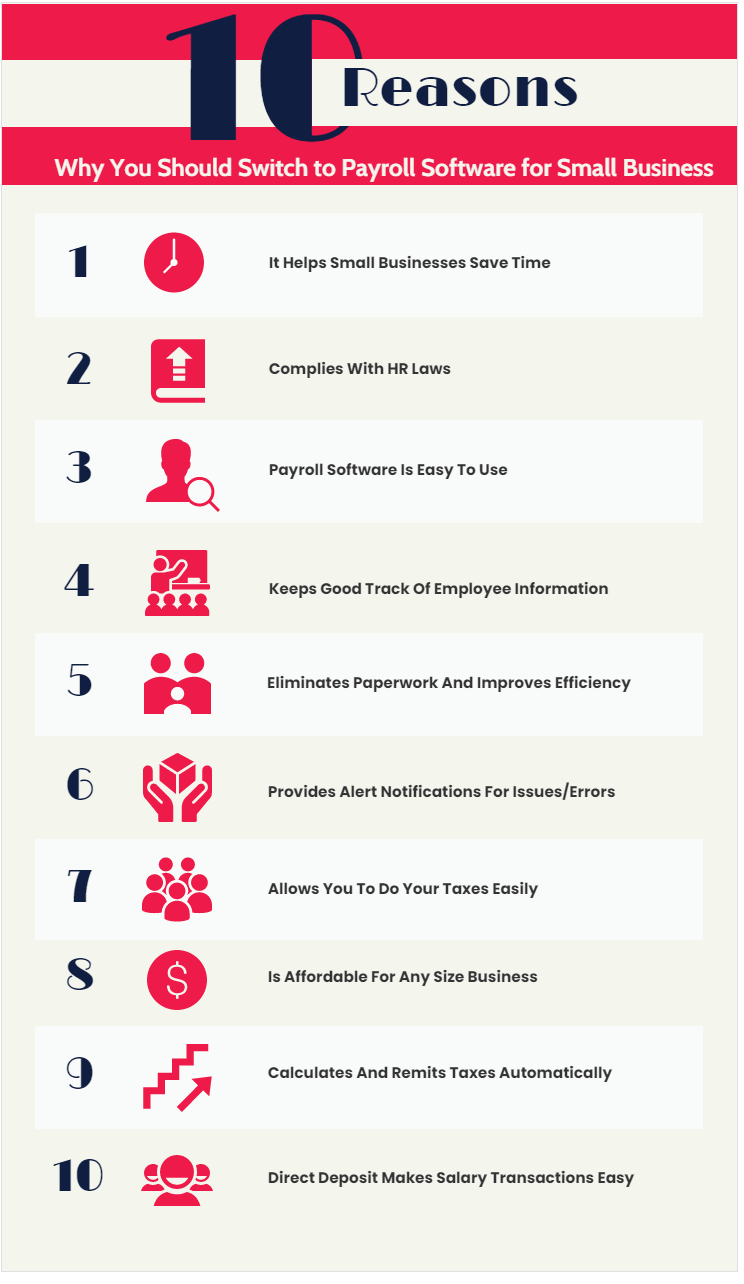

Why You Should Switch to Payroll Software

Payroll management can be very complex and time-consuming. Business management software programs make your job easier and using one for payroll management can solve all of your problems. Once you have the right payroll system at your disposal, it can be extremely easy to manage all of your employees’ payrolls on your own, without the help of an outside agency or accountant. By switching to payroll software, you gain access to more benefits than just being able to handle your employees’ payrolls alone. Here are 10 reasons why you should switch to payroll software for small business.

Table of Contents

Reasons Why You Should Switch to Payroll Software for Small Business

1. It Helps Small Businesses Save Time

Payroll management is not an easy task. If your company has only a few employees, it’s even more difficult because of all paperwork required by law. Payroll management may require many hours of work per week. In some countries, it’s almost impossible to do without any automated tool or at least specialized payroll software. By choosing cloud-based payroll software you will save time and have more time for other important tasks. Moreover, switching from paper checks to direct deposits can significantly reduce mailing costs and increase employee satisfaction with faster payments. That is true if your employees don’t live near your location as well as those who work from home or those who travel too much on their jobs.

