Risk Management: Annualized Loss Expectancy Calculation in 5 Steps

In today’s dynamic business and financial landscape, risk management is a vital foundation for protecting operations and investments. One of the fundamental components within this realm is Annualized Loss Expectancy (ALE), a quantitative metric that gauges potential financial loss due to security breaches, unexpected events, or accidents. Also, by grasping the concept of ALE and mastering its calculation, businesses can make strategic decisions to mitigate risks and safeguard their future effectively.

Table of Contents

Significance of ALE in Risk Management

Informed Decision Making

ALE plays a crucial role in helping organizations make informed decisions about risk management. By quantifying potential financial losses, decision-makers can prioritize which risks to address first and allocate resources accordingly. This strategic approach ensures that resources are utilized effectively to mitigate the most significant threats.

Cost-Benefit Analysis

With ALE, organizations can perform cost-benefit analyses of various risk mitigation strategies. By comparing the estimated ALE of a specific risk with the cost of implementing preventive measures, companies can determine the most cost-effective approach to minimize their exposure.

Compliance and Regulation

Many industries and sectors have specific compliance requirements and regulations that necessitate risk assessment and management. ALE calculations are often used to demonstrate compliance with these regulations and provide evidence of due diligence in risk management practices.

Insurance Planning

ALE also plays a pivotal role in insurance planning. Organizations can use ALE data to determine the appropriate level of insurance coverage required to mitigate financial losses adequately. Insurance providers often require ALE assessments to tailor policies to a company’s specific risk profile.

Mastering Contingency Costs: Guide for Robust Project Management – projectcubicle

ALE in Action: Real-World Examples

Project Management in IT and Software Development- projectcubicle

Implementing ALE Calculations

Step 1: Identify Assets and Risks

To begin the ALE calculation process, organizations must identify their critical assets and potential risks or threats associated with each asset.

Step 2: Determine Asset Values (AV)

Assign a monetary value to each asset. This value should reflect the asset’s importance to the organization and its potential impact on business operations if compromised.

Step 3: Assess Exposure Factors (EF)

Estimate the exposure factor for each risk or threat. EF represents the percentage of potential loss in the event of an incident.

Step 4: Calculate Annualized Rate of Occurrence (ARO)

Analyze historical data or industry benchmarks to determine the ARO for each identified risk. This step requires a thorough understanding of the organization’s historical incident data.

Step 5: Compute Single Loss Expectancy (SLE)

Use the AV and EF values to calculate the SLE for each risk or threat.

Step 6: Calculate Annualized Loss Expectancy (ALE)

Finally, multiply the SLE by the ARO to obtain the ALE for each risk. This will provide a clear picture of the potential financial impact of each risk over a year.

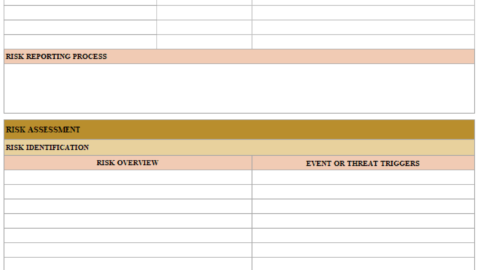

Illustration depicting risk management strategies and calculations.

What is Annualized Loss Expectancy?

Annualized Loss Expectancy, often referred to as ALE, is a quantitative approach utilized to estimate the possible financial loss an organization might encounter within a year. This metric plays a pivotal role in risk assessment, allowing businesses to allocate resources for risk management and mitigation strategically. Also, by delving into ALE, companies gain insights into the monetary ramifications of different vulnerabilities and threats, enabling the development of targeted risk management strategies.

Annualized Loss Expectancy Step 1: Identify Assets and Values

The initial step in the ALE calculation involves identifying the assets within the organization that require protection. These assets span from tangible physical equipment to intangible digital data and intellectual property. Once these assets are identified, each one must be assigned a monetary value. This valuation forms the basis for assessing potential losses in the event of a security breach or other unforeseen incidents.

Example:

Let’s take the case of a company that heavily relies on proprietary software. Assigning a value of $1.5 million to this software serves as a crucial input for precise ALE computation.

Annualized Loss Expectancy Step 2: Assess Threat Likelihood

In this phase, businesses evaluate the likelihood of various threats materializing. These threats encompass a wide range, including cyberattacks, natural disasters, human errors, and more. Each threat is assigned a probability percentage, representing the likelihood of its occurrence in a given year. Also, this step necessitates a thorough examination of historical data, industry trends, and potential vulnerabilities.

Example:

For a retail business, the probability of a data breach might be estimated at 10%, based on recent cybersecurity trends.

Annualized Loss Expectancy Step 3: Determine Potential Loss

Once assets are identified and threat likelihood is assessed, it’s time to quantify the potential loss associated with each threat. This involves evaluating the financial impact a particular threat could have on an asset. For instance, a cyberattack might lead to data loss, system downtime, and damage to the company’s reputation. Assigning a monetary value to these consequences provides a clear picture of potential losses.

Example:

Consider the scenario where a successful cyberattack could result in expenses totaling $500,000 for data recovery, system restoration, and reputational damage for a retail business.

Annualized Loss Expectancy Step 4: Calculate Single Loss Expectancy (SLE)

Single Loss Expectancy (SLE) represents the projected monetary loss in the event a specific threat materializes. This figure is calculated by multiplying the value of the asset by the potential loss associated with the threat. SLE serves as a foundational element for the final ALE computation.

Example:

For the proprietary software valued at $1.5 million, the SLE due to a successful cyberattack would amount to $500,000.

