Cost-Benefit Analysis Explained: A Practical Guide with Real-Life Examples

In today’s economic environment, it is fundamental to use financial tools and techniques to support organizational decision making before you decide to start a new business or make a sweeping change in your current workstream. Organizations across all industries – from construction to the chemical, use various decision-making tools to become successful in their field. Basically, Cost Benefit Analysis Methodology (also known as Benefit Cost Analysis) is a mathematical approach that allows organizations to compare the costs and expected benefits of two or more projects by employing some basic steps. In this article, we will analyze simple but real-world Cost Benefit Analysis Examples and Calculation steps by discussing how net present value is related to it.

Table of Contents

What is Cost Benefit Analysis Methodology?

Most probably you have been using the Cost Benefit Analysis Methodology in your life while purchasing a new car or deciding to move to a new apartment. Because calculating the costs and returns of a decision is an integral part of anybody’s life.

Obviously, every project has a list of expenses and incomes. You need to calculate the net present value (NPV) and payback period to evaluate each of them. Basically, cost benefit analysis is a decision-making tool widely used in finance and economics. It is applicable to many industry projects such as IT, software development, construction, education, healthcare, and information technology.

Generally speaking, the main purpose of tracking the Cost Benefit analysis steps is to calculate the ratio of benefits over costs. Simply put, a Cost Benefit Analysis is conducted to identify how well, or how poorly, a project will be concluded.

A Brief History

A French economist and engineer Jules Dupit, who used this tool before in a bridge project, introduced the concept of CBA in his article in 1848. After this date, a famous economist Alfred Marshall structured this approach in his book” Principles of Economics” in 1890. The U.S. Army Corps of Engineers has been using Cost Benefit Analysis since the 1930s for many projects such as federal waterway infrastructure.

What Makes Cost Benefit Analysis Important?

As mentioned above, Cost Benefit Analysis is a systematic approach widely used in economics that takes into consideration the net present value of costs and expected benefits. It helps to minimize risks and maximize incomes both for your project and your company.

For example, you can use it while deciding to purchase a real estate property or undertake a new project.

But, what is the purpose of making a CBA for an investment?

Basically, Cost Benefit Analysis Methodology serves two purposes ;

- To verify that an investment’s (or a project’s) expected benefits are more than its costs.

- To select an investment (or a project) by comparing their benefits over cost ratios.

In order to make a comparison between the positive and negative aspects of the alternatives, a common unit is required. Money is the common unit used for comparison of alternatives.

In financial analysis, the time value of money is an important factor to consider. While performing a CBA calculation future costs and expected benefits of an investment are converted into the present value by using a discount rate.

Conducting a cost benefit analysis provides a methodology to decision-makers for weighing up a decision such as purchasing a new home or expanding sales in a new region.

It can be conducted by big companies as well as individuals while selecting the most effective alternative.

Cost Benefit Analysis Steps

Whether you are working in the private sector or in the public sector, it is essential to write down all the parameters while you are making a decision such as establishing a new program or expanding a current system. Below are essential steps that you can use while performing a cost benefit analysis.

- Build the structure: Analyze the current status of the change and determine all the requirements clearly.

- Determine the stakeholders: Determine who will be impacted by the change, who will bear the costs, and who will obtain the benefits.

- Categorize the costs and benefits: Categorize and classify costs and benefits as direct, indirect, tangible, and intangible in order to determine their effects clearly.

- Project both costs and benefits: Project and evaluate how costs and benefits change over the lifespan of the program/change. Because all the calculations will be affected by duration.

- List the costs as a monetary value

- List the benefits as a monetary value

- Use Net Present Value to adjust the future cash flows and costs to the present day.

- Calculate payback period

- Perform sensitivity analysis

- Evaluate the results

Cost Benefit Analysis and Net Present Value (NPV)

Before to analyze a cost benefit analysis example and calculation steps, let’s discuss how net present value is related to cost benefit analysis. Whether you are planning to undertake a large project or buying a desktop computer for office works, you need to weigh the expected costs against benefits to take the right decision. Therefore, you must compare both costs and benefits on equal terms. That’s why you need the net present value calculations.

In finance, the time value of money concept holds that 1 USD today has a greater value than 1 USD in the future. Therefore, while making a CBA, you need to bear in mind the time value of money. Using a discount rate adjusts the future cash flows to the present day. However, to provide simplicity, we will use the discount rate as “1” in our example.

