Acid Test Ratio (Quick Ratio) Formula, Example, Definition

Professionals new to financial terms, often think that acid-test ratio or liquidity are chemical concepts that are used to refer to complex chemical processes. However, it is an indicator that shows the ratio between the short-term assets and the short-term liabilities of a company. When I heard them first many years ago, I was surprised and decided to investigate deeply. As a project management professional, I am sure that understanding financial concepts provides many benefits to project teams while making decisions on the baseline budget. In this article, we will talk about the acid test ratio (quick ratio) definition, analyze the formula and demonstrate how the ratio is calculated and how the results will support your financial decision-making process with examples.

Table of Contents

What is the Acid Test Ratio? – A Short Definition

Finance specialists often use ratios and calculations to determine the financial health of a business. They make various calculations to understand the amount of cash needed to cover the debts. Before giving the definition of acid test ratio, we need to talk about liquidity.

Liquidity is a significant concept in business that refers to how easily assets such as stocks and bonds can be converted into cash. Very liquid assets of a business are the assets that can be covered into cash in a short period like days. On the other hand, assets such as equipment and properties can not be covered into cash in a short period. They are less liquid because it may take months/years to liquidate them.

According to the above definitions, cash is the most liquid asset for any business. The quick ratio (also known as acid test ratio) is a mathematical calculation used to measure liquidity. Inputs of the calculation are taken from the balance sheet of the business.

Acid Test Ratio (Quick Ratio) Formula

Acid test ratio (quick ratio) is calculated to comprehend if the firm’s cash or near cash assets could cover the short-term debts in the next twelve months.

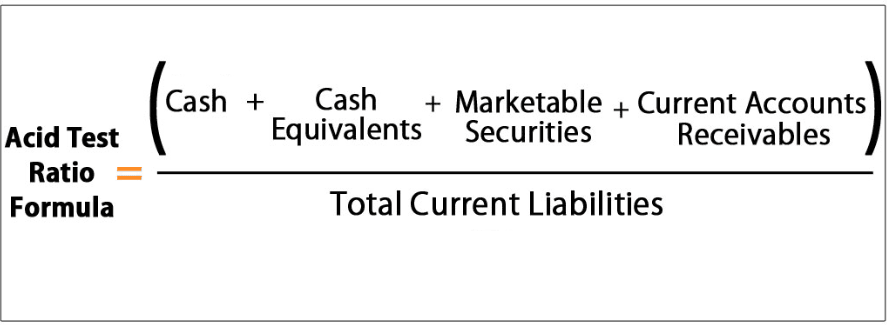

The below formula is used to calculate the ratio of the short-term assets over the total current liabilities of a company.

The acid test ratio formula calculates the result by dividing the summation of the Cash, Cash Equivalents, Marketable Securities, Current Accounts Receivables by Total Current Liabilities.

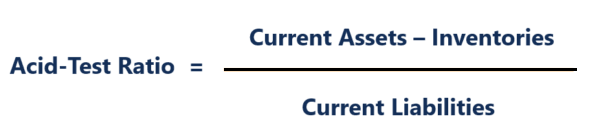

The below formula can also be used to calculate the ratio;

The second formula is widely used to calculate the acid test ratio (quick ratio). The difference between the two formulas is that the second one subtracts the inventory from the total current assets. The reason for this deduction is that the inventory is not considered to be converted into cash in a short time period.

Acid Test Ratio Examples

Let’s analyze the real-life examples given below to calculate the acid test ratio (quick ratio) for each case.

Example 1

Power Co. is a housing company, active in the north east. The below table demonstrates the current assets and current liabilities of Power Co.

| Current Assets | Current Liabilities | ||

| Cash | $80,000 | Accounts Payable | $620,000 |

| Accounts Receivables | $560,000 | Accrued Payable | $35,000 |

| Cash Equivalents | $130,000 | Notes Payable | $90,000 |

Acid Test Ratio = ($80,000 + $560,000 + $130,000 ) / ($620,000+ $35,500 + $90,000)

= 1.033

Example 2

X, Y, and Z are software development companies active in the USA. The below table demonstrates the current assets and current liabilities of each company.

| Assets/Liabilities | X Ltd | Y Ltd | Z Ltd |

| Current Assets | $65,000 | $88,000 | $130,000 |

| Inventories | $6,000 | $7,200 | $19,000 |

| Non-Current Liabilities | $33,000 | $28,000 | $17,000 |

| Total Liabilities | $47,000 | $70,000 | $69,000 |

Let’s calculate the acid test ratio of each company:

- X Ltd

Ratio = ($65,000 – $6,000) / ( $47,000 – $33,000) = 4.21

- Y Ltd

Ratio = ($88,000 – $7,200) / ( $70,000 – $28,000) =1.21

- Z Ltd

Ratio = ($130,000 – $19,000) / ( $69,000 – $17,000) =2.13

Example 3

Health Ltd. is a medical consultancy company. The below table illustrates the current assets and current liabilities of Health Ltd.

| Current Assets | Current Liabilities | ||

| Cash | $28.000 | Accounts Payable | $61.000 |

| Short Term Investments | $51.000 | Short Term Debt | $27.000 |

| Net Receivables | $47.000 | Other | $43.000 |

| Inventory | $8.000 | ||

| Other Current Assets | $15.000 | ||

Ratio = ($28.000+$51.000+$47.000+$15.000)/($61.000+$27.000+$43.000)

=1.076

Evaluating the Acid Test Ratio (Quick Ratio)

As discussed above, the acid-test ratio is a useful tool to show a company’s ability to pay off its current liabilities without relying on the sale of inventory. As it may be difficult to convert it into cash, the inventory is subtracted from the total current assets.

