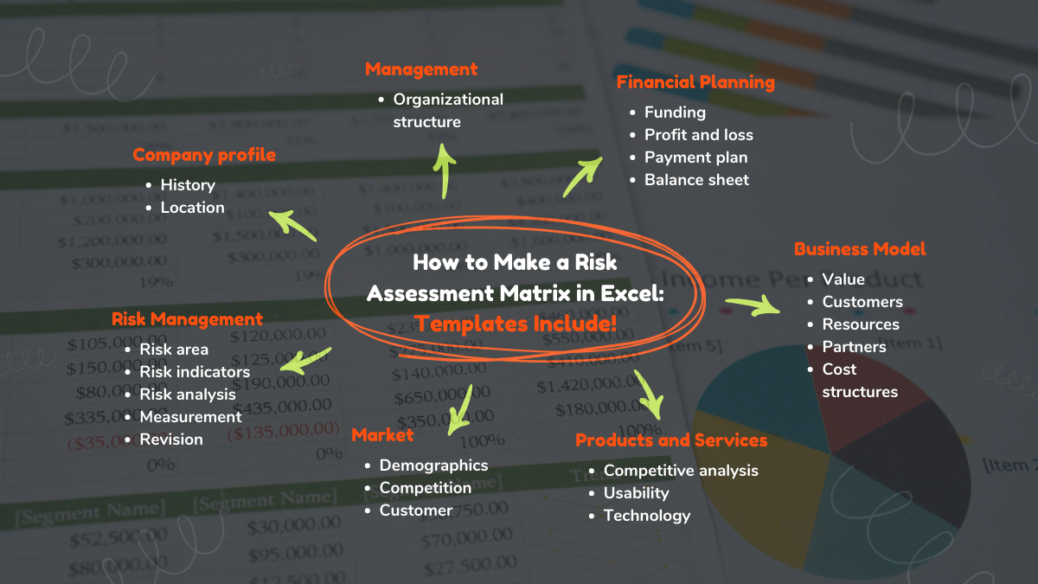

How to Make a Risk Assessment Matrix in Excel: Templates Include!

What is a Risk Matrix Excel Template? How to Make a Risk Assessment Matrix in Excel?Consider it your guiding star amid the deep depths of project management. This isn’t just any table; it’s a painstakingly created map in which you can draw the coordinates of every possible danger. With this map, you carefully assess each risk based on two critical factors: its likelihood and possible influence on your project’s progress.

Table of Contents

Why Use a Risk Matrix Excel Template? Using a risk matrix Excel template is akin to having a seasoned navigator by your side. Not only does it provide a clear visual representation of the challenges ahead, but it also empowers you to prioritize your efforts effectively. It’s the compass that guides you through the choppy waters of risk management, ensuring you steer clear of danger while charting a course toward success.

So set sail to https://www.projectcubicle.com/ where you will discover a wealth of resources to support your journey. It’s a different analogy, but I think our readers understood us very well! With our arsenal of tools and templates (Matrix Template Excel Free Download), you will navigate the high seas of project management with confidence and mastery. We’ll upload tons of templates for you. Prepare to embark on a voyage to success – set the sails, raise the anchor and let’s chart a course to conquer the corporate seas together! Let’s get started!

Understanding the Risk Assessment Matrix

Imagine you’re a captain navigating the vast sea. Each possible event, like a storm or a hidden reef, represents a risk. In the world of project management, a risk assessment matrix is your compass. In Excel, it takes the form of a table, but not just any table. It’s a calculated arrangement where you list all imaginable risks and evaluate them based on two critical factors: the likelihood of each risk happening and the impact it would have on your project’s voyage.

When you craft a risk matrix excel template, you’re effectively plotting the coordinates of each potential risk. This not only provides you with a visual representation but also helps prioritize which risks need your attention first. It’s like knowing which waves to ride and which to avoid as you steer towards your project destination.

What is a Risk Matrix?