Example for CBA and NPV

Net Present Value (NPV) relies on the following decision;

- The value of money today is greater than the value of money later on.

Because money is a tool to make more money! You can buy and sell goods or start a new business, so that earn more money with your current capital.

In our cost benefit analysis example, your company is deciding to undertake a project which longs for three years. The expected total project cost is $ 15,000 today and the expected income after three years will be $25,000. The discount rate is 10%.

Now we will analyze if that is a good investment or not by using Cost Benefit Analysis and Net Present Value.

The Value of Money Today: $ 15,000.

The Present Value (PV) of $ 25,000 is;

PV= $ 25,000 / (1,10 × 1,10 × 1,10) = $ 18,783 now (to nearest cent)

So, if the discount rate is %10, that investment is worth $ 3783. Your company can undertake the project because $ 3783 is a positive value.

A Simple Cost Benefit Analysis Example and Calculation Steps

Let’s assume that a board chairman of a construction company claims his team to make a comparison between two potential real estate development projects. He also reminds them that the company’s financial health is getting poor so he has to select one of them.

The team works and lists below the potential incomes and costs of each project.

Assumptions

Note: In order to simplify the cost benefit analysis example, we will not use a discount rate for each cost and income.

Project 1

– 500 housing units will be constructed.

– 400 of them will be sold and 100 of them will be rented for 20 years.

– Rental Price of each unit is 4,000 USD per year

– Rented 100 units will be sold 70,000 USD after 20 years.

– Construction Cost of each unit is 100,000 USD.

– The sale price of each unit is 120,000 USD.

– The project needs a luxury sales office with a price of 2,000,000 USD.

– The sales personnel cost is 300,000 USD per year.

– The project duration is 3 years.

– Project financing cost is 3,000,000 USD per year

Project 2

– 400 housing units will be constructed.

– 350 of them will be sold and 50 of them will be rented for 15 years.

– Rented 50 units will be sold 80,000 USD after 15 years.

– Rental Price of each unit is 4,500 USD per year

– Construction Cost of each unit is 90,000 USD.

– The sale price of each unit is 135,000 USD.

– The project needs a luxury sales office with a price of 3,000,000 USD.

– The sales personnel cost is 250,000 USD per year.

– The project duration is 2 years.

– Project financing cost is 2,500,000 USD per year

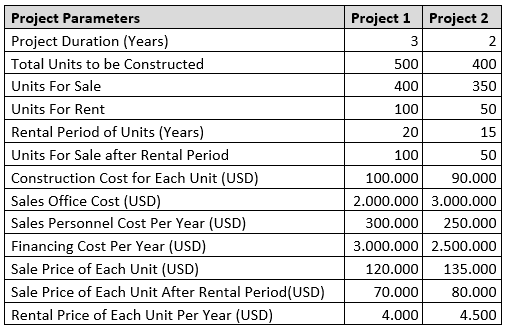

Comparing the Project Parameters

In this cost benefit analysis example, we will calculate the amount of money to be spent and the amount of money to be earned from each project to address economic efficiency.

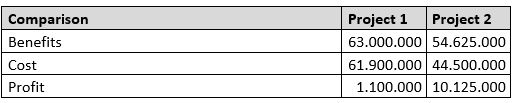

Below table summarizes all the given project parameters.

Cost Calculations

Below table summarizes the project costs.

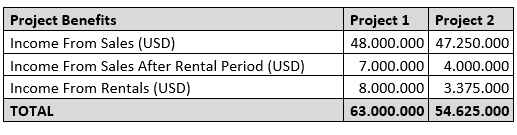

Benefit Calculations

Below table summarizes the project benefits.

Costs and Benefits Comparison

Cost Benefit Analysis-Costs and Benefits Comparison

In this simple cost benefit analysis example, there are too many parameters affecting the board’s decision. Financing costs per year, units for sale, units for rent, total units to be constructed are some of them that make decision making difficult.

The above table summarizes the benefits, costs, and profits of each project. Although the income of Project 1 is more than Project 2, the costs of Project 2 are less than the costs of Project 1.

It is obvious that Project 2 is more profitable than Project 1. If the board chairman selects Project 2, the company will earn more profit by spending less money.

