Understanding and Calculating Counterparty Risk in Financial Transactions

What is Counterparty Risk?

Definition and Relevance

Calculating Counterparty Risk, also known as default risk or credit risk, refers to the risk that one party in a financial transaction will fail to meet their contractual obligations. This risk is crucial because it directly impacts the financial stability and trustworthiness of markets, from simple bilateral contracts like loans and leases to complex financial instruments like derivatives and bonds.

Table of Contents

Real-world Examples

- Swaps: If you’re on the receiving end of an interest rate swap where the other party promises to pay you a fixed rate while you pay them a floating rate, and they default, you lose on the anticipated fixed-rate payments.

- Bonds: When you invest in a corporate bond, your returns are dependent on the company’s ability to make scheduled interest payments and return the principal at maturity. A default means a loss of future cash flows and potentially the principal investment.

- Repos (Repurchase Agreements): In this case, lenders face the risk that the borrower will fail to repurchase the securities that were sold to the lender, usually at a higher price.

- Trade Credits: Businesses offering goods and services on credit terms are exposed to counterparty risk until the client pays the outstanding amount.

Why is Counterparty Risk Important?

Financial Loss

Financial loss is the most immediate and apparent impact of counterparty risk. When a counterparty defaults, the potential profits or benefits from the transaction are lost, sometimes leading to immediate financial strain or longer-term impacts on financial stability.

Liquidity Concerns

A default could result in your assets or capital being tied up for an extended period, leading to liquidity issues. This can be problematic for organizations that operate on thin margins or have tight cash flow timelines.

Credit Crunch

An atmosphere of high counterparty risk can result in a credit crunch, where banks and financial institutions become highly selective in lending. This can lead to a cascading effect where the overall availability of credit in the economy dries up, potentially triggering a recession.

Operational Strain

When a counterparty defaults, the non-defaulting party has to devote resources to manage the fallout, which includes legal battles, renegotiations, and potential restructuring, all of which are resource-intensive and distract from core business activities.

How to Calculate Counterparty Risk?

Calculating counterparty risk is often complex and involves both qualitative and quantitative methods. Here’s a deep dive:

Credit Ratings

Credit ratings, issued by agencies like S&P, Moody’s, and Fitch, provide a first-glance assessment. However, they can sometimes be outdated or may not capture the most current financial stability of a firm. Therefore, relying solely on them can be risky.

Quantitative Metrics

Exposure at Default (EAD)

Exposure at Default (EAD) is a metric that aims to predict the value of a loan or asset at the time of a counterparty’s default. It is calculated by considering various parameters, such as current exposure, potential future exposure, and any collateral posted.

Loss Given Default (LGD)

Loss Given Default (LGD) estimates the amount that would be lost if a default occurs, expressed as a percentage of the total exposure. Also, it often considers factors like recovery rates, the value of collateral, and other mitigants.

Probability of Default (PD)

Probability of Default (PD) is a measure that quantifies the likelihood of a counterparty defaulting on its obligation.

Counterparty Risk Exposure Formula

Here’s the formula to bring it all together:

Counterparty Risk Exposure=EAD×LGD×PD

Collateral and Netting

Contracts often include collateral and netting agreements. Collateral is an asset or assets placed as a guarantee for the obligation, while netting allows the parties to offset mutual obligations. These can significantly lower your calculated counterparty risk exposure.

Stress Testing

Stress testing involves running simulations to understand the counterparty’s ability to fulfill obligations under various adverse economic scenarios. Also, it helps in measuring how volatile or stable your risk metrics are under extreme but plausible conditions.

Risk Mitigation Strategies

Diversification

Diversification is the practice of spreading your investments or contracts across multiple parties to minimize the impact of any single default. Also, it’s the embodiment of the phrase, “Don’t put all your eggs in one basket.”

Regular Monitoring

Regular monitoring involves frequently reviewing a counterparty’s creditworthiness, tracking changes in credit ratings, and analyzing quarterly or annual financial statements. Automated systems and risk management software can aid in this.

Legal Recourse

Having strong contractual clauses that include legal recourse in the event of default can provide an added layer of security. Such clauses can include penalties, arbitration procedures, and terms for the liquidation of collateral.

Collateral Management

Effective collateral management involves regularly reviewing and updating the assets used as collateral to ensure that they adequately cover the level of exposure and can be quickly liquidated in case of default.