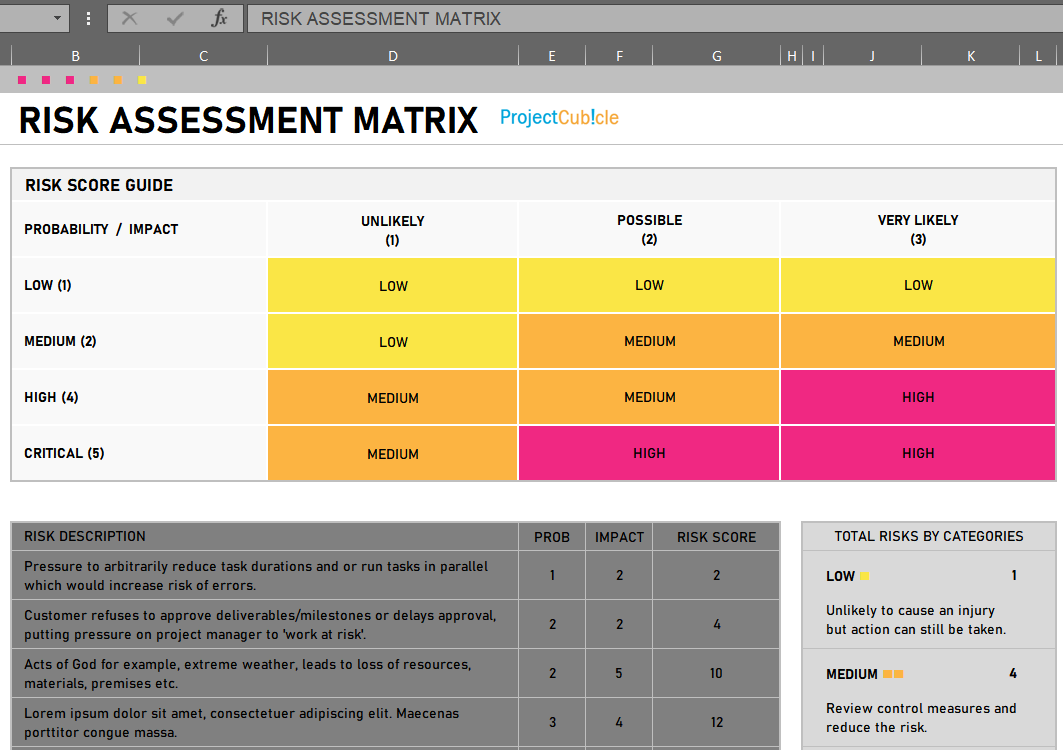

A risk matrix is a pivotal tool utilized across industries to visualize and manage risks effectively. It serves as a graphical representation of potential risks, categorizing them based on their likelihood and impact. This categorization allows stakeholders to prioritize risks and allocate resources efficiently. The matrix typically consists of a grid with likelihood levels on one axis and impact levels on the other, forming a comprehensive framework for risk assessment and decision-making. By providing a clear visual depiction of risk severity, a risk matrix facilitates better understanding and communication among stakeholders, ultimately enhancing risk management practices.

Why Use a Risk Matrix?

The utilization of a risk matrix offers numerous advantages to organizations striving to mitigate risks and achieve their objectives. Firstly, it enables stakeholders to identify and prioritize risks effectively by categorizing them based on likelihood and impact. This prioritization ensures that attention and resources are directed towards addressing high-risk areas that pose the most significant threats to organizational goals. Secondly, a risk matrix serves as a powerful communication tool, allowing stakeholders to grasp the severity of risks at a glance. This visual representation fosters clarity and facilitates informed decision-making, as stakeholders can quickly understand the implications of different risk scenarios. Additionally, by employing a risk matrix, organizations can streamline their risk management processes, enhancing efficiency and effectiveness in identifying, assessing, and mitigating risks across various projects and initiatives.

History About Risk Management

The history of the Risk Assessment Matrix is a journey that blends the evolution of risk management with the advancement of analytical tools. It’s a tale that dates back to the earliest endeavors of humans when risks were assessed instinctively. However, the concept of systematically analyzing risks started to take shape during the Renaissance period, when explorers and merchants began to quantify the uncertainties of sea voyages and trading ventures.

The modern form of the risk matrix that we are familiar with today has its roots in the 20th century, particularly in the fields of engineering and the military. It was during the 1940s and 1950s that more formalized methods were developed, as these fields dealt with increasingly complex projects that demanded a structured approach to identify, assess, and mitigate potential hazards.

Key Development In Risk Management

The advent of personal computing and software like Excel in the late 20th century revolutionized the risk assessment matrix by making it more accessible and user-friendly. Excel enabled project managers to create and manipulate matrices with ease, visualizing complex data and making informed decisions based on the results.

