The Importance of Enterprise Risk Management in Your eCommerce Business

In the modern business world, enterprises face various risks that can affect how efficiently they operate and influence whether they comply with regulations. Simply knowing these risks isn’t enough for your business to stay on top of threats. You need to manage or transfer the risks to make your enterprise resilient in an ever-changing and increasingly complex business environment. That’s where enterprise risk management (ERM) comes in. This article explores the meaning of ERM and why you need it in your business. You’ll also discover the five core components of ERM to see how your business should implement effective risk management.

Table of Contents

For the purpose of ensuring that organizations are able to accomplish their goals, risk management entails comprehending, analyzing, and mitigating potential risks. Therefore, it has to be proportional to the level of complexity and the kind of organization that is involved. Enterprise Risk Management, often known as ERM, is a method to the management of risk that is integrated and coordinated throughout a whole organization and all of its associated networks.

As a result of the fact that risk is present in everything that we do, the tasks that risk experts fill may take on an extremely wide variety of forms. They include positions in engineering, planning, financial services, business continuity, health and safety, and governance, as well as insurance and health and safety.

What’s Enterprise Risk Management (ERM)?

Enterprise risk management (ERM) is a comprehensive approach that focuses on identifying, assessing, and mitigating business risks that may interfere with an organization’s operations and objectives. It’s an organization-wide approach to handling risks.

In traditional risk management, each department in a business handles its own risks and manages control measures individually. This approach has a huge drawback, such that manageable threats for some departments might be serious risks for others in your business.

ERM overcomes this drawback by managing risks at the enterprise level. Instead of leaving each department to manage its own risks, you assess threats using an enterprise-wide lens. As a result, you end up with a cohesive, “big picture” risk strategy.

ERM helps you mitigate almost any type of business risk, but the most common ones include:

- Compliance risks that threaten your business because of violating industry regulations

- Legal risks that may result from lawsuits

- Financial risks that may affect your business’s financial health

- Strategic risks that influence a company’s long-term plan

- Operational risks that may affect your enterprise’s daily activities

Why You Need Enterprise Risk Management in Your Business

Here’s why you should implement enterprise risk management in your business:

- ERM provides a greater awareness of your enterprise’s risks and enhances your ability to respond: ERM gives you insights into all possible risks in your organization, including financial, reporting, compliance, and operational risks. Such risk awareness can dramatically improve your ability to mitigate threats.

- It makes your business operations more efficient and effective: The ERM approach manages risks as an interconnected portfolio instead of silos. Holistically evaluating threats makes business operations more efficient and effective in a way that siloed risk management programs cannot.

ERM ensures you have a clear framework for managing ALL risks so that you can continuously detect, evaluate, and monitor threats before they become serious issues.

- ERM improves your ability to comply with legal and regulatory requirements: Because ERM is an organization-wide risk management approach, it gives sufficient data to demonstrate that all threats are managed effectively. This reduces the chances of not complying with industry regulations.

- ERM has financial benefits: Enterprise risk management ensures you mitigate threats to avoid business disruptions, which saves you money. ERM also allows you to compare risks against opportunities, ensuring you take advantage of profitable business opportunities.

5 Core Components of Enterprise Risk Management

Below are the five core components of ERM that reveal how your business should approach enterprise risk management:

1. Objective Setting

Before determining whether to take a risk, you need to assess your business goals and purpose.

When assessing your business purpose, you should set objectives that support your enterprise’s goals and mission—ensure objectives align with your risk appetite.

2. Risk Identification

This ERM component involves defining and categorizing risks, which can be positive or negative.

When implementing ERM, review all risks that may affect your business goals. Whether the risks are internal or external, classify them as either opportunities or threats and then align them with the general business strategy.

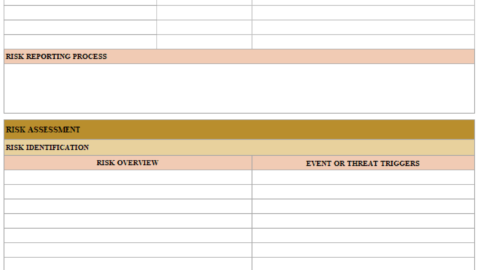

3. Risk Assessment

Here, the ERM framework details the steps of analyzing the impact of risks. You can assess risks by looking at how likely they can occur and their dollar impact.

4. Risk Response

After assessing the risks, you need to identify ways of responding should they occur. There are four ways of responding to risks:

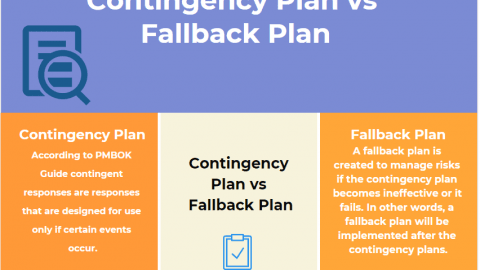

- Avoiding the risk: It involves abandoning the activity that causes the threat.

- Reducing the risk: You remain engaged in the business activity but implement methods to minimize the likelihood or effects of the risk.

- Sharing the risk: Businesses usually share risks by working with third parties.

- Accepting the risk: This involves analyzing possible outcomes and determining whether it’s financially wise to pursue mitigation practices.

5. Control Activities

Control activities are the actions you take to create policies and procedures that will mitigate identified risks. These activities are often called internal controls and can be broken into two processes:

- Preventive control activities: You implement them to stop risks from happening.

- Detective control activities: These control measures recognize when risks when occur to ensure you implement appropriate follow-up steps.

Enterprise risk management is valuable to every organization. It enables your business to resist, recover, and adapt to disruptions in a volatile and increasingly complex business landscape. You need an ERM strategy to create a resilient business.

Francois Simosa is the head of training for the Gragados Training Associates, which provides special project management and risk management training programs.