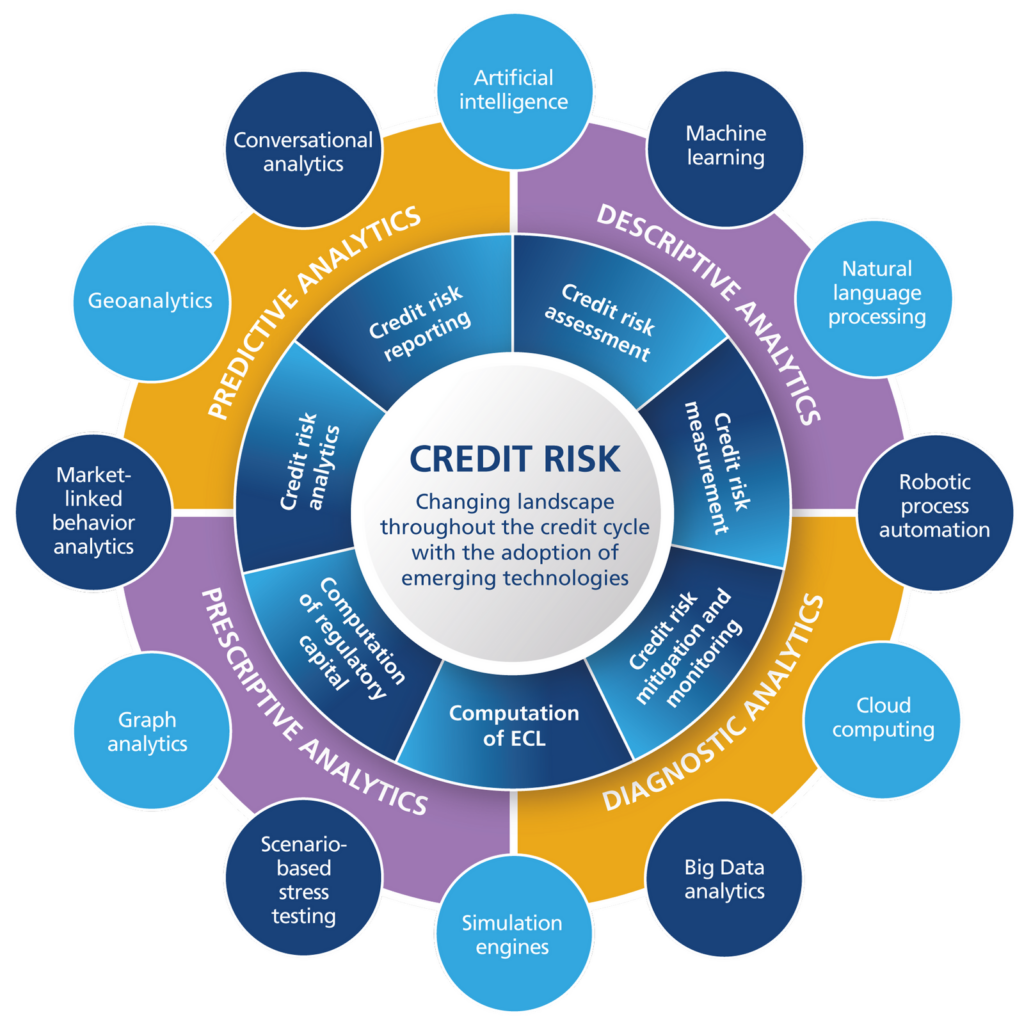

Advanced Analytics for Counterparty Risk

Advanced Analytics for Counterparty Risk

Machine Learning Models

Traditional methods of evaluating counterparty risk are increasingly complemented by Machine Learning Models. Also, these models can ingest a wide array of data, from market indicators to social media sentiments, to make highly accurate predictions about a counterparty’s creditworthiness.

Real-time Risk Monitoring

Real-time risk monitoring tools can provide up-to-the-minute assessments of counterparty risk, offering an opportunity for immediate action, which is particularly valuable in volatile markets.

Big Data

Big Data analytics allow firms to process enormous sets of data quickly and efficiently, providing a more nuanced understanding of market conditions and how they might impact counterparty risk.

Regulatory Considerations

Understanding and managing counterparty risk isn’t just a matter of good business sense; it’s often a legal requirement.

Basel III

The Basel III regulatory framework includes various recommendations for assessing and managing counterparty risk, with a focus on improving the resilience of international banking systems.

Dodd-Frank Act

In the U.S., the Dodd-Frank Wall Street Reform and Consumer Protection Act also has provisions that impact how counterparty risk should be managed, especially in the context of swap transactions and other derivatives.

Local Regulations

Different jurisdictions might have their own local regulations. It’s crucial for companies to be aware of and comply with these rules.

Role of Technology in Managing Counterparty Risk

Blockchain

Blockchain technology is increasingly seen as a potential solution for reducing counterparty risk, especially in complex, multi-party transactions where trust and transparency are critical.

Automated Risk Assessment Tools

Automated Risk Assessment Tools can continuously monitor various metrics to provide real-time counterparty risk assessments. Also ,this can free up valuable human resources for other strategic activities.

Conclusion

Managing counterparty risk is vital for financial stability. Both traditional and new-age tools can help you understand and mitigate these risks effectively. Whether you’re an investor or a financial institution, mastering these methods equips you with the know-how to avoid financial pitfalls.

FAQs on Counterparty Risk

What is Counterparty Risk?

Counterparty risk is the risk of one party in a financial transaction failing to meet their obligations, resulting in financial loss for the other party involved.

Why is Counterparty Risk Important?

Ignoring counterparty risk can lead to financial loss, liquidity issues, and even contribute to a credit crunch in the market. It also puts a strain on operations, requiring legal actions and renegotiations.

How Do You Calculate Counterparty Risk?

What are Some Common Methods to Mitigate Counterparty Risk?

- Diversification: Spread your risks across multiple parties.

- Monitoring: Keep an eye on the counterparty’s financial health.

- Legal Clauses: Include clauses in contracts that offer legal protection.

- Collateral Management: Use assets as collateral to secure the transaction.

What is Stress Testing in the Context of Counterparty Risk?

Stress testing involves simulating extreme economic scenarios to evaluate how resilient a counterparty is. It helps identify vulnerabilities in your risk metrics.

How Does Technology Aid in Managing Counterparty Risk?

Technology like Machine Learning Models and Real-time Monitoring Tools can provide dynamic, up-to-date assessments of counterparty risk. Blockchain is also emerging as a solution for increased transparency and reduced risk in multi-party transactions.

Is Counterparty Risk Regulated?

Yes, regulations like Basel III and the Dodd-Frank Act provide guidelines on how financial institutions should manage counterparty risk. Compliance is often mandatory.

What are the Implications of Counterparty Risk in a Volatile Market?

In a volatile market, counterparty risk can escalate quickly. Also, real-time monitoring and stress testing become even more crucial for risk mitigation.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/