Today, the risk assessment matrix is an integral part of risk management practices across various industries, from construction and manufacturing to IT and healthcare. The matrix has evolved from simple hand-drawn tables to sophisticated digital models, often embedded within project management software and supported by a wealth of historical data and analytical capabilities.

How to Create a Risk Matrix in Excel

Creating a risk matrix in Excel is a straightforward process that can yield valuable insights for organizations. To begin, open Excel and set up a new spreadsheet with appropriate column headers, including Risk ID, Description, Likelihood, Impact, and Risk Rating. Next, enter the relevant data for each risk, such as likelihood and impact assessments, and calculate the risk rating using a predefined formula. Then, design the risk matrix within the spreadsheet, organizing likelihood levels along one axis and impact levels along the other. Apply conditional formatting to the matrix to visually represent different risk levels effectively. Finally, link the data in the matrix to the main table using Excel formulas like VLOOKUP to ensure consistency and accuracy. By following these steps, organizations can create a robust risk matrix in Excel that facilitates comprehensive risk assessment and informed decision-making, empowering them to proactively manage risks and safeguard their objectives effectively.

1. Open Excel Spreadsheet:

- Begin by launching Microsoft Excel on your computer. For instance, you can click on the Excel icon from your desktop or Start menu.

- Once Excel is open, initiate a new spreadsheet by selecting “Blank Workbook” or a similar option.

How to Make a Risk Assessment Matrix in Excel Step 1

2. Set Up Columns:

- In the first row of your spreadsheet, define column headers for various elements of risk management. For example, you might have columns labeled “Risk ID,” “Description,” “Likelihood,” “Impact,” “Risk Rating,” “Mitigation Strategy,” and “Status.”

- Customize the column headers based on the specific aspects of risk management you want to track.

How to Make a Risk Assessment Matrix in Excel Step 2

3. Enter Risk Data:

- Proceed to input the details of each risk into the spreadsheet. Start by assigning a unique identifier to each risk under the “Risk ID” column. For instance, Risk 001, Risk 002, and so on.

- Describe each risk thoroughly in the “Description” column, including relevant information such as the nature of the risk, potential consequences, and any contributing factors.

- Assess the likelihood and impact of each risk using a predefined scale, such as low, medium, or high. Enter these assessments into the “Likelihood” and “Impact” columns, respectively.

- Calculate the risk rating for each risk by multiplying the likelihood and impact scores and entering the result into the “Risk Rating” column.

