7 Software Solutions To Consider For Payroll Taxes

Miscalculations or failure to pay employment tax are costly. The IRS charges 2% for up to 5 late calendar days, increasing to 15% for payments made after the first notification letter. There are also interest payments on penalties, varying on when settlement occurs. Payroll software is the easiest way to manage employee payments and payroll taxes that would otherwise be time-consuming if done manually. Payroll software solutions don’t only allow you to make direct deposits for salaries but also withhold payroll taxes and keep an accurate record.

Table of Contents

Different Types of Payroll Taxes

Payroll taxes are also called employee taxes. As an employee, you are responsible for deducting all the taxes from your employees required by federal and state law. These taxes include their income, social security, and Medicare taxes. Social security and Medicare taxes are also known as FICA taxes because they fall under the Federal Insurance Contributions Act.

You must also pay taxes as an employer for state and federal unemployment, social security, and Medicare taxes.

Social Security and Medicare taxes are combined to create the FICA tax. The two levies are used by the government to pay various programs:

Social Security tax:

Provides money for retirement, retired employees’ dependents, and disabled people and their dependents.

Medicare tax:

Pays for medical benefits for the elderly, handicapped, and those with certain medical problems.

The tax rates for Social Security and Medicare are different. Additionally, there is an extra Medicare tax for eligible workers.

What is subject to payroll taxes? These taxes will deduct from employee paychecks. However, do not deduct every penny of the employee’s taxes. FICA taxes are a shared expense between employers and workers. Display payroll tax on your workers’ paystubs.

Payroll taxes at the federal level are not excluded from self-employment. They must pay self-employment tax in place of FICA tax. Self-employed people must pay Social Security and Medicare taxes under the Self Employed Contributions Act (SECA) tax. Employer and employee taxes are not divided by SECA. Self-employed people must cover all of the tax costs by themselves.

Best Payroll Services Software to Consider for Payroll Taxes

This breakdown of the best software solutions for payroll and taxes makes it easier to find the best payroll services for your business. Best payroll services, according to the business information service TRUiC, should be easy to use, process paychecks, make tax deductions, and maintain employee records as ruled by the law. The software solutions on this list also allow employees to enter times and check their earnings.

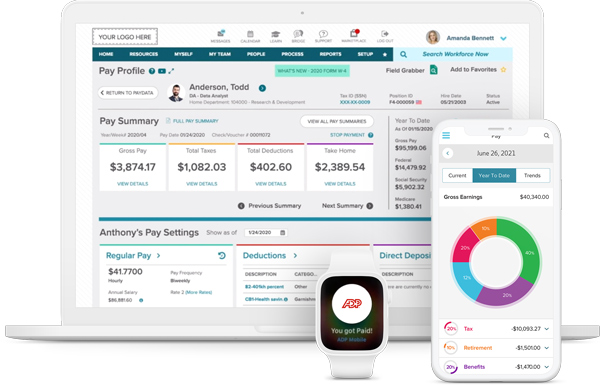

1. ADP Payroll Service

ADP is a well-known payroll software that features scalability and several plan options. Even though ADP’s scalability is ideal for large enterprises, its accuracy rate makes it the most recommended system by the IRS for small businesses. The payroll software also has the most IRS W2s of all available payroll service providers, allowing you to file all employee incomes and deductions accurately. The system integrates all the essential services for payroll under one system, enabling user-friendly management and affordable payroll management while also making it easy to add or take out employees.

2. Gusto Payroll Service

Several tiers of services that include fully-automated payroll, basic reports, and tracking for paid time off make Gusto a popular choice for any sized business. The Gusto payroll software provides access to HR professionals to assist you with any queries. Also, it allows your employees to save with the Gusto Wallet (a free app for your employees), and the platform integrates with other third-party apps like Freshbooks, Xero, and Quickbooks. Gusto has a mobile app, and there is also a contractors version, but the platform does tend to run slowly sometimes.

