Risk Management: What is Backstop? Insights, Examples, Tips, and Tricks

Introduction

Risk management is not just a buzzword; it’s a necessary component of any robust financial strategy. Whether you’re running a corporation, leading a government agency, or simply managing personal investments, the concept of a backstop should be central to your financial planning. This comprehensive guide aims to demystify the concept of backstops in risk management. It will lead you through its historical context, explain its application across different sectors, and differentiate it from its often misunderstood cousin, the bailout. What’s more, this guide will provide you with actionable tips and strategies to make the most of backstops in your financial planning. So let’s dive in.

Table of Contents

Backstop

Backstop: Risk Management – The Foundation

A Brief Historical Context

The term “concept of backstops” has a diverse history, finding roots in various sectors from sports to finance. It gained significant traction in the world of financial risk management after the 2008 global financial crisis. Financial institutions and governments realized the importance of having a fallback mechanism to prevent the complete collapse of systems. Hence, the backstop emerged as a strategic financial tool for risk mitigation.

Financial Metrics and Risk Assessment: The Building Blocks

Before diving into backstop mechanisms, understanding key financial metrics is critical. Familiarize yourself with important risk assessment tools like Value at Risk (VaR), Stress Testing, and Scenario Analysis. These will provide you with a quantitative framework to measure potential losses and understand extreme but plausible adverse conditions under which your assets might suffer.

Understanding Backstops in Different Sectors

Understanding Backstops in Finance

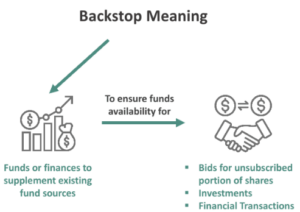

A backstop in finance serves as a safety net, activated when investments go awry or market volatility increases unexpectedly. It is essentially a last-resort guarantee that could take many forms such as revolving credit facilities, letters of credit, or government assurances. These mechanisms are designed to prevent financial free-fall, offering assurance to both investors and market players that there is a safety mechanism in place.

Understanding Backstops in Insurance

In the insurance sector, backstops often come as reinsurance agreements or catastrophe bonds. These financial instruments help insurance companies spread the risk of catastrophic losses, like those due to natural disasters. This way, insurance companies can maintain stability even when hit with high magnitude events, ensuring that they remain solvent and capable of meeting their obligations to policyholders.

Understanding Backstops in Industrial Operations

For sectors like energy, manufacturing, and utilities, concept of backstops can be physical or financial. Examples include excess production capacity to manage demand spikes or pre-arranged lines of credit to cope with sudden financial requirements. Essentially, industrial backstops are mechanisms to manage operational risks that could critically impair the ability to function.

Deciphering Backstops through Real-world Examples

Financial Backstops

In the European Debt Crisis, the European Central Bank (ECB) acted as a backstop for the eurozone countries by buying government bonds. This was a classic example of a financial backstop where an institution (ECB) provided a safety net for governments to prevent the collapse of economies.

Insurance Backstops

The Terrorism Risk Insurance Act (TRIA) in the United States serves as a backstop for insurers in the case of large-scale terrorist attacks. By sharing losses with the government, insurers are more willing to provide terrorism coverage, thus stabilizing the insurance market.

Industrial Backstops

In the energy sector, strategic petroleum reserves act as a backstop against sudden supply shocks. These reserves can be released to stabilize the market, controlling price volatility and ensuring continuous supply.

Applications of Backstops

Corporations and Enterprises

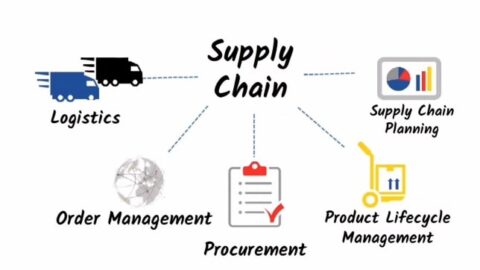

From mitigating foreign exchange risk to securing supply chain operations, backstops find multiple applications in the corporate world. They serve as an integral part of risk management strategies and offer an additional layer of security against market volatility, credit risk, and other unforeseen circumstances.

Government Interventions

During economic or social crises, governments often play the role of backstop to stabilize various sectors, including healthcare, finance, and infrastructure. Instruments such as emergency funds, economic stimulus packages, and sovereign guarantees are forms of government backstops.