How to Make a Risk Assessment Matrix in Excel Step 3

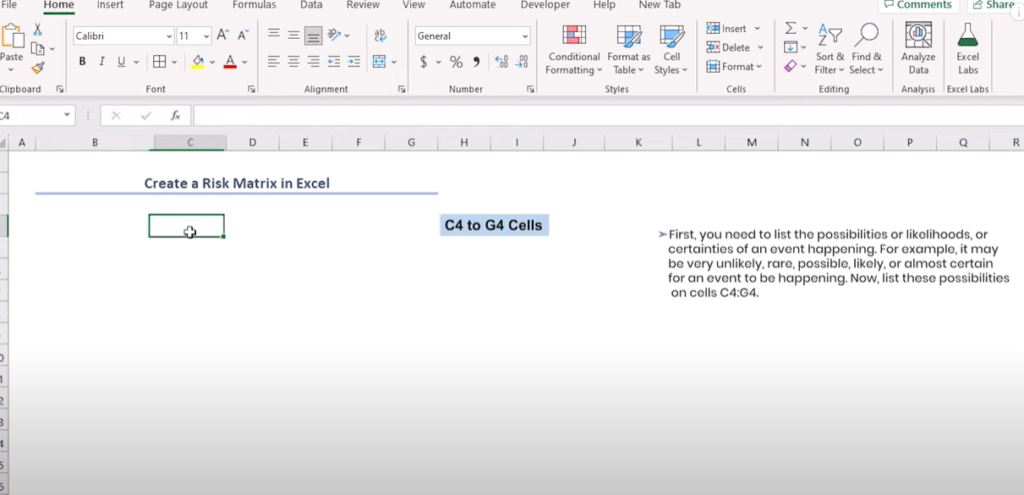

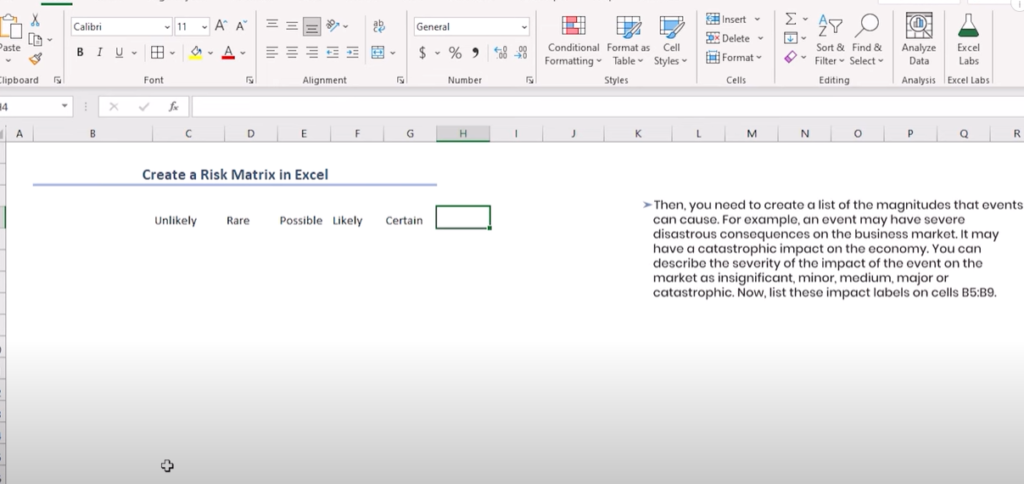

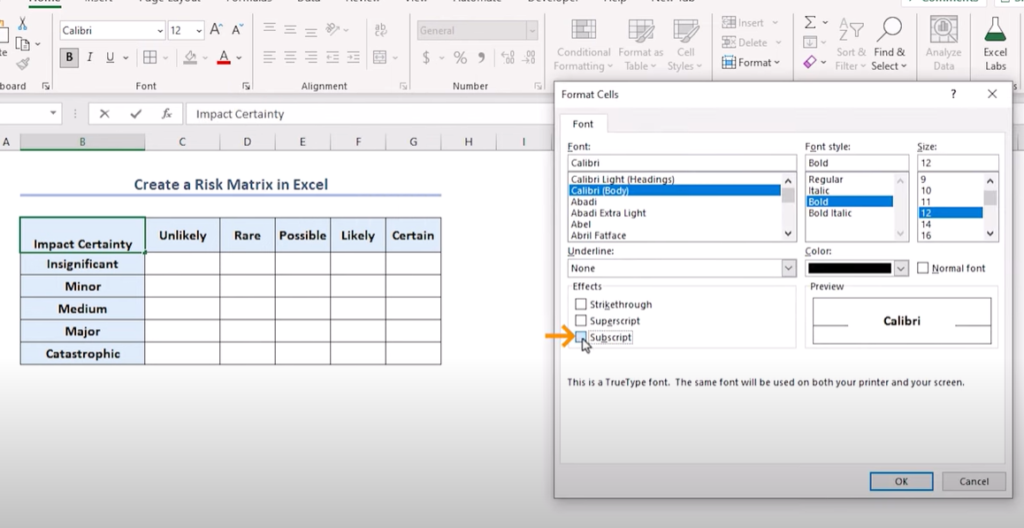

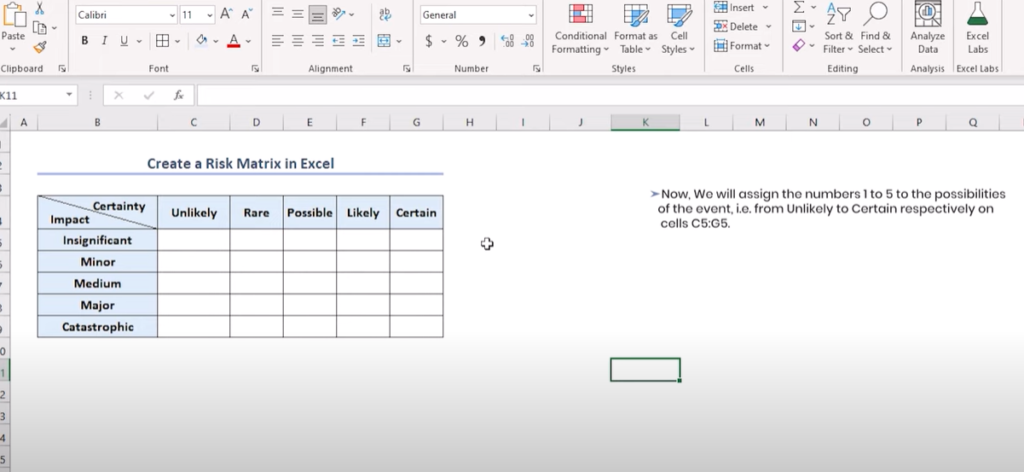

4. Create Risk Matrix:

- To visualize the risk ratings, create a risk matrix in a separate area of the spreadsheet. This matrix will provide a graphical representation of the likelihood and impact of each risk.

