What is the formula for calculating IRR?

What is the formula for calculating IRR? IRR is a financial calculation used to determine an investment’s profitability. This calculation considers the cash flows over the life of the investment and provides a rate of return that measures how efficient the investment is. There are multiple formulas for calculating IRR, but they all rely on taking into account the present value of each cash flow. Knowing how to calculate IRR can help investors make sound decisions about where to invest their money.

Table of Contents

When making an important financial decision, it is crucial to use accurate information. One of the most important calculations you can make is the Internal Rate of Return IRR. This calculation tells you how successful your investment will be. But what is the formula for calculating IRR? And how do you use it correctly? Keep reading to learn more!

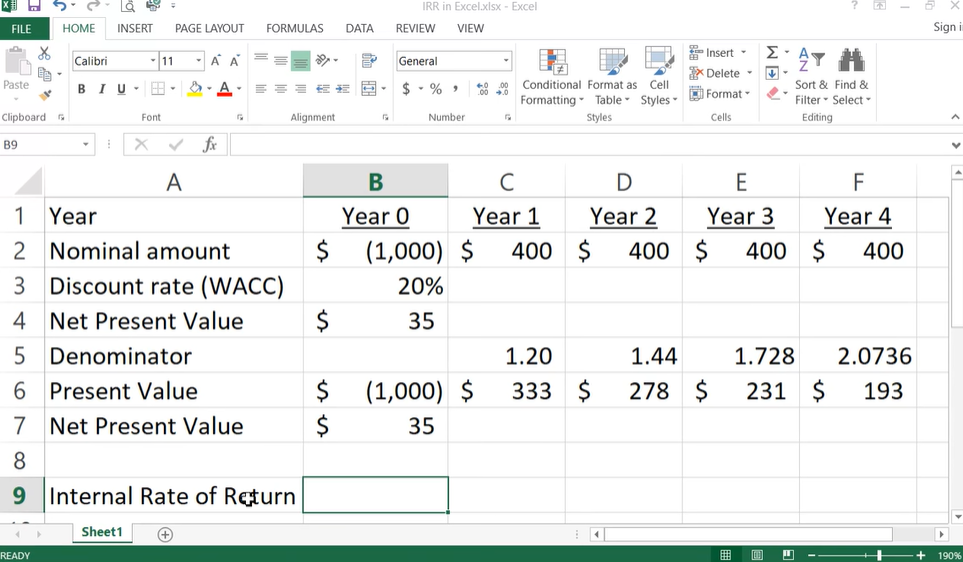

There are two ways to calculate IRR. The first way is to use Excel, and the second way is to use a financial calculator. If you have Excel, we recommend using that method because it is more accurate. Below, we will show you how to calculate IRR in Excel.

The formula for calculating IRR is:

IRR = NPER(rate, -pmt, pv, fv)

Where:

- rate: The interest rate per period. For example, if you make monthly payments, this would be the annual interest rate divided by 12.

- pmt: The payment per period. This should be a negative number if you are making an investment (you are paying out cash), and a positive number if you are receiving payments (you are receiving cash).

- PV: The present value of the investment. This is the amount of money you are investing today.

- FV: The future value of the investment. This is the amount you expect to receive at the end of the investment period.

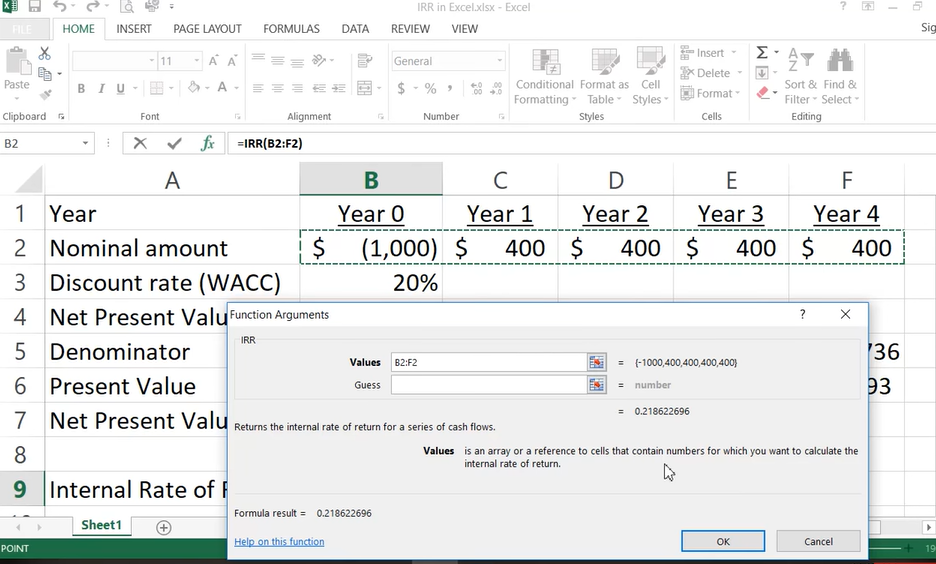

How to calculate IRR in Excel

Calculating IRR in Excel is easy! Just follow these steps:

1. Enter your interest rate in cell A1. For example, if your annual interest rate is 12%, you would enter 12% into cell A1. You will enter 1% into cell A1 if your interest rate is monthly.

2. Enter the number of payments in cell A2. For example, if you make monthly payments, you would enter 12 into cell A2.

3. Enter the present value of the investment in cell A3. This is the amount of money you are investing today.

4. Enter the future value of the investment in cell A4. This is the amount you expect to receive at the end of the investment period.

5. In cell A5, enter the formula =IRR(A1:A4).

6. Press enter, and your answer will appear in cell A5!

That’s all there is to it! Now you know how to calculate IRR in Excel.

When should you use IRR?

IRR is a helpful tool for making financial decisions, but it’s not the only tool you should use. You should also consider other factors, such as the payback period and the net present value. Additionally, IRR can give different results depending on how it’s used, so be sure to use it correctly. For example, if comparing two investments, you should use the same interest rate for both calculations. Otherwise, one investment may appear to be more profitable than it is.

Overall, IRR is a helpful calculation that provides valuable information about an investment’s profitability. By understanding how to calculate IRR and using it correctly, you can make sound financial decisions that will help you reach your goals.

How do I calculate IRR using NPV in Excel?

The IRR function in Excel calculates the internal rate of return for a series of cash flows, assuming equal-size payment periods. However, you can also use the NPV function to calculate IRR.

To do this, enter your interest rate into cell A1, and your cash flows into cells A2 through A10. Then, in cell A11, enter the formula =NPV(A1, A2:A10). This will give you the present value of your cash flows.

Next, create a column with different interest rates (1% to 20%). For each interest rate, calculate the NPV using the same cash flows. The interest rate that results in an NPV of 0 is the IRR. This method is less accurate than the IRR function, but it can be helpful if you don’t have Excel or want to see how sensitive irr calculation is to changes in interest rates.

How do you calculate IRR quickly?

There is no one-size-fits-all answer to this question, as the best way to calculate IRR quickly will depend on your circumstances. However, here are a few tips that may help:

- Use Excel or another spreadsheet program to automate the calculation. This will save you time and ensure that your calculations are accurate.

- Use the IRR function if you have Excel. This is the quickest and most accurate way to calculate IRR.

- Use the NPV function if you don’t have Excel. This method is less accurate but can still give you a good idea of an investment’s profitability.

- Use online calculators. Many free online calculators can quickly calculate IRR for you.

- Use a financial advisor. If you’re unsure how to calculate IRR or don’t have the time to do it yourself, a financial advisor can help. They can also provide other valuable insights to help you make sound investment decisions.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/