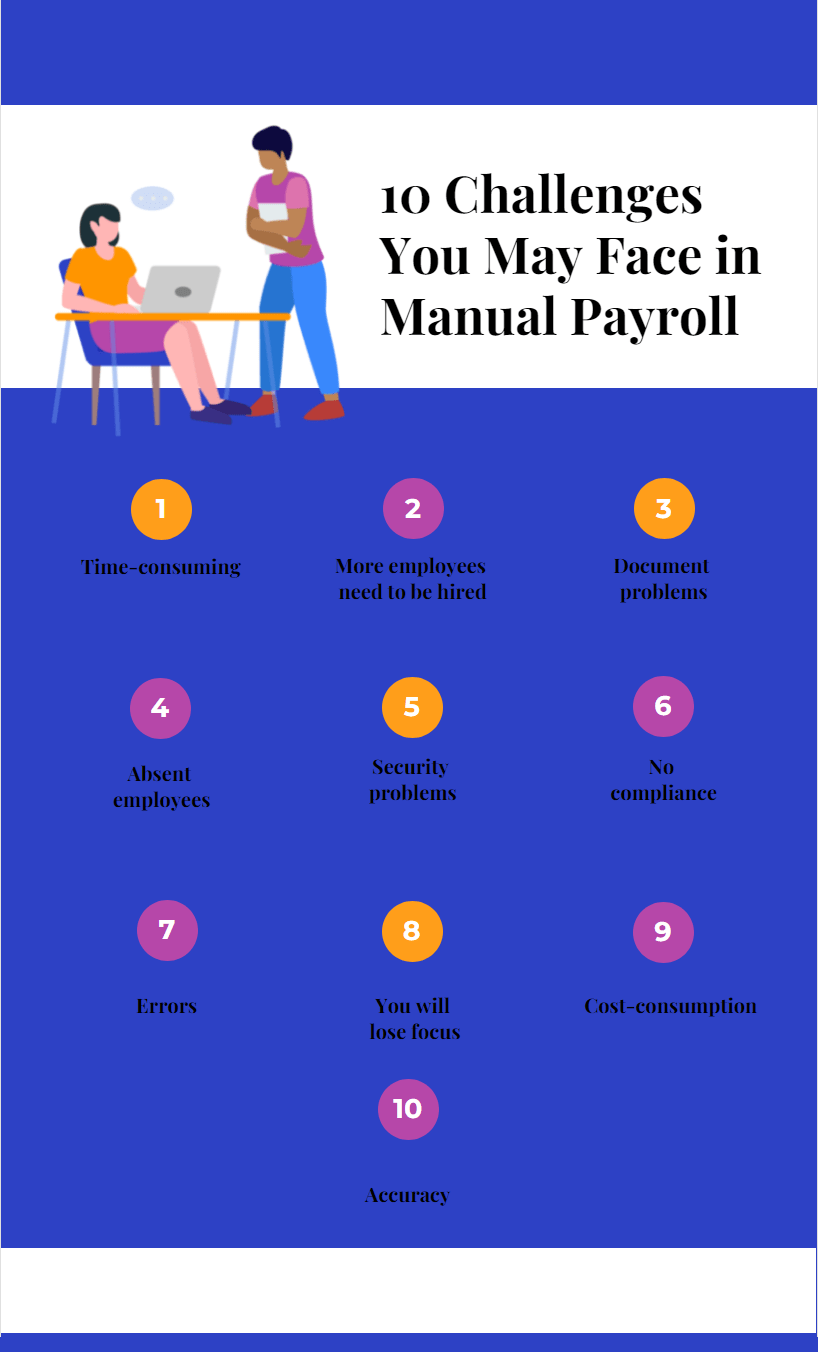

10 Challenges You May Face in Manual Payroll

Handling payrolls manually can be really difficult. When you are working under a big company with lots of employees, it becomes difficult to manually give out payrolls to each of your employees. Manual payroll computation refers to the process of calculating and processing payroll by hand. It is not necessary to make a financial investment in payroll software or outsource payroll.Payroll tax rates are included in the programming of such software, which removes the need for manual computation of payroll taxes. In addition, the program calculates salaries and maintains information on employees’ payrolls. In the case of manual calculation, the payroll representative is responsible for manually calculating all salaries and deductions. A mistake might be made by the representative if she is not cautious.