- Organize the likelihood levels (e.g., low, medium, high) along one axis of the matrix and the impact levels along the other axis.

How to Make a Risk Assessment Matrix in Excel Step 4

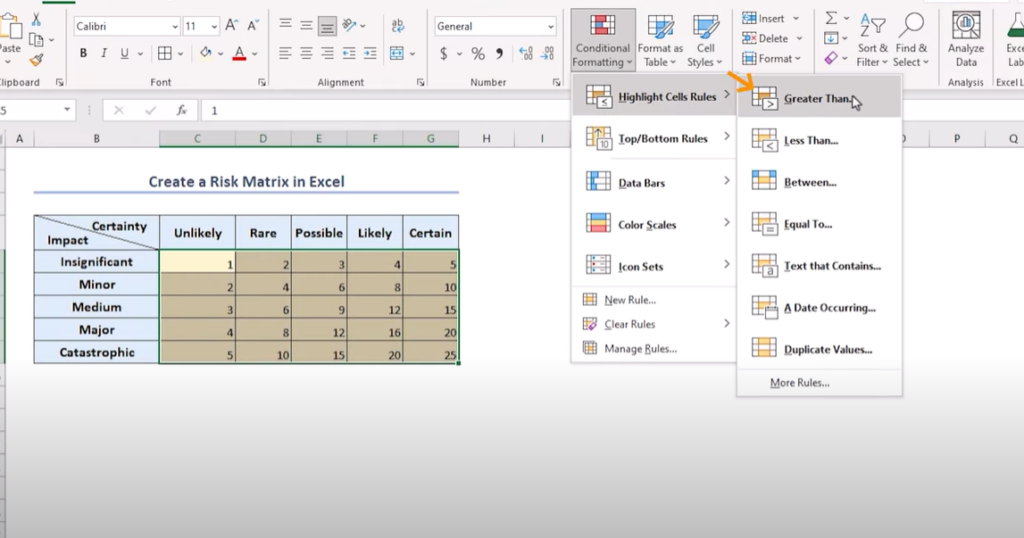

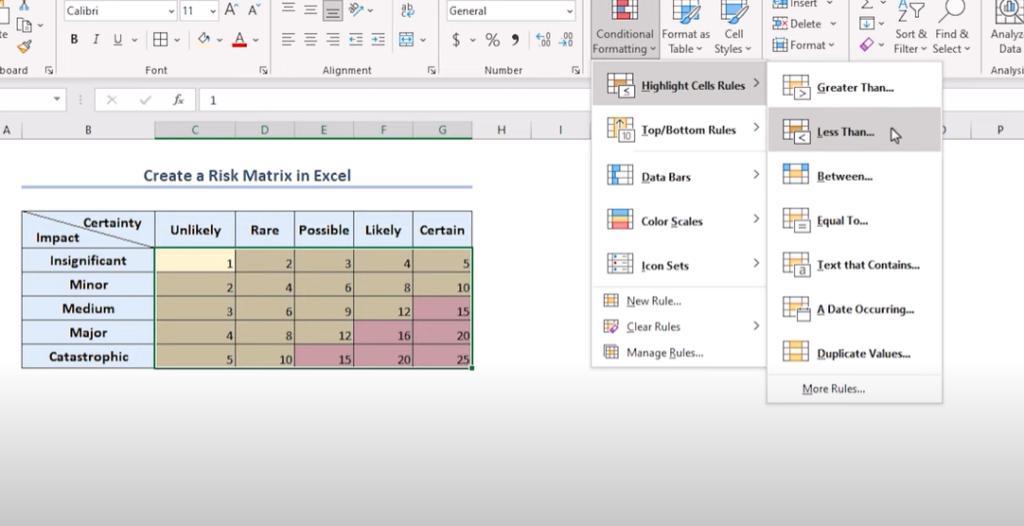

5. Apply Conditional Formatting:

- Use conditional formatting to automatically format cells in the risk matrix based on the risk ratings entered in the main table.