This simple example shows that Cost Benefit Analysis is a useful calculation tool in economics. Decision makers often use it while comparing multiple projects.

Another Real-World Cost Benefit Analysis Example

In the following cost benefit analysis example, three basic steps;

- Conducting a brainstorming session to determine all the costs and benefits related to the decision.

- Assigning a monetary value to all the costs.

- Assigning a monetary value to all the benefits.

- Comparing costs and benefits to calculate the payback period.

Assume that you have a software company operating for three years and you are planning to speed up the delivery dates in order to meet the market demand. You have five coders working full time but you need three more coders to facilitate the testing process. Hiring three more coders requires additional investments such as buying additional furniture, computers, and leasing additional workspace.

Assumptions

- Yearly revenue is $100,000 but it will increase by %30 as the capacity increases.

- Every month you are outsourcing an average of 200 hours of work with a cost of $80 per hour to another software company for testing.

- The productivity of team members will increase by %5 with a more comfortable office environment.

Costs

| Cost Item | Details | Costs (in First Year) |

| Rental Cost | The additional rental cost of moving to a new office | $15.000 |

| Furnishing Costs | Painting walls and buying new furniture | $10.000 |

| Hiring Costs | Cost of hiring three more coders (inc. salaries, benefits, orientation and training, $40,000 for each and the rate of one hired coder is $17,36/hour (24 Days x 8 hours x 12 Months = 2304 hours)) | $120.000 |

| Software Costs | Buying three computers and software licenses | $10.000 |

| Downtime Costs | Approximately $20,000 will be lost due to downtime | $20.000 |

| Total Costs | $175.000 | |

Benefits

| Details | Benefits (within 12 Months) |

| %30 Revenue increase (Yearly revenue is 100,000 USD) | $130.000 |

| The rate of three hired coder is $52,08/hour, Cost of outsourcing is $80/hour. The Difference is (80 – 50,08) x200 hours x 12 months. | $67.008 |

| Improved productivity ($40,000x %5 x 8 Coder) | $16.000 |

| Expected Benefits | $213.008 |

In this cost benefit analysis example, payback period can be calculated as;

$175,000 / $213,008 = 0.821 of a year, or approximately 10 months.

It is often difficult to estimate the benefits rather than estimating costs. Because benefits are subjective and can be affected by the estimator’s bias. On the other hand, as a decision-making tool in economics, the cost benefit analysis often guides decision-makers to select the most effective alternative.

Cost Benefit Analysis Excel Examples

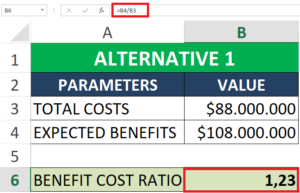

Example #1

ABC Chemical Ltd. is deciding which investment alternative is feasible considering costs and benefits of each of them.

Alternative 1

- Total Costs of Alternative 1 = $ 88.000.000.

- Expected Benefits s of Alternative 1 = $ 108.000.000

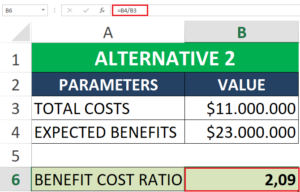

Alternative 2

- Total Costs of Alternative 2 = $ 11.000.000.

- Expected Benefits s of Alternative 2 = $ 23.000.000

Let’s decide which alternative ABC Chemical Ltd . should choose?

In order to decide which alternative is profitable, we will calculate the benefit-cost ratio for each one through a spreadsheet.

Excel Calculation for Alternative 1

= $ 108.000.000 / $ 88.000.000

Benefit-Cost Ratio = 1,23

Excel Calculation for Alternative 2

= $ 23.000.000 / $ 11.000.000

Benefit-Cost Ratio = 2,09

According to Benefit-Cost Ratio calculations of Alternative 1 and Alternative 2, both investment opportunities have positive outcomes. In other words, both alternatives are beneficial for ABC Chemical Ltd. So the company will be in a good position it selects any of the alternatives. However, in that example, benefit-cost ratio of Alternative 2 is higher than benefit-cost ratio of Alternative 1. So, according to the Cost Benefit Analysis, ABC Chemical Ltd. should select Alternative 2, in the light of the information given above.