From this aspect, the acid-test ratio provides a more conservative evaluation of a company’s financial health.

If the ratio is high, the company’s liquidity and overall financial health is well. In other words, if the ratio is 2, the company has $2 of cash or cash equivalent to pay each $1 of current debts. If the quick ratio of an organization is greater than 1.0, then it can be considered to be capable of managing its short-term liabilities. It provides a more conservative measurement because it subtracts inventory which may take longer to be converted into cash.

On the other hand, a low or decreasing quick ratio often indicates that the financial health of the organization is poor.

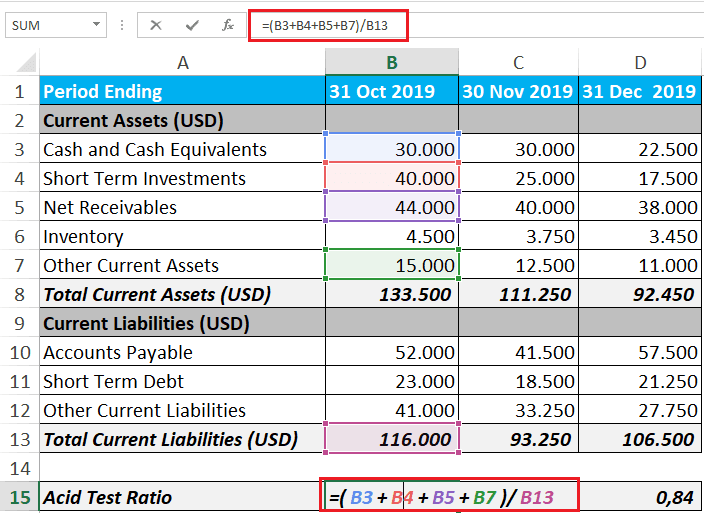

How to Calculate Acid-Test Ratio in Excel (with excel template)?

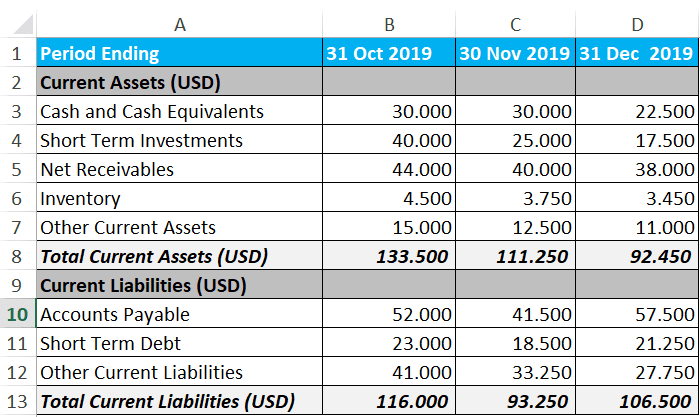

In this acid test ratio example, we will make calculations for Health Ltd. with the help of Microsoft Excel. You can also make calculations by using the excel template provided in the example below.

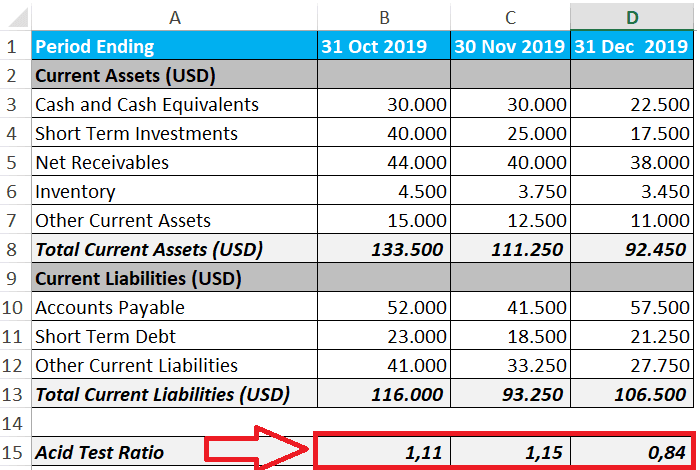

Based on the information provided above figure, the calculation can be made for each period (31 Oct 2019, 30 Nov 2019 and 31 Dec 2019)

Formula = (Cash + Cash equivalents + Marketable Securities + Current Accounts Receivables) / Total Current Liabilities

Finally, the result will be as below figure. It can be easily seen that the ratio is greater than 31 Oct 2019 and 30 Nov 2019. However, it is less than one at the end of December 2019.

Understanding the key aspects of the acid test ratio is very important because it demonstrates an organization’s potential to convert its assets into cash rapidly in order to manage its current debts. If an organization has a reasonable level of quick ratio, it will not need additional cash to meet its current obligations.

If you are a project manager planning to improve your knowledge in the field of program or portfolio management, we recommend you to know the liquidity and acid test ratio very well because these concepts can be used at the program and portfolio management rather than the project level.

See Also

Further Reading

Gallagher, Timothy (2003). Financial Management

I am a Civil Engineer in HES Consultancy Limited, experience as Director and Resident of Works and Technical, Financial and Administrative Project Audit. I have skills in the area of Procurement, Tenders and Contracting. I am PMP and PRINCE2 Certified. Monitoring and Control with the Earned Value Method.

The higher the ratio is, the better the company’s assets and liquidity are. Companies must take this into consideration.

we need to keep Acid Test Ratio high , ts a key to be success.