Tax Tips for Bloggers: How to Calculate Self-Employment Taxes

Understanding and calculating self-employment taxes is essential for achieving financial stability in freelance blogging. As a self-employed blogger, it’s up to you to pay self-employment taxes, also known as SECA taxes.

Table of Contents

This article will guide you through calculating and managing your obligations. We’ll delve into the intricacies of self-employment taxes, differentiate them from income taxes and explain the Self-Employment Contributions Act (SECA) tax.

By the end, you’ll have a solid understanding of how to determine your tax obligations, track and report income and make calculated payments to ensure you’re following IRS tax laws. You’ll empower yourself with the knowledge to navigate self-employment taxes as a freelance blogger.

Understanding Self-Employment Taxes

Self-employment taxes are the taxes you pay on your net earnings, and it’s crucial to differentiate them from income taxes, as they are separate tax obligations. These are governed by the Self-Employment Contributions Act (SECA) tax, which covers Social Security and Medicare taxes.

A complete understanding to calculate self-employment taxes can help you accurately assess your tax obligations and avoid surprises.

Determining Your Obligations

Managing taxes is no small feat. With deadlines to keep track of and IRS rules to follow, it’s up to you to manage each aspect. A good starting point is ‘checking if these apply to you.

You’ll need to assess whether your blogging activities fall within the IRS’ definition of self-employment. Once you establish this, you need to calculate your net earnings from self-employment, which considers your business income and deductible expenses. This is 15.3% of your adjusted gross income (AGI) and includes 12.4% Social Security contributions and 2.9% Medicare contributions.

Understanding to calculate self-employment tax rate is also essential, as it determines the percentage of your net earnings allocated to taxes. By accurately determining your self-employment tax obligations, you can effectively plan and budget for your tax payments throughout the year.

Tracking and Reporting Income

For freelance bloggers, tracking and reporting income is vital to managing self-employment taxes. It is crucial to have detailed records of all blogging-related income, including client payments, affiliate marketing, sponsored content, and other sources.Maintaining organized records ensures accuracy when calculating your net earnings from self-employment, directly impacting your self-employment tax obligations.

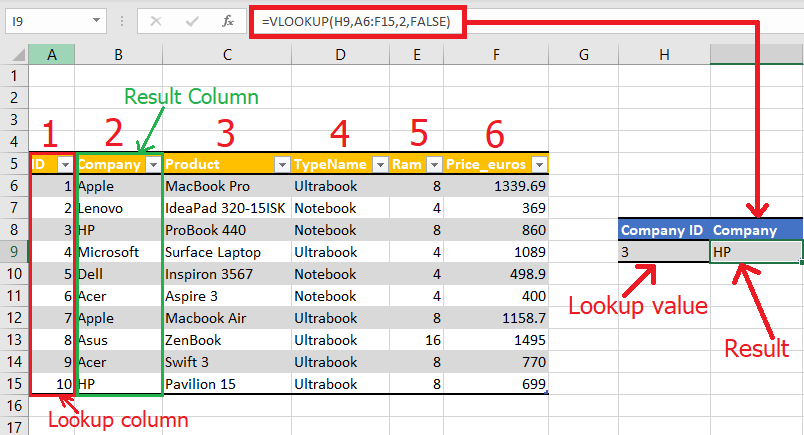

Various methods are available to track and document your payments, such as using accounting software, spreadsheets or dedicated online platforms. By diligently monitoring and reporting your income, you stay compliant with tax regulations and gain valuable insights into your blogging business’s financial performance.

Deductible Expenses and Self-Employment Taxes

As a freelance blogger, understanding deductible expenses is vital to reducing your liability. Deductible expenses are legitimate business costs that can be subtracted from your blogging income, lowering taxable self-employment earnings. For example, everyday deductibles for bloggers may include website hosting fees, professional development courses, office supplies, internet expenses, and marketing costs.

Knowing the rules and limitations surrounding deductible expenses is crucial, ensuring they are necessary and ordinary for your business. Taking advantage of deductible expenses can maximize your tax deductions and lower your overall self-employment tax burden. It is recommended to keep thorough documentation and consult with a CPA for guidance on eligible deductions.

