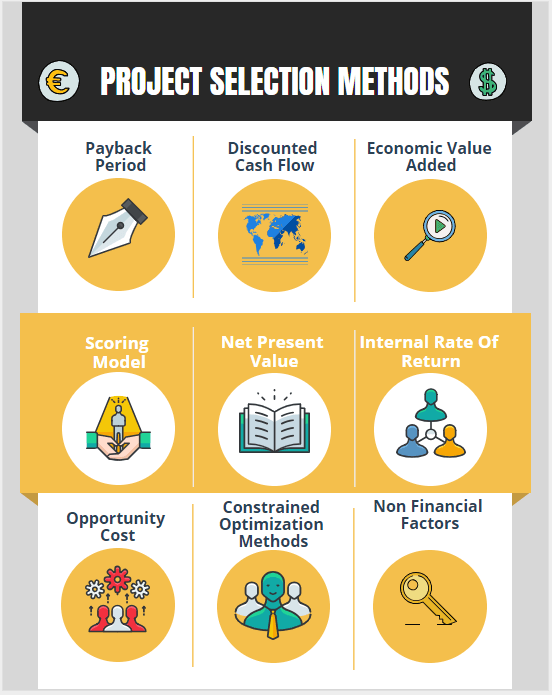

Understanding Project Selection Methods for Decision Making

The success of organizations is dependent on the profitability of projects that they select. Once an opportunity has appeared for a project, there are several reasons that need to be analyzed before an organization decides to take it up. Project selection is one of the most important processes that influence the future incomes and existence of an organization. Because the financial health of an organization depends on making right decisions and selecting profitable projects. There are various qualitative and quantitative project selection methods used to choose the best one among the alternatives. In this article, we will categorize the project selection methods and discuss non financial criteria for project selection. Note that this is an important concept from the PMP certification exam point of view.

Table of Contents

What are the Project Selection Methods ?

Let’s assume that you are working in a company which has been handed several project contracts. Due to the financial assumptions and constraints, it is not possible to perform all the project at the same time so your company should make a selection between them.

Now it is time to use the project selection methods. Basically, project selection methods involve a group of time tested techniques that aim to filter the projects with a high possibility of success. There are various methods for this purpose. Such methods can be classified into two main groups.

1. Benefit Measurement Methods

2. Constrained Optimization Method

Using these methods provide many benefits to the organization ‘ s future operations. It is better to select The Constrained Optimization Method for big and complex projects. If the project is small and less complex, the Benefit Measurement Methods can be more effective.

Benefit Measurement Methods

This method is useful for the projects which are based on the present value of estimated cash flow. In order to make a decision, the cost-benefit of each project can be calculated and compared with the other projects.

Payback Period

The payback period is the amount of time required to recover the cost of an investment. It is an essential project selection method that considers the ratio between the investment cost and average incomes of each period. For example, if the total cost of our project is $300,000 and expected return revenue is $100,000 per year, our payback period would be 3 years (measured from the date of project completion).

Basically, the project with the shortest payback period can be selected among the alternatives. Payback Period is a widely used project selection method because of its simplicity.

Discounted Cash Flow

In this method, the present value of a future return is calculated by using an applicable discount rate. Simply it calculates the future value of money which can not be the same as it is today.

Economic Model or Economic Value Added (EVA)

The Economic Model is an estimate that focuses on the return earned by the company. It is the net profit after deductions. The project with the highest economic value can be selected.

Scoring Model

The scoring model is one of the easiest models for project selection. In this method, the project selection team comes together and list the selected projects then determines the criteria for selecting. According to the determined criteria and priorities, each project is scored. The project which has the highest score will be selected by the management.

Net Present Value (NPV)

Net Present Value is the difference between the present values of cash inflows and outflows of the project. The project with the highest Net Present Value can be selected. Unlike the payback period model, Net Present Value (NPV) considers the future value of costs and incomes. However, there are some limitations of the Net Present Value (NPV). The Net Present Value (NPV) calculation requires estimating future costs and incomes. Estimations may be affected by the expert’s bias. Incorrect estimations may lead to wrong decisions.

Internal Rate Of Return

Internal Rate Of Return is the interest rate which makes the Net Present Value zero. Simply we can say that it is the rate at which the present value of the inflow is equal to the present value of the outflow. The project with the highest Internal Rate Of Return can be selected.

Opportunity Cost

The Opportunity Cost also known as The Alternative cost is the value which is given up when choosing another project. The project with the lowest Opportunity Cost can be selected.

Constrained Optimization Methods

The constrained optimization methods are mathematical project selection methods which require complex mathematical calculations in order to decide which project has more benefits than another.

Below techniques are used in The Constrained Optimization Methods;

• Linear Programming

• Non-linear Programming

• Integer Programming

• Dynamic Programming

Summary

As discussed in this article, there are several methods available for selecting a project. Project selection methods provide tools and techniques to select the most suitable one among the alternatives. It is best for an organization to try different methods for the same project and analyze both results. If the project is small and less complex, the Benefit Measurement Methods can be more effective and The Constrained Optimization Method can give correct results for big and complex projects.

While selecting a project, non financial criteria for project selection must also be considered. Customer relationships, political issues, customer satisfaction, stakeholder’s expectations are some of the criteria that must be classified as non financial criteria for project selection.

In this article, we discuss the project selection methods from a different point of views. However, there are also qualitative project selection methods available such as Delphic Method, Powell Barkhi Method, etc. Understanding both qualitative and quantitative project selection methods will help you to determine the best alternative among others. Note that you can encounter one or more questions in the PMP Exam related to the topic.

External Reference

kilthub.cmu.edu

See Also

Adhar Dhaval is experienced portfolio, program and project leader with demonstrated leadership in all phases of sales and service delivery of diverse technology solutions. He is a speaker sharing advice and industry perspective on emerging best practices in project leadership, program management, leadership and strategy. He is working for the Chair Leadership Co.