YEARFRAC and Year Calculations in Excel: How to use the Excel YEARFRAC function

How to use the Excel YEARFRAC function? Excel, Microsoft’s powerful spreadsheet software, is equipped with an array of functions to perform date and time calculations, making it an indispensable tool for professionals across industries. Among these functions, YEARFRAC and the YEAR function stand out for their ability to manage yearly calculations with precision, even accounting for complexities like leap years. This guide delves deep into how these functions work, their applications, and how to leverage them to streamline your data analysis tasks.

Table of Contents

Understanding YEARFRAC in Excel

The YEARFRAC function in Excel calculates the fraction of a year that exists between two specified dates. This function is particularly useful for financial analyses where interest calculations over partial years are necessary, or in any scenario requiring precise duration measurements in year fractions.

How is YEARFRAC Calculation in Excel?

How is YEARFRAC Calculation in Excel?

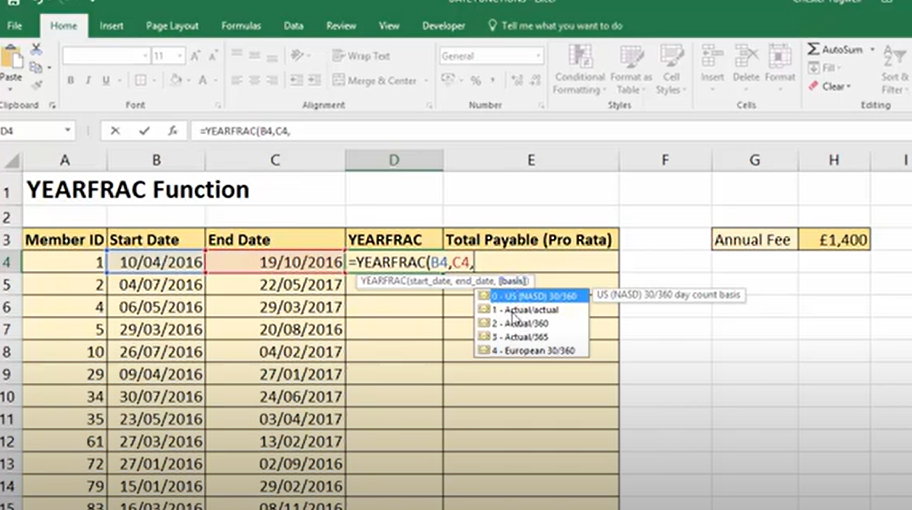

To perform a YEARFRAC calculation, you would use the following syntax:

=YEARFRAC(start_date, end_date, [basis])

start_dateandend_dateare the two points in time you’re measuring between.[basis]is an optional argument that specifies the day count convention to use.

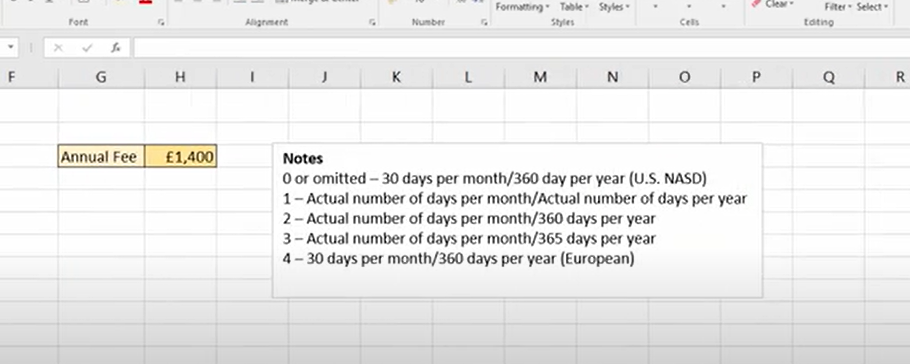

The basis for YEARFRAC can be one of the following values:

| Basis | Description |

|---|---|

| 0 | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

Choosing the right basis is crucial for accurate calculations, especially in financial contexts.

important notes about year calculations in excel

What Is the YEAR Function in Excel?

How to use yearfrac function in excel? The YEAR function is another time-related function that extracts the year from a given date, returning it as a four-digit number. This is incredibly useful for when you need to categorize or analyze data based on the year.

How to Perform a Year Count in Excel?

A year count can be performed using both the YEAR and YEARFRAC functions, depending on your specific needs. While YEAR can give you the year portion of a date, YEARFRAC can help you calculate how many years, including fractional years, have passed between two dates.

Does YEARFRAC Account for Leap Years?

How to use yearfrac function in excel? Yes, YEARFRAC does account for leap years, which is particularly important when using the Actual/actual basis (1). This ensures that your calculations are precise, even when the period in question includes February 29.

Exploring the Basis of YEARFRAC

The basis parameter in the YEARFRAC function determines how the function calculates the days in a year, which directly influences the year fraction result. Selecting the appropriate basis allows for customized calculations tailored to specific accounting or financial requirements.

What Does YEARFRAC Do in Sheets?

In Google Sheets, YEARFRAC operates similarly to Excel, providing users with the ability to calculate the fraction of a year between two dates. This functionality supports a wide range of applications, from academic to financial analysis, ensuring users can obtain precise duration measurements.

Does YEARFRAC Account for Leap Years?

Yes, YEARFRAC accurately accounts for leap years, which is crucial for financial calculations requiring precision. The function’s ability to consider the actual number of days in each year, especially when the Actual/actual basis is used, ensures that calculations are precise and reflect real-world durations.