Backstop and Individual Investors

For individual investors, derivative instruments like options and futures can serve as a backstop. These financial products can be structured to limit downside risk while potentially preserving upside gains.

How is a Backstop Different from a Bailout?

Mechanisms and Triggers

While both concept of backstops and bailouts are forms of financial safety nets, they differ in their triggers and operational mechanisms. A backstop is proactive and predetermined, coming into play under specific, pre-agreed conditions. In contrast, a bailout is reactive, initiated after a crisis has erupted to prevent further fallout.

Funding and Obligations

Backstops often require collateral or premiums and are generally well-defined in contractual agreements. Bailouts, however, often involve taxpayer money and can carry more nebulous terms, such as future equity stakes or regulatory oversight.

Unlocking Best Practices for Utilizing Backstops

Risk Analysis and Strategy Design

Detailed Explanation:

Before implementing any backstop, it’s vital to understand the landscape of potential risks and opportunities.

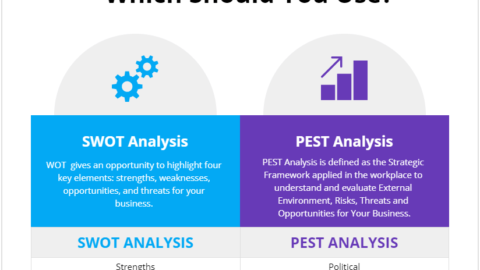

- SWOT Analysis: This classic approach helps you identify internal factors (Strengths and Weaknesses) and external factors (Opportunities and Threats) related to your business. Utilizing SWOT can clarify which weaknesses may necessitate a backstop and what external threats could make a backstop critical.

- PESTLE Analysis: This framework expands your focus to wider socio-economic factors that may impact your business. It can help you identify changes in legislation, economic downturns, or social trends that could be threats requiring a backstop.

Practical Tips:

- Use multiple team members or departments to conduct these analyses for diversified viewpoints.

- Turn the findings into actionable insights that inform your backstop strategy.

- Regularly update your analysis, especially when entering new markets or launching new services/products.

Source Identification and Due Diligation

Detailed Explanation:

Choosing the right source for your backstop is crucial.

- Financial Institutions: If you’re opting for a financial institution like a bank, look into its credit rating, long-term stability, and track record in honoring backstop arrangements.

- Government Bodies: Sometimes, especially in large infrastructure projects, government bodies act as backstops. Assess political stability, historical precedents, and bureaucratic efficiency.

- Due Diligence: This involves ensuring compliance with regulations, reviewing financial stability, and even conducting interviews or site visits as needed.

Practical Tips:

- Get legal advice during the due diligence process.

- Review cases where the entity has previously acted as a backstop to assess their performance.

- Perform ongoing monitoring, as the entity’s financial condition can change over time.

Avoiding Common Pitfalls

Detailed Explanation:

Several pitfalls can undermine the effectiveness of a backstop.

- Counterparty Risk: This is the risk that the entity providing the backstop will default or fail to honor the agreement.

- Contractual Terms: Reading the fine print helps you understand fees, activation criteria, and any limitations or conditions imposed by the backstop.

Practical Tips:

- Engage experts to evaluate the counterparty’s financial and operational health.

- Include exit clauses in the contract that allow for a relatively painless disengagement if conditions are not met.

Tips and Tricks for Robust Backstop Risk Strategy

Know Your Risk Tolerance

Your approach should be aligned with how much risk you’re willing to tolerate.

- Risk Averse: Consider multi-layered backstops, potentially from diverse sources, to maximize security.

Assess the Cost and Benefit

- Costs: These can be direct (fees, premiums) or indirect (opportunity costs of capital that’s held in reserve).

Timing and Activation Strategies

- Strategic Timing: Assess the best time to activate the backstop based on both financial metrics and broader market conditions.

Practical Tips:

- Have predefined metrics or indicators that will trigger the activation of your backstop.

- Conduct regular strategy reviews to ensure that your backstop remains aligned with your business objectives.

By implementing these practices, you’ll be well on your way to creating a robust backstop strategy that not only mitigates risk but also aligns well with your broader business strategy.

Conclusion

The concept of backstops is vital in the complex world of risk management. Whether you’re a multinational corporation, a small business, or an individual investor, understanding the dynamics, the benefits, and the potential pitfalls of backstops can equip you to make informed financial decisions. With the tips and strategies outlined in this guide, you’re now better prepared to navigate the challenging terrain of risk management.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/