Enterprise Risk Management (ERM) Protect and Enhance Your Enterprise’s Value

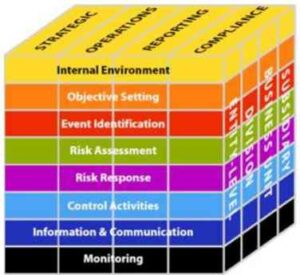

Enterprise risk management (ERM), which provides a portfolio view of the most important risks. is a framework for managing organizational risks.

Table of Contents

Do you know what the principal risks facing your organisation are?

Do you need help in developing a Risk Management Framework covering JDs, principles, procedures and reporting structure?

Do you know the risk appetite and risk assessment criteria for your projects and business divisions?

Do you need support in your enterprise’s risk tool selection, configuration and risk-reporting design specification?

What You Get

✔ Risk management framework which aligns with ERM best-practice frameworks such as King IV principles; the COSO; and ISO 31000:2018

✔ Portfolio risk analysis and reporting providing visibility over inherent, current and target risk exposure through risk identification, assessment with mitigation plans

✔ A dedicated BAU risk unit to support the overall Enterprise risk management (ERM) by improving risk maturity amongst divisions

Steps to implement Enterprise Risk Management (ERM)

Risk Management Framework components

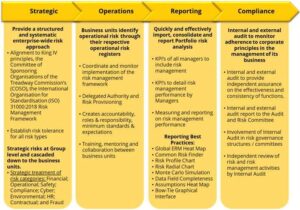

A risk management framework should be established to methodologically assess risks and opportunities affecting value creation.

This risk governance framework will capture and communicate risks in a standard form and timeframe. The Risk Management Framework will specify the Risk Reporting, PMO and Key Performance Indicators (KPIs) that would need to be established per Business Unit.

Risk Escalation Reporting & Governance

Review and Monitor Performance (Ongoing continuous process, Self-Assessments Independent monitoring and evaluation)

Conduct an initial Enterprise-wide risk assessment on the risk appetite

Evaluate the current state of the risk culture to assess the risk appetite and define risk assessment criteria to identify opportunities for improvement. Develop risk registers from this risk assessment criteria to identify residual and inherent risk exposure, existing controls, risk treatment plans and risk owners. Establish monitoring mechanisms for daily monitoring and reporting.

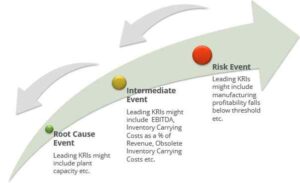

Identify Key Risk Indicators (KRIs) for Enterprise Risk Management

KRIs can be used to identify emerging risks and root causes.

Monitor these risks and their mitigation, as well as agree which to prioritise and trigger points for escalation.

Strategic responses and action plans developed for each trigger point

How Dada can help you

See how we can help keep your projects strategically aligned so that you can deliver on the benefits with our flexible monthly subscriptions allowing you to change your resources quickly post lock-down without the H&S liabilities.

See Also

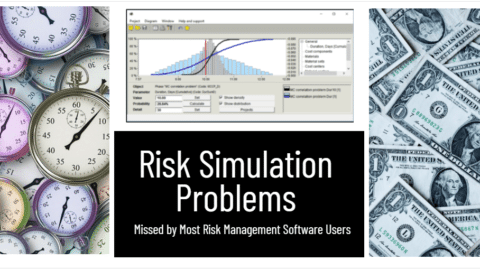

Difference Between Quantitative and Qualitative Risk Analysis

A dedicated Career Coach, Agile Trainer and certified Senior Portfolio and Project Management Professional and writer holding a bachelor’s degree in Structural Engineering and over 20 years of professional experience in Professional Development / Career Coaching, Portfolio/Program/Project Management, Construction Management, and Business Development. She is the Content Manager of ProjectCubicle.

Sometimes everyone should take risks but for a business, it is one of the last things to do. So, Risk Management consultation is important.

Success come from risk , everyone have to take risk but with control. So Enterprise Risk Management is important.

The goal of an ERM is to understand an organization’s tolerance for risk, categorize it, and quantify it.