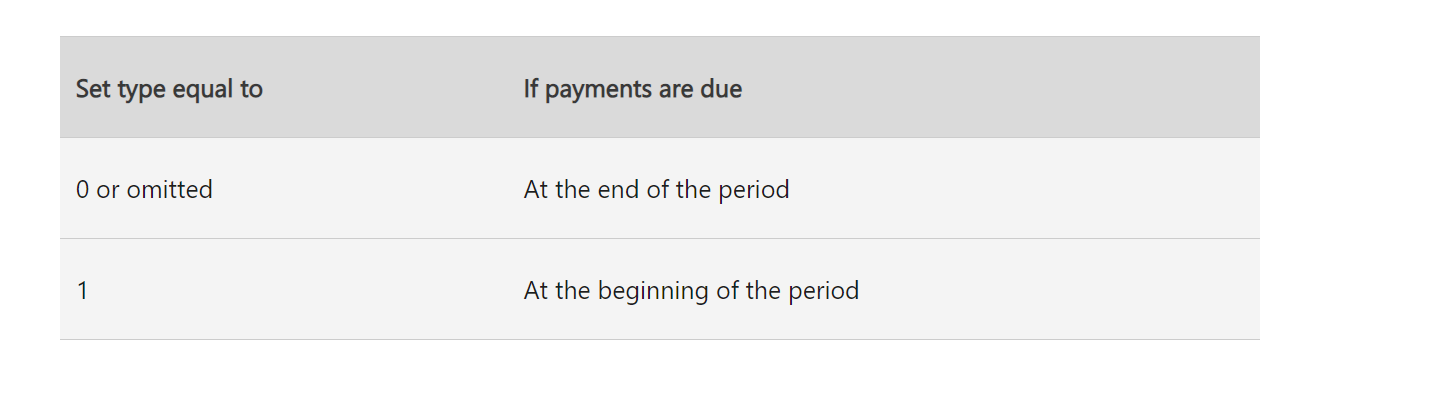

- [type] (optional): Specifies when payments are due (0 for payments made at the end of the period, 1 for payments made at the beginning of the period). The default is 0.

Unlocking the Power of NPER: A Step-by-Step Guide

Let’s use an example to illustrate how NPER works:

- You borrow a loan of $10,000 (pv) at an annual interest rate of 5%.

- The loan requires a monthly payment (pmt) of $150.

- You want to know how many months (periods) it will take to repay the loan in full (fv = 0).

Steps in Excel:

- Enter the following formula into a cell:

=NPER(5%/12, -150, 10000, 0)

- Note: We divide the annual interest rate (5%) by 12 to get the monthly interest rate.

- Tip: The payment amount (pmt) is entered as a negative value since it represents money flowing out.

- Press Enter. The result will be the number of months required to repay the loan, which in this case might be around 70.

Schedule Variance (SV) in Earned Value Management – projectcubicle

Beyond the Basics: Advanced Applications of NPER

NPER isn’t just for calculating loan repayment periods. Here are some additional ways to leverage its power:

- Investment Planning: Use NPER to estimate how long it will take for your investments to reach a specific target amount, considering periodic contributions and interest earned.

- Loan Comparison: Compare different loan options by calculating the payment periods for each using NPER. This helps you choose the loan with the shortest repayment timeframe.

- Scenario Analysis: Play with different interest rates and payment amounts within the NPER formula to see how they affect the loan repayment period.

Tips and Tricks for NPER Mastery

- Error Handling: Ensure your inputs (rate, pmt, pv) are valid numbers. If there’s an error, Excel will display an error code. Also, common mistakes include using a positive value for payment or forgetting to convert the annual interest rate to a periodic rate.

- Goal Seek: Combine NPER with the Goal Seek function to find the payment amount required to achieve a desired loan repayment period. Also, this is helpful for setting realistic repayment goals.

What is Nper in a PMT function?

In the PMT function, Nper stands for the total number of payments required to settle a loan. Also, it’s one of the required arguments you input into the function.

What does Nper mean in Excel PMT?

Nper has the same meaning in Excel’s PMT function as explained above. It represents the total number of periodic payments for the loan.

What is the difference between Nper and PMT?

Nper and PMT are different inputs used in the PMT function:

- Nper (number of periods) tells the function the total number of payments you’ll make.

- PMT (payment) is the output of the PMT function, which calculates the periodic payment amount you need to make based on the loan details.

What is Nper in the FV formula?

The FV (Future Value) formula itself doesn’t directly use Nper. However, Nper can be indirectly related to FV. Also, it can represent the number of periods over which you want to calculate the future value of an investment.

What is type in Nper Excel?

The type argument in the PMT function is optional and specifies whether the payment is made at the beginning or end of the period. In most cases, it’s left blank and defaults to 1, assuming the payment is made at the end of the period.

How to calculate PMT?

You can calculate the PMT (periodic payment) using the PMT function in spreadsheets like Excel or by using financial calculators. The function itself requires several inputs:

- Rate: The interest rate per period (usually monthly or yearly).

- Nper: The total number of payments to be made.

- Pv: The present value, which is the initial loan amount.

Here’s an example of the PMT function in Excel:

=PMT(rate, nper, pv)

Let’s say you take a loan of $10,000 (present value) with an annual interest rate of 5% (converted to monthly rate: 5%/12 = 0.4167%) and the loan needs to be repaid over 2 years (24 monthly payments). The formula would be:

=PMT(0.004167, 24, 10000)

This would give you a monthly payment amount of around $430.13.

I hope this clarifies the concept of Nper and PMT function!

By incorporating the NPER function into your Excel spreadsheets, you gain valuable insight into loan repayment timelines. This empowers you to make informed financial decisions, estimate future expenses, and approach your financial goals with confidence. So, the next time you need to tackle loan calculations, remember NPER – your friendly neighborhood number cruncher in Excel!

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/