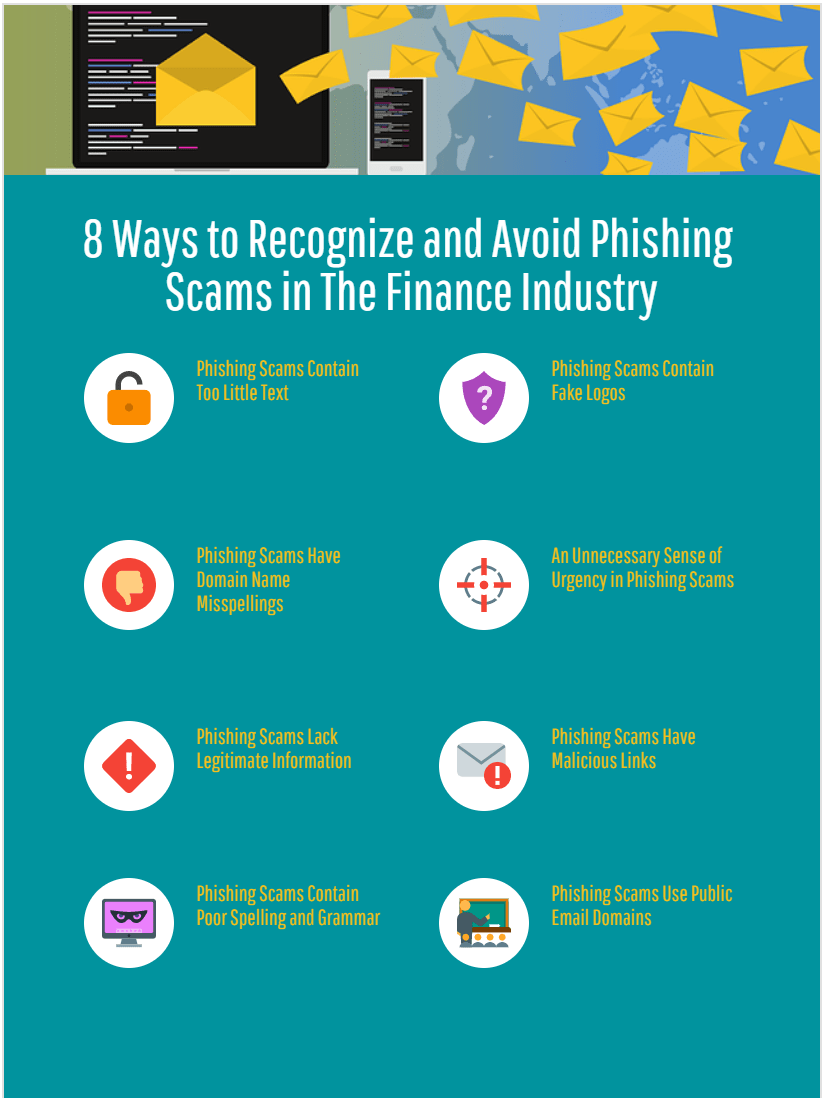

8 Ways to Recognize and Avoid Phishing Scams in The Finance Industry

Banks and other financial institutions have shifted most of their operations to digital platforms. This has created a revolution in credit and debit card fraud, making phishing and other scams soar. Today, digital banking fraud is more than people thought it was. It is now a massive international industry that’s growing daily.

The finance industry is consistently looking for ways to counter the sophisticated tools used by cybercriminals. However, their success depends on if they can identify various threats like phishing scams. This article discusses how the finance industry can recognize and avoid phishing scams.

Read on to find out more.

Table of Contents

1. Phishing Scams Contain Too Little Text

Many phishing emails do not contain a significant amount of text. Attackers know that a single click is enough to compromise a company’s network and data. Therefore, they rarely spend time writing too much text in emails. They only attack an image, short video, link, or anything else you’d click on easily.

Don’t be in a rush to click on an image or link sent without accompanying text. Start by checking the email to ensure it matches the address on the company’s website. If the two emails don’t match, block emails from that address and click the trash button to remove them from your inbox.

2. Phishing Scams Have Domain Name Misspellings

Buying a domain name is easy today; you can do it from the comfort of your living room. Cybercriminals have taken advantage of this convenience and are now spoofing websites. They create misspelled domain names that are almost indistinguishable at a glance to impersonate legit company websites.

The only way to avoid falling victim is to double-check a web address before opening a website. A spelling mistake on the domain name is a sign of a phishing scam. A wide variety of security tools such as firewalls or proxy server can help you block future access to such web addresses from your devices.