Calculating and Paying Self-Employment Taxes

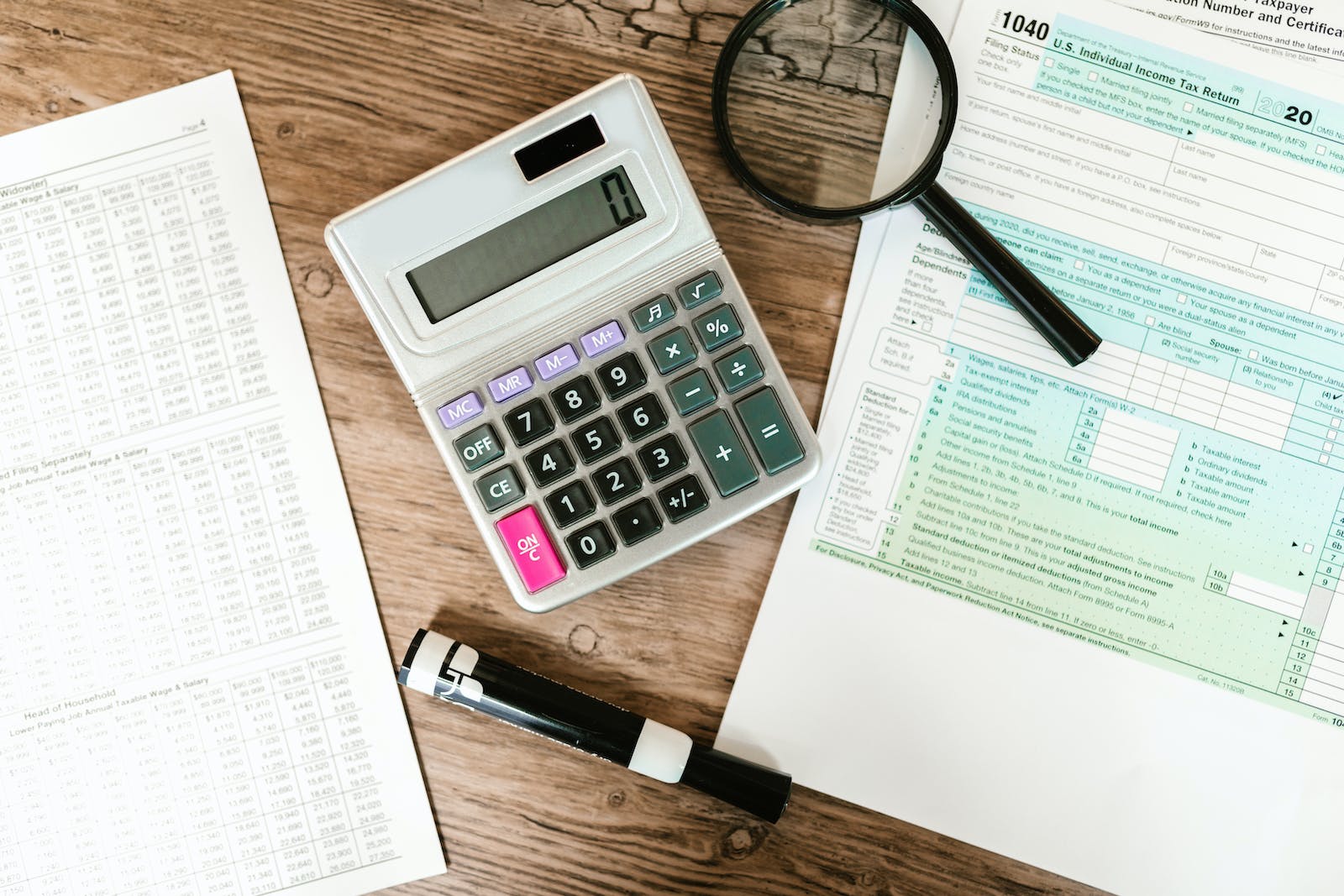

Calculating and paying self-employment taxes is a fundamental responsibility for freelance bloggers. To accurately calculate your self-employment taxes, you must complete Schedule SE, which determines the amount owed based on your net earnings from self-employment.

Knowing the due dates for payments is essential, as they typically coincide with quarterly estimated tax payments. If you are unable to pay your taxes timely, you can end up incurring penalties and interest charges. Fortunately, various payment options are available, including online fees, electronic funds withdrawal or mailing a check. You can maintain compliance and financial stability as a self-employed blogger by staying organized, keeping track of payment due dates, and fulfilling your tax obligations promptly.

Self-Employment Tax Considerations

When it comes to calculation considerations, there are essential considerations that freelance bloggers should be aware of. The Tax Cuts and Jobs Act changed self-employment tax rules, and it’s crucial to understand the implications. Additionally, self-employed individuals may claim the Qualified Business Income Deduction, which can further reduce their taxable income.

By staying informed about considerations, you can optimize your tax strategy and minimize your overall tax burden as a freelance blogger.

Tips for Minimizing Taxes

As a freelance blogger, there are strategies you can employ to minimize your expenses and liability and retain more of your hard-earned income. One practical approach is to reduce your taxable self-employment income by maximizing deductible expenses.

Keep detailed records and take advantage of all eligible business deductions. Think about making contributions to retirement plans created especially for independent contractors, like a solo 401(k) or a Simplified Employee Pension (SEP) (k). By doing this, you can invest in your future while also reducing your taxed income.

Conclusion

Navigating self-employment taxes is a crucial aspect of financial management for freelance bloggers. By understanding the intricacies of self-employment taxes, tracking and reporting income accurately, identifying deductible expenses and calculating and paying taxes diligently, bloggers can ensure compliance and minimize their tax burden.

It is essential to stay informed about considerations and explore strategies to reduce taxable income. Consulting with a tax professional is highly recommended to maximize tax deductions and available benefits. By proactively managing your income, freelance bloggers can achieve financial stability and focus on growing their blogging business with confidence. You can always look for a smart tax tool like FlyFin A.I. that automatically finds deductions for you.

11+ years strategic communications, marketing, and project management experience. I am a trainer at StarWood Training Institute, focusing on online courses for project management professionals.