7 Tips To Improve Insurance Project Management

Project management has proven to be an essential tool to the success of a business in any industry. Insurance businesses are now adopting the same to help them serve their clients better. Are you an insurance manager and are looking for ways to improve the insurance project management aspect of your operations? This article will assist you accordingly by giving you tips to follow to tell more about project management for insurance company matters.

Table of Contents

Read through for this insight and practice the following:

1. Adopt The Right Tools

For any project to prosper, you need to practice proper communication. Proper communication means delivering the right message to the right person using the appropriate channel.

To achieve this, you need to invest in appropriate communication channels. There are many to choose from, both for formal and informal needs. Adopt collaborative tools with features like live chats to help your team work better and easily share information for smooth project management for insurance company.

To communicate with your clients, use proper tools, such as emails and phone calls to portray professionalism. As part of creating the right communication channels, have policies on whom to contact regarding what matter and the protocols to follow. With these implementations, everyone will always be in the loop regarding projects, increasing their success rates.

Most insurance companies’ projects revolve around customers. It makes customers the centerpiece of any insurance, yours included. Therefore, you need to invest in insurance CRM tools. These tools will help you better your relationship with your clients. It will lead to customer satisfaction with your products and services, which is the end goal for any insurance company.

2. Bring Everyone On Board

When it comes to formulating and starting new projects, most executive teams tend to leave out some workers in the process. It is primarily due to their rank at work. However, this shouldn’t be the case. As an insurance project management business, you need to work as a team to realize your projects. A junior assistant might bring in insight that could be helpful in the execution of your project.

As part of the inclusion, you need to bring everyone on board regarding projects. Ask for everyone’s opinion on the matter. Let all members know why you think a given project is viable and essential to your business. With such an engagement, all stakeholders will embrace the project. It increases the project’s chances of success since everyone is invested in it. The same applies to any new technology you adopt.

3. Keep It Simple

There are many aspects related to executing insurance Project Management, from documents to a plan to technology to many other things. Many stakeholders are involved in implementing a project, all with different capabilities. Therefore, it’s essential to keep everything simple.

With simplicity, everyone will understand and do their part efficiently. No one will fail to undertake its responsibilities because they didn’t understand a particular aspect.

Once you maintain a simple project management plan, it will be easy to implement, helping you achieve it as planned.

4. Adopt A Proactive Approach

In an insurance agency, there are many uncertainties, especially when it comes to risks. Various risks arise every day, meaning you need to stay ahead to cover your clients’ needs efficiently.

Based on this, your team needs to sit down and assess the risks associated with a given project plan. It doesn’t end at identifying the risk; you need to formulate ways to mitigate these occurrences should they happen. With a potential problem and possible solutions, you should document them as a plan for Insurance Project Management. This way, if you don’t manage to prevent the risk from occurring, you have a plan in place to turn things around.

By adopting a proactive approach, you’re always ahead of any risk that might hinder the realization of your insurance projects.

5. Be Flexible in Project Management for Insurance Company

As stated earlier, there are many uncertainties involving the insurance industry, such as changing customer and market needs. It means that what was essential before might not be crucial today, hence the need to maintain flexibility in your operations.

Therefore, as you make your project plans, don’t make them too rigid that they can’t adopt any changes without altering the whole procedure. The market situation and clients’ needs should always be your guiding principle for insurance project management. Doing this will always make you ahead of the insurance game, putting you in a better position amongst your competitors.

6. Constantly Monitor Your Project Plan

In executing a project, several issues might arise that deviate you from the initial project schedule you had. It isn’t commendable, which is why you always need to review your plans.

Compare your actualization procedure against what you had laid out in the plan.

Are you still on track? If you aren’t, you need to ask yourself why. Understand the situations that led to misalignment and address them accordingly as the insurance project manager. With this said and done, get back on track with your original plan. These plans are mainly associated with your budget and time frame.

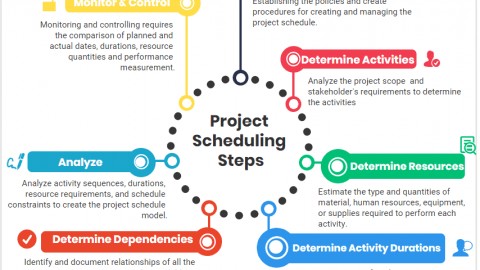

7. Practice Proper Scheduling

For the efficient execution of your insurance project plan, you need to plan your resources adequately, including your staff.

Without proper scheduling when doing Insurance Project Management, there’ll be a lot of redundancies without your team not knowing what they’re required to do. They’ll be working with no end goal, which is a recipe for the disaster of any project manager, insurance or not.

There are tools you can utilize to make scheduling possible and efficient. The first step is to break down your project into manageable activities. It will help you set clear and achievable goals for your team.

The second step is to allocate resources to these tasks. Please refrain from assigning tasks at the departmental level as you do this. Give each staff functions they need to do and include a time frame.

Such a system makes everyone know what’s expected of them regarding a given project. It allows for accountability in that, should anyone fail to execute a given role, be responsible for the project not happening. Nobody wants to be in this situation; this means working to fulfill the roles, leading to the realization of your projects.

Conclusion on Insurance Project Management

Project management in your insurance business as an insurance project manager doesn’t require much from you. With adequate planning and implementation of the tips given in this article, you’ll always realize all your projects.

The greatest thing to take home in this is to practice teamwork; you can’t achieve a project single-handedly at the end. After all, two heads are always greater than one.

Victor Z Young is a Civil Engineer with 35 years of experience working alongside the executive team of various construction companies. Victor specializes in construction insurance, delay analysis, performance analysis and engineering. He holds a Doctor of Project Management from Northwestern University.