Table of Contents

Here are ten challenges you might face in manual payroll.

1. Time-consuming

Time is the biggest factor. When you are working with many employees, you have to invest a lot of time while handling payrolls. Many companies outsource their payrolls, and outsourcing payrolls will transfer your entire burden of handling payrolls to the outsource service providers. One such example of outsourcing payroll service is Aurion outsource service; you can know about them from aurion.com. Outsource service providers save you time and make your job easier.

2. More employees need to be hired

The company will need to hire more employees to manually hand out payroll. Because if you have a huge number of employees working under you, no one person can do the job. Thus, you will have to spend a lot more money than you calculated. It might even create a problem with the budget of your company.

3. Document problems

You might face problems in handling so many documents of so many employees. Sometimes documents get misplaced, creating problems later while handing out payments. When handling payrolls manually, it becomes difficult to keep every information in an organized manner. Also, all the documents are generally being stored sometimes, and problems occur when the documents are often misplaced. Thus, it causes a huge turmoil when manually handing out payrolls.

4. Absent employees

You might face another issue when employees take leave from the office. Sometimes employees take sick leaves or vacation leaves which causes the company to be prone to many errors. When employees are absent, you will also have to find other employees to fill in their place and understand all the work from the beginning. It is hectic and time-consuming.

5. Security problems

Security problems might occur when you are manually handling the payroll job. There are network errors, embezzlement, theft occurring these days. Without an expert, you won’t be able to handle all these. You won’t be able to ensure your employees the security they deserve.

6. No compliance

When manually handling payrolls, you have to take extra care of the legislative updates. There are new laws implied by the government, and if you fail to abide by any of these, you will have to pay the penalty for your actions. ESI finds, TDS deduction, all these need to be taken extra care of.

There are different rules and regulations which you might not know about. You also have to stay updated about all the new rules for payment that the government is introducing. This is not only time-consuming; it is also very hectic.

Outsourced payroll systems are often based on conventional procedures that strictly correspond to the regulations set out by the state, federal government, and other governing bodies. As a result of the stringent rules they must follow, they are more likely to be in compliance, sparing your company hassles down the line.

7. Errors in manual payroll calculations

It is normal for any human to make errors while handling many files, which should be avoided. All the payrolls will overburden you, causing you to make mistakes. You will have to look after the business and the payrolls. It can cause various problems, like untimely payments and wrong payments. This can cause turmoil in your company, and this will spoil the image of your company. If the employees do not get their payrolls in time, they might even threaten to leave.

8. You will lose focus

You will lose focus on the key factors of the business when you have so much burden. This might bring loss to your company. As an HR, you will have to stay focused; manually handing out payrolls will make you lose focus.

9. Cost-consumption

You will need to invest a lot of money hiring employees to buy computers and software. By outsourcing payrolls, you would save money and invest that in business growth. If you choose to do otherwise, you need to prepare a big budget indeed.

10. Lacking accuracy in manual payroll

You might face accuracy problems while handling payrolls manually. You might send wrong payments to the wrong persons because of stress and burden from all the work. Paychecks that are not delivered on time may have a bad influence on employee relations and may even lead to employee attrition if the situation is not resolved quickly.

Final thoughts: is manual payroll still relevant?

So, I guess you should outsource payrolls to avoid facing any of these problems. Manually doing all this work can be problematic. One of the most significant advantages of using an outsourced payroll system is the ease with which it can be implemented. Because payroll providers and software systems are already set up to follow payroll protocols, you can just submit your company’s information and then step aside to let them do their job. In-house systems are more unstable to construct and maintain over time since they are built by the organization itself.

Over 15 years of global experience in Finance & Accounting. She holds a Doctor of Finance from the University of Toronto

Payroll processing is an essential function of any organisation. However, the traditional method of manual salary processing can be time-consuming, error-prone, and costly. The process involves gathering data, calculating salaries, processing taxes, and issuing paychecks. All of these activities require time, effort, and expertise.

—

Regards,

Reblog it

Handling payrolls for a large company can be incredibly time-consuming and overwhelming, especially when dealing with multiple absent employees and the constant fear of making errors. I remember the struggle of keeping track of countless documents and trying to stay updated on ever-changing regulations while juggling other responsibilities. It’s safe to say that outsourcing payroll would have saved me from many sleepless nights and allowed me to focus more on the core aspects of the business.