What is the Basis of YEARFRAC?

The basis of YEARFRAC refers to the day count convention used in the calculation. Excel offers five options, each represented by a number from 0 to 4:

- 0: US (NASD) 30/360

- 1: Actual/actual

- 2: Actual/360

- 3: Actual/365

- 4: European 30/360

Each basis applies different rules for counting days and months, affecting the calculation outcome. Choosing the correct basis is essential for aligning the calculation with specific financial or analytical standards.

What Does YEARFRAC Do in Sheets?

In Google Sheets, much like in Excel, the YEARFRAC function calculates the year fraction between two dates. It follows the same syntax and offers the same basis options, ensuring consistency across platforms. This cross-platform functionality allows users to apply their Excel knowledge directly in Google Sheets, facilitating seamless data analysis and reporting activities.

Conclusion

The YEARFRAC function in Excel is a testament to the software’s capability to simplify complex operations into user-friendly formulas. Whether you’re analyzing financial statements, managing projects, or simply organizing dates, understanding how to leverage YEARFRAC can significantly enhance your Excel proficiency. By incorporating this function into your Excel toolkit, you unlock a new dimension of date-related analysis, poised to tackle challenges with accuracy and insight.

Practical Applications and Examples

Example 1: Calculating Age Precisely

=YEARFRAC(DOB, TODAY(), 1)

This formula calculates the precise age of an individual or item from its date of birth (DOB) to the current date.

Example 2: Interest Calculation for Partial Years

=Interest_Rate * YEARFRAC(Loan_Start_Date, Loan_End_Date, 3)

This formula calculates the interest accrued over a loan period that doesn’t align perfectly with the start and end of a calendar year.

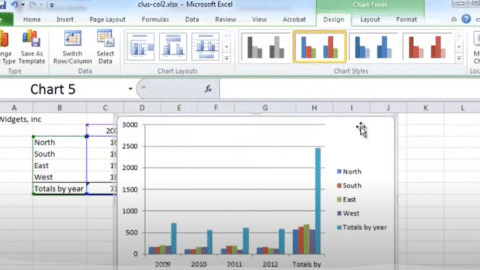

Visualizing YEARFRAC and YEAR Calculations

To enhance understanding, visuals such as step-by-step screenshots or diagrams illustrating how to input these functions into Excel and view their results would be beneficial. However, in this format, I recommend creating or consulting tutorials with images for a more intuitive learning experience.

Closing Thoughts

The YEARFRAC and YEAR functions in Excel are indispensable tools for managing and analyzing time-related data. Whether you’re calculating age, determining interest over partial years, or simply extracting the year from a date, these functions offer the precision and flexibility needed for a wide range of applications. By understanding how to use these functions effectively, you can unlock new insights from your data and streamline your analytical processes.

Your Feedback Matters

Your insights and experiences with using YEARFRAC and YEAR functions in Excel are invaluable. If you have questions, suggestions, or specific scenarios you’d like us to explore further, please don’t hesitate to reach out. Your feedback helps us refine our guides and better cater to your Excel learning needs.

FAQs on YEARFRAC in Excel

1. What exactly does the YEARFRAC function do in Excel?

YEARFRAC calculates the fraction of a year that exists between two dates. This can be useful for calculating interest payments, age, service tenure, and other scenarios where understanding the exact portion of a year is necessary.

2. Can YEARFRAC handle different types of year lengths?

Yes, YEARFRAC can adjust calculations based on the day count convention specified by the basis argument. This means it can accurately account for leap years as well as different financial year conventions.

3. How do I choose the right basis for my YEARFRAC calculation?

The choice of basis depends on the context of your calculation:

- 0 (US/NASD 30/360) is commonly used in finance for corporate bonds.

- 1 (Actual/actual) is used for calculations that require precise accuracy, including government bonds.

- 2 (Actual/360) is often used in banking for certain interest calculations.

- 3 (Actual/365) is used for some financial calculations in banking.

- 4 (European 30/360) is used for bonds in the European market.

4. How does YEARFRAC differ from simply subtracting one year from another?

YEARFRAC provides the fractional part of the year between two dates, not just the difference in their year numbers. This is crucial for precise time-span calculations where the exact duration matters, not just the difference in years.

5. Does YEARFRAC account for leap years?

How to use yearfrac function in excel? Yes, especially when using the Actual/actual basis (1). YEARFRAC will consider the actual number of days in each year, ensuring calculations are accurate even for periods that include a February 29.

6. Is there a way to use YEARFRAC for calculating age in Excel?

Absolutely. You can use YEARFRAC with a person’s birthdate as the start_date, today’s date (TODAY()) as the end_date, and typically basis 1 (Actual/actual) to get a precise calculation of age in years, including the fractional part.

7. How do I avoid errors when using YEARFRAC in Excel?

Ensure your start_date and end_date are correctly formatted as dates in Excel. If you input them as text or in an incorrect date format, YEARFRAC may return an error. Using the DATE function to create dates (e.g., DATE(year, month, day)) can help avoid such issues.

8. Can YEARFRAC be used across different spreadsheet programs like Google Sheets?

Yes, YEARFRAC is also available in Google Sheets with the same syntax and functionality, making it easy to apply your Excel knowledge in Google’s spreadsheet environment.

9. What are some common applications of YEARFRAC in professional settings?

Professionals use YEARFRAC for calculating prorated salaries, lease terms, depreciation schedules, interest payments, and service tenure for benefits eligibility, among other applications.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/