Excel Yield Function: Understanding the Basics and Maximizing Your Spreadsheet Efficiency

Introduction

When it comes to working with data and performing complex calculations in Excel, one function that stands out is the Yield function. Whether you’re a beginner or an experienced user, understanding how to utilize the Excel Yield function can significantly enhance your spreadsheet efficiency. In this comprehensive guide, we will delve into the intricacies of the Yield function, providing you with the knowledge and expertise needed to master this powerful tool. So, let’s get started and unlock the full potential of Excel!

Table of Contents

Excel Yield Function

1. What is the Excel Yield Function?

The Excel is a powerful tool designed to calculate the yield on a bond or other fixed-income security. It enables Excel users to determine the annual yield of an investment based on various factors, such as the bond’s price, maturity date, and coupon rate. By utilizing this function, individuals can efficiently analyze and compare different fixed-income investments, aiding in informed decision-making processes.

2. How Does the Excel Yield Function Work?

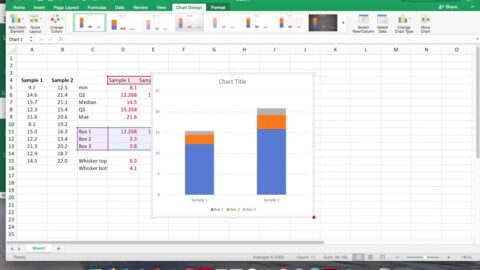

The Excel Yield function operates on the concept of iterative calculations, employing a trial-and-error method to find the desired yield value. It uses an initial guess and then iteratively refines the guess until it reaches an acceptable level of precision. Also, by adjusting the guess, the function progressively narrows down the yield value that satisfies the bond’s present value equation, which equates the sum of the present values of future cash flows to the bond’s current price.

3. Using the Excel Yield Function for Bond Yield Calculation

One of the primary applications of the Excel Yield function is in the calculation of bond yields. Bonds are fixed-income securities that pay periodic interest payments (coupon payments) and return the principal amount (face value) at maturity. Also, the yield of a bond reflects its overall return to investors and is a crucial factor in determining its attractiveness as an investment. By utilizing the Excel Yield function, you can quickly and accurately calculate the yield of various bonds, enabling you to make informed investment decisions.

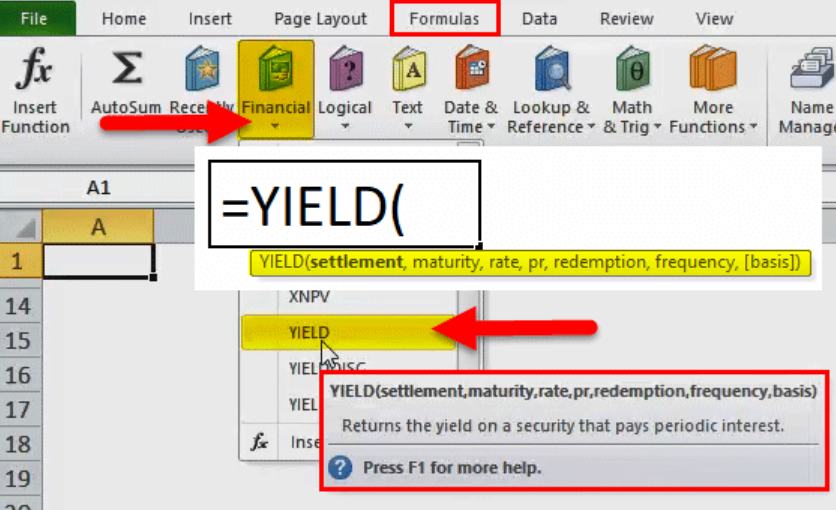

4. The Syntax of the Excel Yield Function

The syntax of the Excel Yield function is as follows:

=YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])

- settlement: The settlement date of the bond.

- maturity: The maturity date of the bond.

- rate: The annual coupon rate of the bond.

- pr: The bond’s price per $100 face value.

- redemption: The bond’s redemption value per $100 face value at maturity.

- frequency: The number of coupon payments per year.

- [basis]: An optional argument specifying the day count basis to use.

