Understanding Downside Risk: The Complete Guide for Managing, Tips, and Tricks

Risk Management: Why Risk Management in Investment is Non-Negotiable

In the ever-changing and often volatile landscape of investing, risk management is an inescapable reality. Among the various forms of risk, Downside Risk is one that all investors—be it a newbie looking at index funds or a seasoned trader dealing with derivatives—need to comprehend and manage effectively. This guide aims to serve as your one-stop resource for understanding and managing Downside Risk. With specific insights, examples, tips, and tricks, you’ll be well-equipped to navigate the complexities of investment risk.

Table of Contents

What is Downside Risk? A Simple Definition and Example

Simply put, Downside Risk refers to the potential loss you could suffer in an investment. It helps you answer the question: “What’s the worst that could happen?” While “total risk” would give you a comprehensive picture of both profit and loss potential, Downside Risk specifically focuses on how much you stand to lose.

Example:

Imagine you invested $1,000 in Company A. If the maximum loss you can incur is $200, then this $200 is your Downside Risk.

Why is Downside Risk Important? The Three Pillars Expanded

Long-term Strategy: Safeguarding Future Gains

Understanding Downside Risk allows you to build a robust long-term strategy. For example, if you’re saving for retirement, knowing the Downside Risk associated with your investment options will help you choose the ones that align with your risk tolerance and long-term goals.

Asset Allocation: The Bedrock of a Balanced Portfolio

Asset allocation isn’t just about diversifying but about intelligently diversifying by understanding the risk and return profiles of different asset classes like stocks, bonds, and real estate. Knowing Downside Risk lets you do that more effectively.

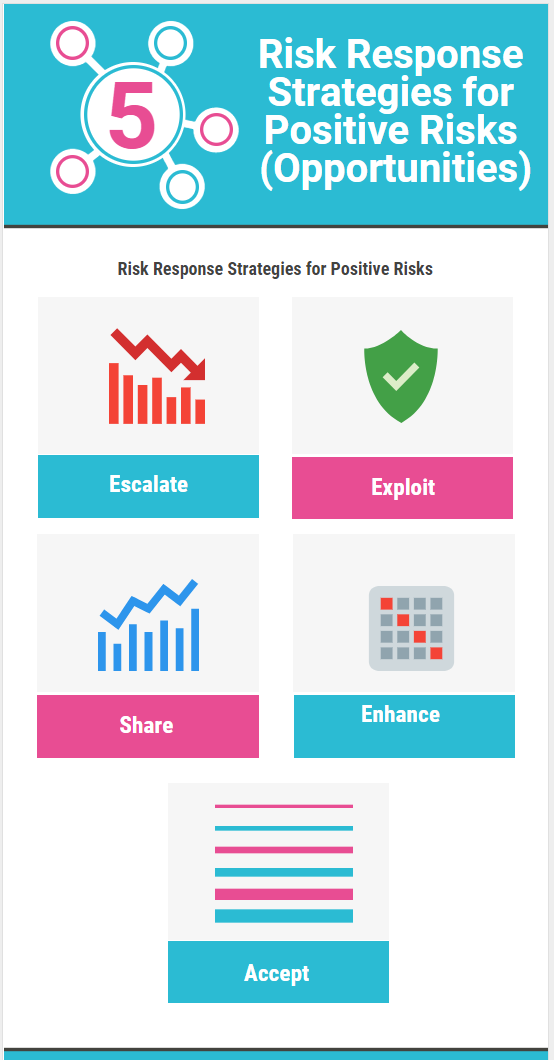

Risk Management: The Lifeguard of Your Investment Pool

Risk management strategies can vary from basic moves like diversification to more advanced tactics like options trading. The first step, however, is understanding the Downside Risk of each asset in your portfolio.

Types of Downside Risks: Not All Risks are Created Equal

Downside Risks can differ significantly depending on the type of asset, market conditions, and other factors.

Market Risk

Also known as systematic risk, this risk affects nearly all assets in a particular market. For example, an economic downturn usually depresses stock prices across the board.

Specific Risk

Unsystematic or specific risk is limited to a particular asset or group. For instance, bad quarterly results can affect a single company’s stock.

Liquidity Risk

Liquidity Risk is often overlooked but essential. This risk means you might not be able to convert your investment into cash without a significant loss. For example, certain real estate investments might not sell quickly, or thinly-traded stocks may not have a buyer when you want to sell.

Credit Risk

If you own bonds or other fixed-income securities, credit risk is a significant concern. It’s the risk that the borrower defaults, impacting your returns.

How to Measure Downside Risk: A Toolkit

Standard Deviation

This statistical measure indicates the variability of returns. A high standard deviation often signals greater risk. Many financial platforms provide this data for specific stocks or portfolios.

Value at Risk (VaR)

VaR estimates the potential loss an investment could face over a specified period under normal market conditions. For example, a VaR of $100 at 95% confidence means that there is a 95% chance that the most you will lose is $100.

Drawdown

Drawdown helps you understand the peak-to-trough decline during a specific record period for an investment. This is particularly useful for understanding how investments perform during adverse conditions.

Beta

Beta measures an investment’s sensitivity to market movements. For example, a beta of 1.2 means the asset is expected to be 20% more volatile than the market.