- Assign different formatting styles, such as colors or icons, to represent low, medium, and high-risk levels.

6. Link Cells:

- Establish links between the risk ratings in the main table and corresponding cells in the risk matrix. This linkage will ensure that changes made to risk ratings are reflected accurately in the matrix.

- You can use Excel formulas like VLOOKUP or INDEX/MATCH to retrieve the risk ratings from the main table and populate the cells in the risk matrix dynamically.

7. Include Mitigation Strategies and Status:

- Allocate columns in the main table for documenting mitigation strategies and tracking the status of each risk.

- Provide options for data entry in these columns, such as drop-down lists for selecting predefined mitigation strategies or status updates, or free text entry for adding custom information.

8. Format and Customize:

- Enhance the appearance and usability of the spreadsheet by formatting it effectively.

- Add borders, colors, and styles to differentiate sections of the spreadsheet and highlight important information.

- Ensure that the layout is intuitive and easy to navigate, with clear labels and organized data.

9. Test and Review:

- Before finalizing the risk management matrix, thoroughly test its functionality with sample data.

- Review the spreadsheet for any errors, inconsistencies, or areas for improvement.

- Make necessary adjustments based on feedback from stakeholders or usability testing.

5×5 risk Matrix Template Excel Free

You can download a 5×5 risk matrix template Excel free from projectcubicle.com. This template is a valuable resource for organizations seeking to streamline their risk management processes. With this template, you can effectively categorize risks based on their likelihood and impact, facilitating comprehensive risk assessment and decision-making. To download the template, simply click on the following links:

- 5×5 Risk Matrix Template Excel Free Download

- Free Download 5×5 Risk Matrix Template Excel

- Get Your 5×5 Risk Matrix Template Excel Now

By downloading the 5×5 risk matrix template Excel free / Matrix Template Excel Free Download from projectcubicle.com, you can expedite your risk management efforts and ensure consistency and accuracy in risk analysis. Don’t miss out on this valuable resource!

Why Choose Our Matrix Template Excel?

With our Matrix Template Excel, you gain access to a comprehensive yet intuitive tool designed to streamline your risk management efforts. Here’s why it stands out:

- Ease of Use: Say goodbye to complicated setups and convoluted processes. Our template is designed with user-friendliness in mind, allowing you to start assessing risks immediately.

- Flexibility: Whether you’re a novice or an Excel expert, our template caters to all skill levels. Customize it to suit your specific project needs with ease.

- Efficiency: Time is of the essence in project management. Our template helps you save valuable time by providing a structured framework for risk assessment and prioritization.

- Visual Clarity: Clear, concise, and visually appealing – our Matrix Template Excel ensures that you can easily identify and understand the risks associated with your project.

How to Get Started:

Getting started with our Matrix Template Excel is quick and simple. Just follow these steps:

- Download: Click the link below to download the Matrix Template Excel to your device.

- Customize: Tailor the template to fit your project requirements by adding or removing elements as needed.

- Input Data: Input your risk data into the designated cells, including likelihood, impact, and any other relevant information.

- Analyze: Use the template to assess and prioritize risks based on their likelihood and impact, gaining valuable insights to inform your decision-making process.

Download Now and Elevate Your Risk Management Efforts!

Don’t let risk management become a daunting task. Download our Matrix Template Excel today and empower yourself with a powerful tool that simplifies the process, allowing you to navigate the challenges of project management with confidence. Click below to embark on a journey towards streamlined risk management:

FAQs About Risk Management in Excel

How do you create a risk matrix?

Creating a risk matrix involves several steps:

- Define Risk Categories: Determine the categories you’ll use to assess risks. These typically include likelihood and impact.

- Set up a Grid: Create a grid in Excel with likelihood levels on one axis (e.g., low, medium, high) and impact levels on the other (e.g., minor, moderate, severe).

- Assign Values: Assign numerical values or scores to each level of likelihood and impact. For example, you might use a scale of 1 to 5, with 5 representing the highest likelihood or impact.

- Plot Risks: Plot each identified risk on the grid based on its assessed likelihood and impact. This will determine its position within the matrix.