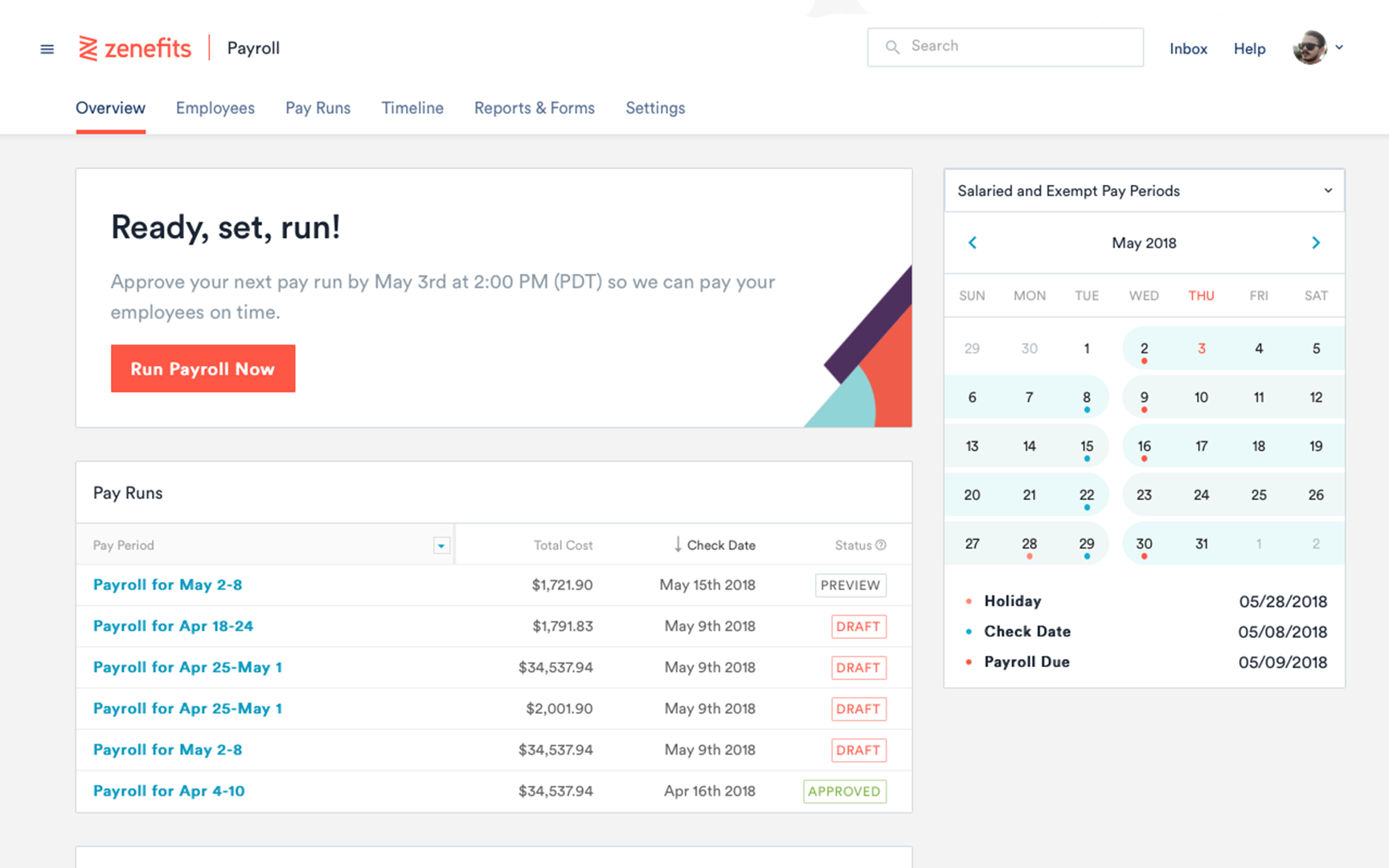

3. Zenefits Payroll Software

Small to midsize enterprises can benefit from the solid solutions provided by Zenefits payroll software. The platform has the essential payroll functions while incorporating seamless human resources management and benefits administration at a low price. Zenefits is easy to navigate in its basic features, but the more advanced features demand more effort. Its employee app is exceptional, but the mobile app doesn’t feature all tasks.