2. Complies With HR Laws

In addition to allowing employees to be paid on time, a payroll system makes it easier for companies with fewer than 50 employees (the requirement in most states) to meet federal and state employment laws. When you do it yourself, mistakes are easy to be made. Payroll systems will help keep your company compliant.

3. You’ll Always Know What You Owe

Payroll is one of those headaches that can sneak up on any business owner—especially when the time comes to pay quarterly taxes and file W-2s at year’s end. A good payroll system eliminates guesswork and helps reduce stress by simplifying reporting requirements and providing alerts about upcoming deadlines so you can plan ahead.

4. Payroll Software Is Easy To Use

One of the best reasons to use payroll software is that it’s easy. You won’t need any experience or training, and it can be up and running within hours. If you don’t want employees spending time on calculating taxes, holidays, sick days, etc., then you might find yourself falling in love with automated payroll management. All of these calculations are done at both the federal and state level. Most providers will also handle deductions like health insurance or retirement accounts automatically as well.

5. Keeps Good Track Of Employee Information

When someone leaves your company, it can be tough to get all of their information off of your hard drive and into your new system. Because human resources departments don’t always store their employee information in one central location. With a payroll software solution, all of that vital data is stored on one platform. This makes it easy for you to update anything on record with just a few clicks. It can be especially helpful when tax season rolls around and you need every detail at your fingertips. It also means no more time wasted hunting down each employee’s W-2 or making phone calls trying to track them down. Instead, everything is organized and easy to access within seconds.

6. Eliminates Paperwork And Improves Efficiency

You can’t escape paperwork in most office jobs. But you can make it easier by choosing payroll software that automates much of it. Payroll software will save time and increase efficiency, which means your staff can spend more time focusing on customer service and growing your company. Plus, it’s never been easier to transition from paper-based systems to automated ones—and paystubs are no exception. A good payroll system includes an online portal where employees can view their pay stubs or W-2 forms at any time, making them easy to access. It also reduces mistakes that could cause problems with taxes or other government agencies.

7. Provides Alert Notifications For Issues/Errors

You can do your own taxes easier with payroll software. This makes it easy to figure out any tax implications during tax season and know if someone qualifies for a deduction or not. If you want things to become really easy, consider onboarding payroll software for your business. By doing so, everything will work out with minimal effort and in the right direction. One of the most important reasons to switch to payroll software is it will nullify the errors keeping you and your employees tension-free.

8. Allows You To Do Your Taxes Easily

Having your own payroll system is great, but it’s not just about getting all of your information from one source. It’s also about making your job easier and saving you time by doing tasks automatically for you. Payroll software can help with filing taxes because it will automatically calculate what tax is owed and how much money needs to be paid out. That way, when it comes time to do your taxes, there won’t be any missing numbers or hard-to-find forms that could cause an issue. And with easy setup and administration, as well as extensive reporting features that can help you analyze how things are going over certain periods of time—and even show long-term trends—your finances will be in good hands.

9. Affordable For Any Size Business

Most companies are surprised at how affordable payroll software is. Compared to purchasing your own hardware and hiring an in-house accountant, which can cost thousands of dollars per month, it’s hard to beat. It also makes sense from a budgeting perspective. Payroll management doesn’t have to be difficult or expensive if you’re working with automated systems that are designed specifically for your needs—and your pocketbook.

10. Payroll Software Calculates And Remits Taxes Automatically

You’ll receive new W-2s from your employees, which means that it’s time to start calculating their annual income taxes. You can either hire an accountant or do all of that paperwork yourself. With payroll software, though, it’s much easier—and cheaper—to just have everything handled automatically. Your tax liability is calculated and paid every time your employee is paid, so you don’t have to worry about any paperwork during tax season.

11. Direct Deposit Makes Salary Transactions Easy

Direct deposit is an effective way of ensuring that your employees get paid. Rather than waiting around for checks in the mail, employees can be sure their paychecks are on time and accurate. It also helps them budget more effectively. If you want to eliminate all of those headaches and streamline your payroll process, consider switching to payroll software for small business with direct deposit capabilities. Employees will appreciate it too!

Over 15 years of global experience in Finance & Accounting. She holds a Doctor of Finance from the University of Toronto