3. Phishing Scams Lack Legitimate Information

Some information doesn’t sound legit the first time you read it. However, many people ignore simple red flags and end up becoming victims of phishing scams. For instance, read and understand every word in the emails you receive before taking any actions.

Watch out for information that doesn’t match what the organization communicates in its emails. Also, be careful if the message sounds too good to be true. For instance, you can receive an email from a credit company purporting to repair credit for free. Cheap credit repair would sound more legit in this case.

Getting to great credit scores can push you to fall into such a credit repair scam. But then, you will be safer if you take your time to check if the email is legit. For instance, you can compare the contact information attached to the email with the organization’s website contacts.

4. Poor Spelling and Grammar

Phishing emails are notorious for poorly written spelling and grammar. Such emails mainly target the most gullible people because these criminals are people who can’t write proper English. With phishing, cybercriminals use automated tools to send the same email to thousands of addresses.

A reply to the email shows the criminal that you are likely to fall for more of their tricks. However, these are scams that you’ll have to be too naïve to fall victim to as an informed person. The top tip is to look out for grammatical errors and sentences that lack a good flow because they rarely make spelling errors.

Organizations only hire qualified people to handle their communication channels. Thus, small grammar mistakes are rare and almost unheard of in their emails. It is even easier to detect phishing when errors are all through the text. Being keen on such details can help you stay safe from banking fraud.

5. Fake Logos

Many people can’t differentiate genuine and fake logos. It is essential to know the logos of organizations that you do business with online. Cybercriminals want to ensure everything they use, from emails, web addresses, etc., look natural, and logos are no exception.

They create logos that have similar colors to those of the organizations they want to spoof. This is to thwart users who are not keen to verify if the logo looks authentic or not. However, you won’t miss any fake or malicious-looking attributes on the logo.

Click on the organization’s website and compare the logos if you are in doubt. This is a simple yet important thing that will save you from falling victim to credit or debit card fraud and losing great credit scores. Don’t ignore even the most minor malicious HTML attribute that you may note on a logo.

6. An Unnecessary Sense of Urgency

Phishing scammers often create a sense of urgency to make their victims act with haste. They know that you may notice that things aren’t okay if you have enough time to decide the next step. For example, they acknowledge that you’d have to verify if the email is from the actual organization.

Thus, they include subjects or calls to action asking you to act immediately. They include a prize that you risk losing if you fail to act within a specified period. This manufactured sense of urgency has made many individuals and businesses fall victim to banking fraud, losing a lot of finances in the process.

Criminals can also impersonate senior company managers then send them phishing emails. These emails could direct them, for instance, to reply with sensitive credit card information.

Employees may not realize this if not trained in cybersecurity, but it will turn to costly banking fraud. This may expose a business to credit card fraud and affect its corporate credit management.

7. Phishing Scams Have Malicious Links

You should avoid clicking on suspicious links and attachments at all costs. Infected attachments and links that lead you to malicious websites can lead to significant banking fraud. Most attachments contain malware that could have a devastating impact on your business if clicked on by an employee.

Teaching your employee how they can recognize malicious links can be helpful. For instance, shortened links are some of the tricks used by cybercriminals to launch banking fraud. Most emails containing such links may bypass Secure email gateways making it vital to avoid and delete them manually.

8. Phishing Scams Use Public Email Domains

Emails sent from public domains like Gmail are not likely to be from legitimate organizations. Only a few organizations use these domains as many have their domains on emails. Thus, you should not trust an email source if it has a public domain in its email address before you confirm.

The best thing to do is to look up the organization’s domain on the internet. This will help you find out if the email is from a bogus source or a legit one. You can also call the organization to confirm if their email address uses a public domain to avoid falling victim to a scam.

Conclusion

Phishing scams have increased in frequency and are becoming more sophisticated. Businesses in the finance industry are among those that these attacks have badly hit. For instance, phishing scams have contributed to a massive percentage of credit card frauds reported worldwide.

Knowing how you can recognize a phishing scam can help you avoid falling into a trap. The tips in this article will help you identify and avoid these scams, especially if you’re in the finance industry. It is also essential to train your employees to reduce your business’s exposure to these risks.

See Also

Dan has hands-on experience in writing on cybersecurity and digital marketing since 2007. He has been building teams and coaching others to foster innovation and solve real-time problems. Dan also enjoys photography and traveling.