Tips and Tricks for Managing Downside Risk: The Master’s Guide

Diversification: Don’t Put All Your Eggs in One Basket

The golden rule of investing is diversification. Spread your investments across asset classes, sectors, and geographies. For example, if technology stocks are facing Downside Risks, having investments in utilities or healthcare can balance the loss.

Hedging: Using Derivatives as Safety Nets

You can use options and futures to protect against severe losses. For example, buying a put option allows you to sell your asset at a predetermined price, offering a kind of insurance against steep declines.

Stop-Loss Orders: The Safety Latch

A stop-loss order sells an asset when it reaches a specific price. For instance, if you set a stop-loss order at $90 for a stock bought at $100, the stock will be sold automatically when the price hits $90, capping your loss.

Asset Allocation and Rebalancing: The Routine Check-up

Regularly reassess your portfolio to ensure it aligns with your investment objectives and risk tolerance. Rebalancing involves buying or selling assets to maintain your desired asset allocation.

Advanced Techniques: For the Skilled Investor

Risk/Reward Ratio

Always consider the risk/reward ratio. For example, don’t take on a risk where you stand to lose $1,000 just to gain $100.

Tactical Asset Allocation

Tactical asset allocation allows for a portfolio mix that you can modify based on short-term market forecasts.

Use of Robo-Advisors

Robo-advisors can automatically rebalance your portfolio, ensuring it aligns with your investment strategy and risk profile.

Low-Volatility Stocks

Investing in low-volatility stocks can offer a safety net during turbulent times. These are usually large, stable companies that pay dividends.

Conclusion: A Lifelong Commitment to Risk Management

Successfully managing Downside Risk is not a one-off activity but a continual process that requires vigilance, strategy, and adjustment. Through tools, tips, and insights provided, you’ll be on your way to making more informed decisions, thereby optimizing your risk management and, ultimately, your returns.

Psychological Aspects of Downside Risk: The Emotional Toll

Emotional Biases: How Our Brains Can Mislead Us

Our emotional biases can heavily impact how we approach investment decisions. Loss aversion, the tendency to prefer avoiding losses over acquiring gains, can make investors overly cautious or lead to premature selling.

Guidelines for Overcoming Loss Aversion

- Separate Emotion from Decision-Making: Train yourself to focus on statistical data rather than gut feelings.

- Create a Checklist: Develop a checklist that outlines all the factual criteria an investment must meet before you decide to sell.

Managing Expectations: Emotional Preparedness

It’s crucial to prepare yourself emotionally for potential losses. The better you understand the Downside Risk, the less likely you are to make impulsive decisions like panic selling.

Tips for Emotional Preparedness

- Reality Check: Before investing, establish the worst-case scenario and decide whether you can emotionally and financially handle it.

- Create Exit Strategies: Know under which conditions you would exit an investment and stick to that strategy.

Downside Risk PDF

Tax Implications: A Neglected Perspective

Capital Losses and Taxes: The Silver Lining

Capital losses, which are a realization of Downside Risk, can be used to offset capital gains in many jurisdictions. This practice is commonly known as tax-loss harvesting.

Steps for Tax-Loss Harvesting

- Identify Investments: Look at your portfolio and find investments that have lost value.

- Sell and Reinvest: Sell the losing investments and immediately reinvest in similar, but not “substantially identical,” assets.

- Report Losses: Report these capital losses on your tax return.

Tax-Efficient Funds: An Underutilized Tool

Tax-efficient funds are designed to minimize tax liability. They are particularly useful for managing after-tax Downside Risk in taxable accounts.

How to Choose a Tax-Efficient Fund

- Look for Low Turnover: Funds that frequently buy and sell assets incur more capital gains taxes.

- Mind the Dividends: Funds that pay out fewer dividends are generally more tax-efficient.

Real-World Case Studies: Lessons from the Past

Dot-Com Bubble: A Cautionary Tale

The Dot-Com Bubble was marked by extreme investor optimism and a lack of attention to Downside Risk. The subsequent crash left many investors with significant losses.

Lessons Learned

- Importance of Diversification: Investors with all their money in tech stocks were hit hardest.

- Due Diligence: Many of the companies had neither earnings nor a clear path to profitability.

2008 Financial Crisis: A Lesson in Systemic Risks

The 2008 Financial Crisis was a systemic risk event that significantly impacted almost every investor.

Lessons Learned

- Diversification Limits: Even a well-diversified portfolio suffered because the crisis impacted various asset classes.

- Liquidity Concerns: Cash or cash equivalents like Treasury Bills were one of the few safe havens.

Technology’s Role in Managing Downside Risk: Future Trends

Algorithmic Trading: Next-Gen Risk Management

Algorithmic trading can offer real-time, automated Downside Risk management, such as setting stop-losses or dynamically hedging a portfolio.

How to Start with Algorithmic Trading

- Research: Understand the types of trading algorithms available.

- Simulation: Test the algorithm in a simulated environment.

- Implementation: Apply the algorithm to a small portfolio before full-scale implementation.

AI and Machine Learning: The Future of Predictive Analysis

AI and Machine Learning: The Future of Predictive Analysis Risk Management

Machine learning algorithms can analyze complex financial markets, offering predictive models that can help anticipate Downside Risk more effectively.

Getting Started with AI in Investment

- Choose a Platform: Several fintech companies offer AI-based platforms for individual investors.

- Understand the Model: It’s crucial to understand what the model does and doesn’t account for to use it effectively.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/