5. Common Errors and Troubleshooting Tips

While using the Excel, you may encounter a few common errors. One such error is the “#NUM!” error, which occurs when the function fails to converge on a solution within 20 iterations. Also, to resolve this, you can adjust the initial guess or check the provided inputs for accuracy. Another error is the “#VALUE!” error, which usually arises due to incorrect input types or invalid data. Double-check the inputs and ensure they align with the expected format to rectify this error.

6. Excel Yield Function vs. Yield to Maturity

It is important to distinguish between the Excel and yield to maturity (YTM) concepts. While the Excel Yield function calculates the yield on a bond, YTM represents the total return anticipated on a bond if it is held until maturity. YTM considers the bond’s purchase price, coupon rate, time to maturity, and the face value of the bond. Also, by comparing the yield calculated using the Excel Yield function to the YTM, investors can gain insights into the bond’s potential profitability and evaluate its suitability for their investment portfolio.

7. Practical Applications and Use Cases

Excel finds widespread application across various financial scenarios. It is particularly valuable for investors, financial analysts, and portfolio managers involved in fixed-income securities. Also, accurately calculating yields helps these professionals assess the risk and return characteristics of different bonds, determine fair pricing, and make informed investment decisions. The Excel Yield function is also instrumental in creating financial models, performing sensitivity analyses, and conducting scenario-based assessments.

8. Tips for Optimizing Your Use of the Excel Yield Function

To maximize your efficiency and leverage the full potential of the Excel Yield function, consider the following tips:

- Understand the underlying financial concepts: Familiarize yourself with bond pricing, coupon rates, and yield calculations to grasp the essence of the Excel Yield function.

- Utilize named ranges: Implement named ranges for your inputs to enhance formula readability and simplify future adjustments.

- Consistency in units: Ensure consistency between the frequency of coupon payments and the other inputs. For example, if using an annual coupon rate, set the frequency to 1.

- Cross-reference with external data sources: Validate your calculated yields by cross-referencing them with reputable financial data providers or industry benchmarks.

- Perform sensitivity analyses: Adjust key inputs, such as bond prices and coupon rates, to assess the impact on yields and make informed investment decisions.

- Stay up-to-date with Excel updates: Regularly check for updates and new features that may enhance the functionality and performance of the Yield function.

9. Excel Yield Function FAQs

9.1 What is the purpose of the Excel Yield function?

The Excel Yield function allows users to calculate the yield of a bond or fixed-income security, aiding in investment analysis, comparison, and decision-making processes.

9.2 Can the Excel Yield function handle different payment frequencies?

Yes, Excel is flexible and can accommodate various payment frequencies, such as annual, semi-annual, quarterly, or monthly coupon payments.

9.3 Is it possible to calculate the yield for a bond with irregular cash flows?

Yes, Excel can handle bonds with irregular cash flows by incorporating the appropriate cash flow amounts and dates into the calculation.

9.4 How can I incorporate the Excel Yield function into a financial model?

To incorporate Excel into a financial model, reference the function within your model, providing the necessary inputs and adjusting the formula based on your specific requirements.

9.5 What are some alternative methods for calculating bond yields in Excel?

In addition to Excel, alternative methods for calculating bond yields in Excel include utilizing the IRR function, utilizing the XIRR function for bonds with irregular cash flows, or building custom formulas based on financial principles.

9.6 Are there any limitations or constraints when using the Excel Yield function?

While Excel is a powerful tool, it is important to note that it assumes certain assumptions, such as the absence of transaction costs and the reinvestment of coupon payments at the yield rate. Also, evaluating these assumptions and considering other factors is crucial when making investment decisions.

10. Conclusion

In conclusion, Excel is an invaluable tool for financial professionals and Excel users alike. By accurately calculating the yield on bonds and other fixed-income securities, this function enables users to make informed investment decisions, analyze financial scenarios, and optimize their spreadsheet efficiency. Also, with a deep understanding of Excel and its practical applications, you can unlock the full potential of Excel and take your data analysis skills to new heights.

Remember, mastering the Excel Yield function requires practice and continuous learning. So, don’t hesitate to explore further resources, consult experts, and experiment with real-world examples. Also, doing so can enhance your expertise, gain a competitive edge, and excel in your financial endeavors.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/