- Color Code: Apply conditional formatting or color-coding to the cells in the grid to visually represent the risk levels.

- Analyze and Prioritize: Analyze the position of each risk within the matrix and prioritize them based on their location (e.g., risks in the high likelihood/high impact quadrant may require immediate attention).

Is there a risk assessment template in Excel?

Yes, there are many risk assessment templates available in Excel. These templates often include pre-defined sections for identifying and evaluating risks, assessing likelihood and impact, calculating risk scores, and documenting mitigation strategies. You can find these templates online or create your own based on your specific needs.

excel risk assessment matrix template

What is a risk matrix in Excel?

A risk matrix in Excel is a visual representation of risks based on their likelihood and impact. It typically consists of a grid where risks are plotted according to their assessed levels of likelihood and impact. Excel is commonly used to create and manipulate risk matrices due to its flexibility and computational capabilities.

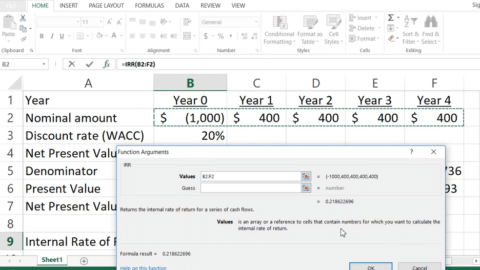

How to calculate risk in Excel?

To calculate risk in Excel, you typically need to assess two main factors: likelihood and impact. You can assign numerical values or scores to each factor, then multiply the likelihood score by the impact score to obtain a risk rating. For example, if likelihood is rated on a scale of 1 to 5 and impact is rated on a scale of 1 to 5, the risk rating would be the product of these two scores (e.g., likelihood score of 4 multiplied by impact score of 3 equals a risk rating of 12).

How do you create a 3×3 matrix in Excel?

To create a 3×3 matrix in Excel, follow these steps:

- Open Excel: Launch Excel and start a new worksheet.

- Enter Data: Enter the data you want to include in the matrix into the appropriate cells. For a 3×3 matrix, you would enter data into nine adjacent cells.

- Format Cells: Highlight the range of cells containing your data and use Excel’s formatting options to adjust the appearance of the matrix as desired. You can change font styles, cell borders, colors, and more.

- Add Labels: Include labels for rows and columns to provide context for the data in the matrix. These labels help users understand what each cell represents.

What is a 4×4 risk matrix?

A 4×4 risk matrix is a risk assessment tool that categorizes risks based on four levels of likelihood and four levels of impact. It typically consists of a 4×4 grid where risks are plotted according to their assessed likelihood and impact levels.

How do I create a matrix?

To create a matrix in Excel, you need to organize your data into rows and columns within the spreadsheet. Each cell in the matrix represents a data point, and you can format the cells to visually represent patterns or relationships within the data. You can also add labels to rows and columns to provide context for the data in the matrix.

Is a pivot table a matrix?

While a pivot table in Excel can be used to summarize and analyze data in a tabular format, it is not typically considered a matrix. Pivot tables allow you to aggregate and manipulate data dynamically, but they do not have the same structure or visual representation as a traditional matrix.

How do you make a matrix formula?

To create a matrix formula in Excel, you can use built-in functions like SUMPRODUCT, INDEX, or VLOOKUP to perform calculations based on the values in the matrix. These formulas allow you to manipulate and analyze data within the matrix, performing tasks such as calculating totals, finding specific values, or generating summary statistics.

Conclusion

In conclusion, understanding and effectively managing risks are essential components of success in both personal and professional endeavors. From ancient civilizations to modern-day enterprises, the practice of risk management has evolved significantly, driven by the need to navigate uncertainties and seize opportunities.

As we continue to face complex challenges in an ever-changing world, the importance of robust risk management practices cannot be overstated. Whether it’s safeguarding financial investments, protecting against cybersecurity threats, or ensuring the safety of space exploration missions, proactive risk management is key to resilience and sustainability.

By embracing risk management principles and leveraging tools and frameworks such as risk matrices, organizations and individuals can proactively identify, assess, and mitigate risks, thereby maximizing opportunities for growth and innovation while minimizing potential pitfalls.

Ready to elevate your risk management game? Download our Matrix Template Excel now and start navigating the uncertainties of your projects with confidence. Don’t let risks hold you back—empower yourself with the tools and knowledge to thrive in today’s dynamic world.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/