How to Calculate Compound Interest in Excel: A Comprehensive Guide 📊💰

How to Calculate Compound Interest in Excel? If you’re looking to master the art of calculating compound interest in Excel, you’re on the right track. Whether you’re a finance student, a professional, or just someone trying to organize personal investments, understanding the formula for compound interest in Excel is crucial. Excel’s powerful computing ability lets you effortlessly apply the compound interest formula to your data, allowing you to see potential growth over time. This knowledge could be the key to unlocking a more informed financial future. Whether you’re computing for savings, investments, or loans, mastering this formula can help you make more educated financial decisions. So, let’s dive into the world of Excel and demystify the process of computing compound interest.

Table of Contents

In today’s digital age, where information is readily accessible at our fingertips, mastering the art of calculating compound interest in Excel is an invaluable skill. Whether you’re a financial analyst, a student studying finance, or simply someone who wants to manage their investments more effectively, this guide will provide you with a step-by-step tutorial on calculating compound interest using Microsoft Excel. We understand the importance of clear and concise instructions, so let’s dive right into the world of compound interest calculations. 💹📈

Takeaways 🎉💡

- Calculating compound interest in Excel is a valuable skill for financial management.

- It allows you to estimate the future value of your investments accurately.

- Understanding the frequency of compounding and the time horizon is essential for maximizing returns.

- Excel offers handy functions to streamline compound interest calculations.

Excel Count Rows [2024]: What Is the Formula to Count Rows in Excel?

Formula in Excel for Compound Interest

The formula in Excel for compound interest is a powerful tool for your financial calculations. Understanding how to use this formula in Excel for compound interest can greatly assist you when calculating the future value of your investments. Learning how to correctly utilize this Excel formula for compound interest is essential.”

“When searching for formula in Excel for compound interest, you can perform the desired calculation using this formula in Excel for compound interest. This formula in Excel for compound interest provides you with precise results for your financial calculations and helps you plan your future investments more accurately.”

“The formula in Excel for compound interest is an indispensable tool for assessing the growth potential of your investments. This Excel formula assists you in predicting how your initial investment will grow and contributes to shaping your financial future.”

“Learning formula in Excel for compound interest is essential for better planning your future investments and reaching your financial goals. This formula can help you optimize your investment strategies and further strengthen your journey towards financial success.”

“The compound interest formula in Excel not only makes your financial calculations more efficient but also sheds light on your financial future. By using formula in Excel for compound interest, you can gain a better understanding of how your investments will grow and make more informed decisions.

Understanding Compound Interest 🧮

How to Calculate Compound Interest in Excel? Before we delve into the Excel calculations, it’s essential to grasp the concept of compound interest. Compound interest is the interest calculated not only on the initial amount (principal) but also on the accumulated interest from previous periods. In simpler terms, your money earns interest not just on the original sum but also on the interest it has already earned. 💡💰

Setting Up Your Excel Spreadsheet 📊📑

How to Calculate Compound Interest in Excel? Let’s start by setting up your Excel spreadsheet for calculating compound interest. Follow these steps carefully:

Step 1: Open Excel Launch Microsoft Excel on your computer. If you don’t have it installed, you can use the online version or download a free alternative like Google Sheets. 🖥️

Step 2: Enter Your Data In your Excel spreadsheet, create the following columns:

Principal Amount (P): This is the initial amount you’re investing. Annual Interest Rate (r): Enter the annual interest rate in decimal form (e.g., 0.05 for 5%). Number of Compounding Periods (n): This represents how many times interest is compounded per year. Time (t): The number of years you plan to leave your money invested.

Step 3: Formulas for Calculating Compound Interest Now, let’s input the formulas you’ll need:

Compound Interest Formula 🧮

A = P(1 + r/n)^(nt)

In this formula:

A represents the future value of your investment. P is the principal amount. r is the annual interest rate in decimal form. n is the number of compounding periods per year. t is the time in years.

Step 4: Calculate Compound Interest In a new cell, use the formula mentioned above to calculate the future value of your investment. You can do this as follows:

=A1 * (1 + B1/C1) ^ (C1*D1)

Make sure to replace the cell references (A1, B1, C1, D1) with the appropriate cells in your spreadsheet. 🧾💼

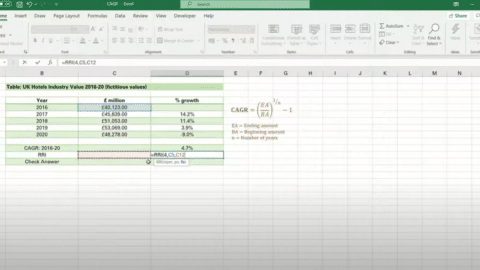

An Example Calculation 📈💡

Let’s illustrate this process with an example:

Suppose you have $5,000 to invest at an annual interest rate of 6%, compounded quarterly over 5 years. Using the formula above, you can calculate the future value of your investment.

Principal Amount (P): $5,000 Annual Interest Rate (r): 6% or 0.06 Number of Compounding Periods (n): 4 (quarterly) Time (t): 5 years

Plugging these values into the formula, you’ll find the future value of your investment.

Future Value (A) Calculation 📈

=A1 * (1 + B1/C1) ^ (C1*D1)

=5000 * (1 + 0.06/4) ^ (4*5)

=5000 * (1 + 0.015) ^ 20

=5000 * (1.015) ^ 20

=5000 * 1.349858807576003

=$6,749.29

So, after 5 years, your $5,000 investment will grow to approximately $6,749.29 when compounded quarterly at a 6% annual interest rate. 📊💰

FAQs ❓🤔

Q1: What is compound interest?

Compound interest is the interest calculated not only on the initial amount (principal) but also on the accumulated interest from previous periods.

Q2: Why is it important to understand compound interest?

Understanding compound interest is crucial for making informed financial decisions and optimizing investments.

Q3: Can I use Google Sheets instead of Excel?

Yes, you can use Google Sheets or other spreadsheet software that supports formulas.

People Also Ask 🧐

Q: How often should I compound interest for maximum returns?

A: The frequency of compounding can affect your returns. Generally, more frequent compounding (e.g., quarterly or monthly) leads to higher returns.

Q: Are there any Excel functions for compound interest calculations?

A: Yes, Excel has built-in functions like FV and CUMIPMT that can simplify compound interest calculations.

Start mastering compound interest in Excel today! 🚀💼

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/