Mastering Contingency Costs: Guide for Robust Project Management

Introduction

Navigating the labyrinthine world of project management involves more than just a roadmap and a set of objectives. The nature of projects—be they in construction, finance, engineering, or risk management—is fundamentally unpredictable. Herein lies the critical importance of understanding Contingency Costs. Designed as a comprehensive guide for project managers, engineers, financial experts, and risk managers, this resource aims to cover every facet of this often misunderstood financial term, providing practical tips, case studies, and actionable steps for mastery.

Table of Contents

Contingency Cost Example pdf

What Are Contingency Costs?

Contingency Costs, often mistaken as mere financial cushions, serve a higher purpose—they are the insurance against uncertainties that could derail a project. Also, these funds are strategically earmarked to handle disruptions ranging from labor unrest to supplier delays, market volatility, and natural disasters.

Tip: To safeguard the integrity of your project budget, always include Contingency Costs as a separate line item. This enables better tracking and transparency in how these essential funds are utilized.

Why Contingency Costs Matter: An Industry Perspective

Budget Flexibility in Financial Markets

For financial analysts or portfolio managers, contingency costs can provide the liquidity needed to navigate through turbulent market conditions. Also, these funds can act as a buffer, offering maneuvering room when the market turns bearish, thereby ensuring the portfolio’s resilience.

Sustainability in Engineering Projects

In sectors like renewable energy, the absence of a contingency fund could be the difference between project success and failure. For instance, if a solar farm experiences a malfunction in its tracking system, the project could incur not just repair costs but also potential revenue loss from decreased energy production.

Example: A contingency fund in a solar energy project can be immediately channeled into replacing or repairing malfunctioning tracking systems, thereby ensuring that the energy output remains consistent.

Calculating Contingency Costs: The ABCs

Comprehensive Risk Analysis

Risk managers have a crucial role to play in performing a comprehensive risk analysis. Also, this involves identifying potential risks and categorizing them based on their likelihood and impact.

Leveraging Historical Data

Project managers should meticulously collect and analyze data from similar past projects to inform their Contingency Cost estimates. Also, this involves scrutinizing timelines, budgets, resource allocation, and unforeseen issues encountered.

Tip: Deploying advanced project management software can help in sifting through massive datasets, allowing for more nuanced comparisons between different projects.

Technical Expert Input

Engineers, with their domain-specific knowledge, can offer detailed insights into the potential technical issues that could arise, making their contribution essential in fine-tuning the Contingency Costs estimates.

Methods for Estimating Contingency Costs: A Comparative Analysis

Percentage Method: A Construction Industry Staple

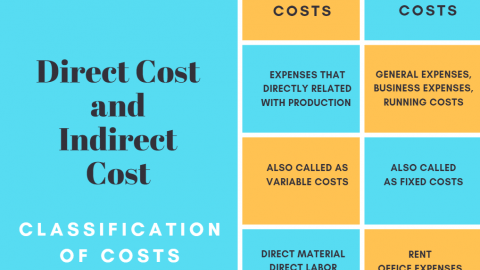

The simplest and perhaps most traditional way to calculate Contingency Costs is as a fixed percentage of the total estimated project cost. Also, while straightforward, this method lacks nuance and may either overestimate or underestimate the required funds.

Monte Carlo Simulation: The Financial Analyst’s Tool

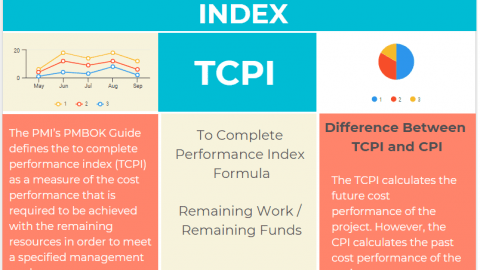

Monte Carlo simulations offer a stochastic approach to estimating Contingency Costs. By simulating thousands of scenarios, this method provides a probability distribution of potential outcomes, enabling more precise planning.

Analogous and Parametric Estimating: The Engineer and Risk Manager’s Choices

While Analogous Estimating relies on historical data from similar projects, Parametric Estimating takes a more granular approach, breaking down individual project elements to calculate the risks and costs associated with each.

Case Studies: Lessons from the Frontline

Financial Market Crash of 2008

Many investment firms and hedge funds were unprepared for the massive financial downturn that took place in 2008. Also, those who had wisely allocated for Contingency Costs managed to stay afloat, some even capitalizing on the crisis to invest in undervalued assets.

Infrastructure Overhaul in a Major City

An ambitious public transportation revamp in a major city encountered multiple hiccups, including labor strikes and material shortages. Also, the costs skyrocketed, and the lack of an adequate contingency fund worsened the financial strain.

Common Pitfalls and How to Avoid Them

Chronic Under-budgeting

The most prevalent mistake is under-budgeting for Contingency Costs. This often leads to budget overflows, causing a financial strain on the project.

Trick: Setting up a monthly budget review meeting can act as a safety net, allowing you to adjust the contingency fund as the project progresses.

Lack of Industry Knowledge

Failure to understand the latest industry trends and technological advancements can severely impair the ability to accurately assess risks.

Tip: Engineers and financial experts should make it a habit to attend industry conferences, webinars, and continually read up on the latest trends.

Ignoring Real-time Updates

Financial analysts must adjust their contingency plans according to real-time market data to ensure they are not caught off guard by sudden market shifts.

Tip: Utilize sophisticated market tracking software that offers real-time alerts and updates.

Your Action Plan: Take the Next Step

The culmination of this understanding should now propel you to act. Also, consider downloading our Contingency Cost Planning Toolkit, equipped with customizable templates to aid in your planning.

Armed with this comprehensive guide, you are not only prepared but also empowered to handle the uncertainties that inherently accompany projects in any industry. Also, take the next steps to secure your projects and maintain their viability, regardless of the obstacles you might face.

What is a Contingency Cost Example?

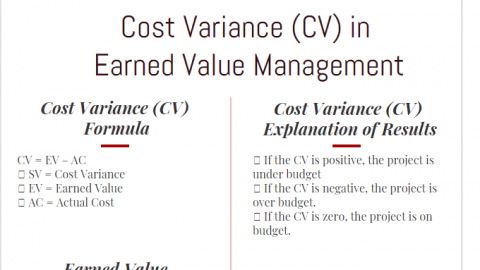

In a $1 million construction project, a 10% contingency fund equals $100,000. Also, if a crucial machine breaks and costs $30,000 to replace, the contingency fund covers it.

How to Calculate Contingency Cost?

- Percentage Method: Set aside a fixed percentage of the total project cost. For a $500,000 project with a 10% contingency, the fund is $50,000.

- Monte Carlo Simulation: Use computer simulations to estimate a range of possible costs and their likelihood.

- Expert Judgment: Consult experts to gauge what unexpected costs might come up.

What’s a Contingency Example?

In software development, losing a key team member can delay the project. Also, a contingency plan would include steps and budget for hiring a replacement.

What Does 20% Contingency Mean?

A 20% contingency means adding an extra 20% to the estimated project cost for unexpected events. For a $100,000 project, this means setting aside an additional $20,000, making the total budget $120,000.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/