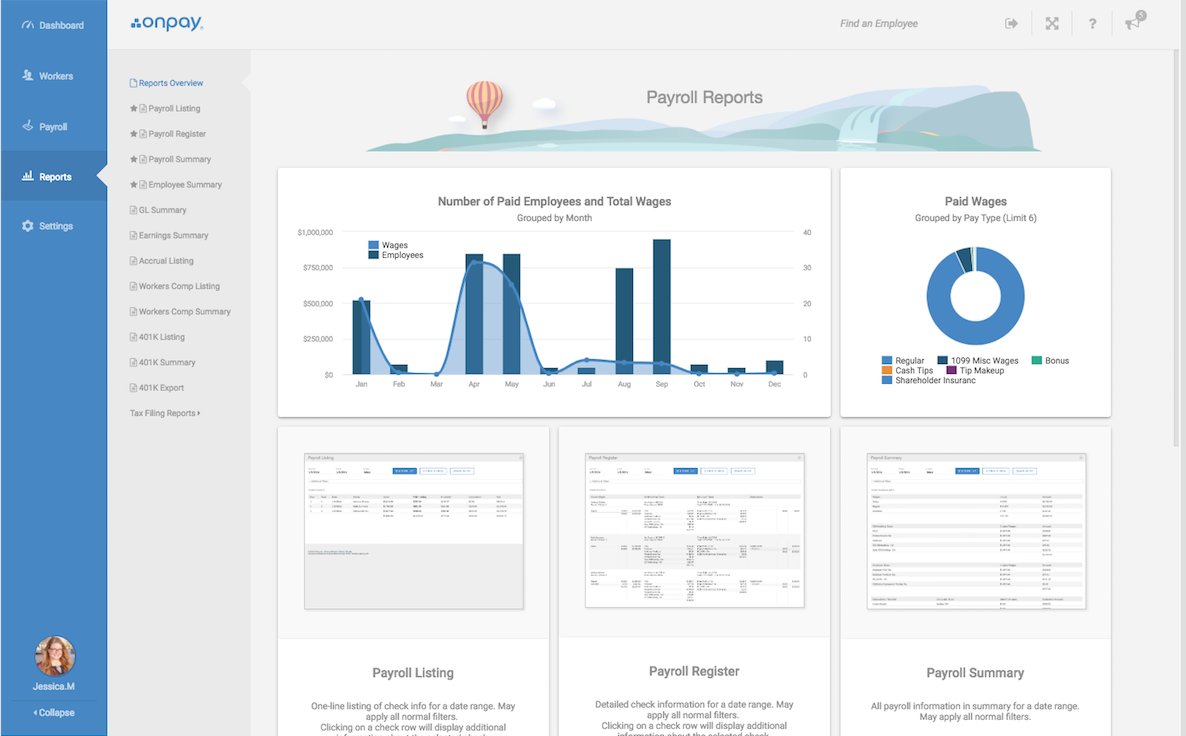

4. OnPay Payroll Service

If your business has more demands than just basic payroll taxes processing, then the OnPay payroll software is an excellent solution. The system is responsive and allows unlimited and customized payroll reports, and enables accounting software integrations and HR add-ons. Another plus for this software is its employee and administration versions.

5. Intuit QuickBooks Payroll

If you are looking for a payroll system that integrates with Intuit’s QuickBooks, then QuickBooks Payroll is ideal since your entries will automatically appear on your accounting system. You can use integrations from third-party HP support, and time tracking on its TSheets is a breeze for employees. QuickBooks payroll is costly, and you pay extra for 1099s.

6. Square Payroll Software

If you prefer a straightforward payroll taxes system, then Square Payroll is best. Square’s Payroll integrates with its other products. It includes a mobile app for easier administration and time tracking. The software has W-2 and 1099 capabilities and is ideal for businesses with substantial employee turnovers like restaurants or grocery stores. One drawback is that there are only hourly and salary earnings and limited online help.

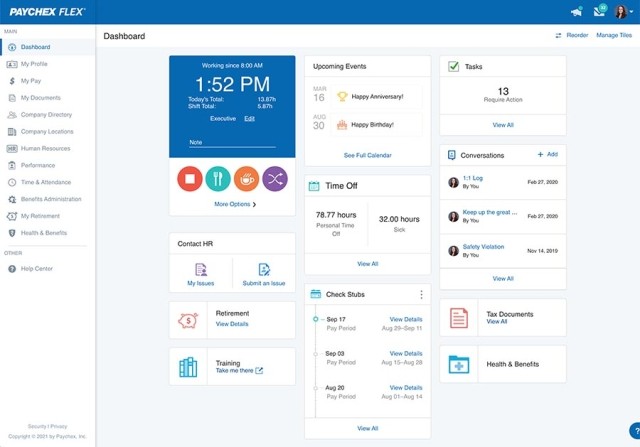

7. Paychex Flex

Paychex Flex has a robust feature allowing over 160 reports for everything from salaries to turnover. Options include HR reporting add-ons and other integrations. Its support gets mixed reviews, and the software has hidden setup and tax document fees.

Final Word on Managing Payroll Taxes

These are the key features of these software solutions for your payroll taxes. ADP comes highly recommended for all business types and sizes, but the one you decide on depends on your business and its payroll needs.

Irma Gilda is chief executive of Sonic Training and Consultancy Co., the training platform offers project planning and scheduling More than 60 k learners have used the platform to attain professional success. Irma is a professional Primavera P6 Trainer.