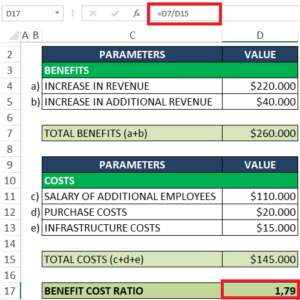

Example #2

Fox Car Maintenance Company is thinking to expand its current repair shop, and for that purpose, it will require additional vehicle mechanics and equipment. The owner of the company decides to make a cost benefit analysis to understand if that investment is beneficial or not. Here below you can find all the parameters related to costs and benefits.

- Hiring 5 more vehicle mechanics will provide a revenue increase by 45 % within one year. This expansion is planning to bring a revenue of $ 220.000.000.

- This expansion will increase the brand awareness of Fox Car Maintenance Company. Thus, this will bring additional revenue of $ 40.000.000.

- The salary of the new vehicle mechanics is around $ 110,000.

- The purchase cost of new equipment is $ 20,000.

- The cost of additional electrical and mechanical infrastructure will be around $ 15,000

Let’s perform a Cost Benefit Analysis for the given example.

Total Benefits (TB)

- Total benefits of the expansion: Increase in revenue of hiring 5 more vehicle mechanics + Increase in revenue of brand awareness

- TB: $ 220.000.000 + $ 40.000.000 = $ 260.000.00

Total Costs (TC)

- Total costs of the expansion: Salary of additional employees + purchase cost of new equipment + cost of additional electrical and mechanical infrastructure.

- TC: $ 110,000 + $ 20,000 + $ 15,000

- TC: $ 145,000

Now we will make the calculations by using Excel.

According to the Benefit-Cost Ratio calculations, the expansion of the current repair shop has positive outcomes. The Fox Car Maintenance Company should expand its business and employ new vehicle mechanics as well as purchasing new equipment and build new infrastructures.

Where to Use Cost Benefit Analysis? Example Scenarios

As discussed above, cost benefit analysis facilitates the course of the decision-making process across a wide variety of areas. It is applied to many disciplines from business to finance. You can take advantage of using cost benefit analysis when;

- Comparing two or more projects

- Deciding whether to start a new business

- Making the right hiring decisions

- Comparing investment opportunities

- Evaluating social benefits

- Evaluating policies

- Making decisions regarding changes

Summary

These simple but real-world cost benefit analysis examples show how to conduct cost benefit analysis in different situations. It is important to bear in mind the intangible benefits such as customer satisfaction, environment, employee satisfaction, or health and safety, historical importance while making cost benefit or benefit cost analysis in economics.

Because benefits do not only consist of revenues obtained from business actions but also consist of intangible factors. In order to make a correct cost benefit analysis, you need to calculate the current worth of future earnings with the help of financial techniques such as net present value.

Sometimes it may be difficult to compare the options that have very close values. At this stage, intangible factors affect the final decision.

Generally, these kinds of analyses are evaluated by high-level stakeholders, top management, and board members. After the selection of the project, they start the process of developing the project charter.

See Also

Expected Monetary Value Calculation

Further Reading

[1] The social CBA

A dedicated Career Coach, Agile Trainer and certified Senior Portfolio and Project Management Professional and writer holding a bachelor’s degree in Structural Engineering and over 20 years of professional experience in Professional Development / Career Coaching, Portfolio/Program/Project Management, Construction Management, and Business Development. She is the Content Manager of ProjectCubicle.

I am the student of environmental science department and progress my education

It’s very good

i am a student of Computer system Engineering and it is very helpful for me

ensoft, a software house, is considering developing a payroll application for use in academicinstitutions and is currently engaged in a cost-benefit analysis. Study of the market has shownthat, if they target it efficiently and no competing products become available, they will obtain ahigh level of sales generating an annual income of £800,000. They estimated that there is a 1 in10 chance of this happening. However, a competitor might launch a competing applicationbefore their own laun

NEED SOLUTION

The Board of Quest plc is due to meet to consider investing in a new project which will allow the company to diversify its existing product range. Before the meeting the Finance Director, has asked you, to evaluate the project using the following information.

Market research has been undertaken at a cost of HK$500,000 which shows that the project will result in the following cash flows:

Year 1

Year 2

Year 3

Year 4

Sales volume (units)

100,000

130,000

130,000

90,000

Selling price (HK$/unit)

472

523

551

660

Variable cost (HK$/unit)

275

315

351

403

Fixed costs (HK$)

8,760,000

9,030,000

9,320,000

9,610,000

These forecasts are after taking account of selling price inflation of 3·0% per year, variable cost inflation of 6·0% per year and fixed cost inflation of 3·5% per year.