Annualized Loss Expectancy Step 5: Compute Annualized Loss Expectancy

The ultimate step involves calculating the Annualized Loss Expectancy by multiplying the Single Loss Expectancy (SLE) by the probability of the threat occurring. This computation provides a comprehensive overview of the potential financial impact an organization could encounter in a year.

Example:

If the likelihood of a cyberattack stands at 10% and the SLE is $500,000, the resulting ALE for the retail business would be $50,000.

The Components of ALE

ALE comprises three key components: Single Loss Expectancy (SLE), Annual Rate of Occurrence (ARO), and Exposure Factor (EF).

- Single Loss Expectancy (SLE): SLE represents the financial loss when a specific asset is compromised. Also, it is calculated by multiplying the asset’s value by the exposure factor.

- Annual Rate of Occurrence (ARO): ARO refers to the estimated number of incidents occurring within a year. Also, it takes into account historical data, industry trends, and potential vulnerabilities.

- Exposure Factor (EF): EF represents the percentage of loss an organization would suffer if an incident occurred. Also, it considers the potential impact on the asset’s value.

Steps to Calculate Annualized Loss Expectancy

Calculating ALE involves several steps that help organizations arrive at an accurate estimate of potential financial losses. Here’s a step-by-step guide:

- Identify Assets at Risk: Identify the critical assets susceptible to security breaches or incidents.

- Determine Asset Values: Assign a monetary value to each identified asset. This value should encompass both tangible and intangible aspects.

- Calculate Single Loss Expectancy (SLE): For each asset, calculate the SLE by multiplying its value by the exposure factor (EF).

- Estimate Annual Rate of Occurrence (ARO): Analyze historical data, industry trends, and potential vulnerabilities to estimate the likelihood of incidents occurring within a year.

- Quantify Annual Loss: Multiply the SLE by the ARO to obtain the annual loss for each asset.

- Sum Up Annual Losses: Sum up the annual losses of all assets to arrive at the total potential annual loss.

- Calculate Annualized Loss Expectancy (ALE): ALE is calculated by multiplying the total potential annual loss by the exposure factor (EF).

Real-World Applications of ALE Calculation

The application of Annualized Loss Expectancy (ALE) calculation extends across various industries and sectors, demonstrating its universal relevance in risk management.

For instance, consider a financial institution that deals with sensitive customer data and financial transactions. By calculating ALE, the institution can determine the financial impact of a data breach or cyberattack. Also, this information aids in the allocation of resources toward robust cybersecurity measures, employee training, and incident response plans.

Similarly, in the healthcare sector, ALE calculation helps hospitals and medical facilities assess the potential financial losses associated with breaches of patient information. Also, this insight guides the implementation of stringent data protection measures, safeguarding patient privacy and the organization’s financial well-being.

Factors Influencing ALE

The accuracy of Annualized Loss Expectancy (ALE) calculation relies on a variety of factors that contribute to the overall risk landscape:

- Threat Landscape: The evolving nature of threats, including cyber threats, natural disasters, and human errors, directly impacts the ARO.

- Asset Value: The value of assets at risk significantly influences the potential financial impact of incidents.

- Exposure Factor: The extent of potential loss an organization would face due to an incident is determined by the exposure factor.

- Risk Mitigation Measures: The effectiveness of risk mitigation measures, such as security protocols and disaster recovery plans, can reduce the ARO and EF.

- Industry Regulations: Compliance with industry regulations and standards can impact the likelihood of incidents and subsequent financial losses.

Conclusion

In the realm of risk management, the Annualized Loss Expectancy (ALE) calculation emerges as a beacon of quantification and strategic decision-making. By comprehensively assessing potential financial losses, organizations can proactively allocate resources, implement targeted security measures, and formulate robust incident response plans. Also, the integration of ALE in risk management strategies bridges the gap between technical and non-technical stakeholders, fostering collaboration and ensuring a holistic approach to safeguarding assets and data. As industries continue to navigate the intricate landscape of risks, ALE stands as a steadfast ally in the pursuit of resilience and stability.

FAQs (Frequently Asked Questions)

1. What is the significance of Annualized Loss Expectancy (ALE)?

ALE is a crucial metric in risk management that quantifies potential financial losses due to various threats, aiding businesses in making informed decisions.

2. How does ALE contribute to risk mitigation?

By evaluating ALE, companies gain insights into the financial impact of vulnerabilities and threats, allowing for the formulation of targeted risk management strategies.

3. What factors influence the calculation of ALE?

The calculation of ALE involves identifying assets, assessing threat likelihood, determining potential losses, calculating Single Loss Expectancy (SLE), and computing the Annualized Loss Expectancy.

4. Why is assigning a value to assets important in ALE calculation?

Assigning monetary values to assets helps in estimating potential losses and gauging the financial impact of security breaches or incidents.

5. How does ALE enhance decision-making in uncertain environments?

Understanding ALE equips businesses with the knowledge needed to allocate resources effectively, enabling them to navigate challenges and uncertainties with confidence.

In the realm of risk management, the Annualized Loss Expectancy (ALE) calculation emerges as a beacon of quantification and strategic decision-making. By comprehensively assessing potential financial losses, organizations can proactively allocate resources, implement targeted security measures, and formulate robust incident response plans. The integration of ALE in risk management strategies bridges the gap between technical and non-technical stakeholders, fostering collaboration and ensuring a holistic approach to safeguarding assets and data. As industries continue to navigate the intricate landscape of risks, ALE stands as a steadfast ally in the pursuit of resilience and stability.

Thank you dear reader!

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/