In addition included in the fixed costs is a figure of HK$1,000,000 which represents an apportionment of general overheads. The balance of the fixed costs are incremental fixed costs which are associated with the new project.

The total machinery costs of the project in year 0 are estimated to be HK$40,000,000 and the machinery from the project will be sold for scrap with a value of HK$4,000,000 at the end of year 4.The company will also have to spend HK$ 3,000,000 refurbishing the building before the new machinery can be installed.

Quest plc pays corporation tax of 25% per year. This is paid in the following year (i.e. one year in arrears) Capital allowances on an 18% reducing balance basis are available on the machinery only. A balancing charge or allowance is available at the end of the fourth year of operation.

Quest plc has a real cost of capital of 9% and the general rate of inflation is 3.7%

Required:

Recommend to the Board whether the project should be undertaken by:

Calculating the nominal after-tax Net Present Value of the new project using the money cost of capital.(Round to the nearest whole number)

Calculating the Internal Rate of Return of the new project.

After the Board meeting, you were asked to consider the risk of the project and you have reported back to the board that the Expected Net Present Value and the Standard Deviation of the project are HK$1,290,000 and HK$1,640,000 respectively.

Required:

Calculate the percentage probability that the project will be value destroying (you can assume a normal distribution of outcomes.) and briefly discuss the difficulties of using probability analysis in incorporating risk into investment appraisal.

One of the directors thinks that incorporating inflation into the calculation in the way outlined above is too time consuming and just adds more costs to the business without giving a significant benefit.

Required:

Explain one other way that inflation can be incorporated in the NPV calculation and discuss which method you think the company should adopt.(use the figures above to support your answer)

can I have an example of cost-benefit analysis of a road construction project in excel form. please.

Very helpful. Thank you very much. May I have a a social cost benefit analysis = one that does not have financial or tangible benefits. For example, introducing social workers in schools to eliminate cases of child suicides.

1. A government is considering building a tunnel across a sea channel which can currently only be crossed by ship. The following Information is available.

(i) The tunnel will consist of a tow- truck railway and cars and passengers will be carried by train. It will cut crossing time by two hours for car and passengers.

(ii) The relevant categories of traffic are:

(a) Cars (and their passengers)

(b) Passengers not in cars

(c) Freight

(iii) The authorities who would operate the tunnel have decided to charge a toll which would maximize revenue. The toll that they have decided to charge is 160 per car which compares favorably with the charge by ship which is 200.

(iv) Because of the quicker and chipper journeys available, it is forecast that the following traffic per year for the foreseeable future will be diverted from the existing method of travel:

75,000 cars (with the average of two passengers)

50,000 passengers not in cars

350,000 tonnes of fright

In addition 50,000 extra car journeys (with two passengers each) will be made.

(v) The average value of passenger’s time is 6 per hours.

(vi) The diverted traffic will reduce the cost of operation of the existing ship by 40 million a year, while at the forecast levels of traffic, the maintenance and operating cost of the tunnel will be 3 million. Its capital cost will be 400 million. The life of the tunnel will be 50 years.

(vii) Assuming that the monetary figures given the above reflect social value, calculate the IRR of the streams of social costs and benefits.

2. A government is considering whether it should close down the branch line passengers services from station A to station B. no good are currently carried by rail. The chief accountant of the government estimate the annual cost of the train movement, track maintenance, signaling, and other expense to be 1, 520,000, including 120,000 toward depreciation and interest charges. If the line were closed at any time, the diesel train operating on it could be sold to another country for 240,000. Noting else has any re-sale value the line is used for 1000 single Journeys each day (250 days per year). The single fare is 4.00. So the line is losing money, a deficit met by taxation. If the line is closed, It is estimated that of the former journeys 800 will be made by bus (at the same fare) and 200 will not be made. The bus fare is the same as the rail fare and the extra bus fares exactly offset the bus operations extra cost. Bus journey takes an average of 40 minute longer than the rail journey. The average value of passenger’s time is 2 per hour. Enumerate the social costs and benefits associated with the proposal.