CAGR Formula in Excel: What is the difference between CAGR and XIRR? – projectcubicle

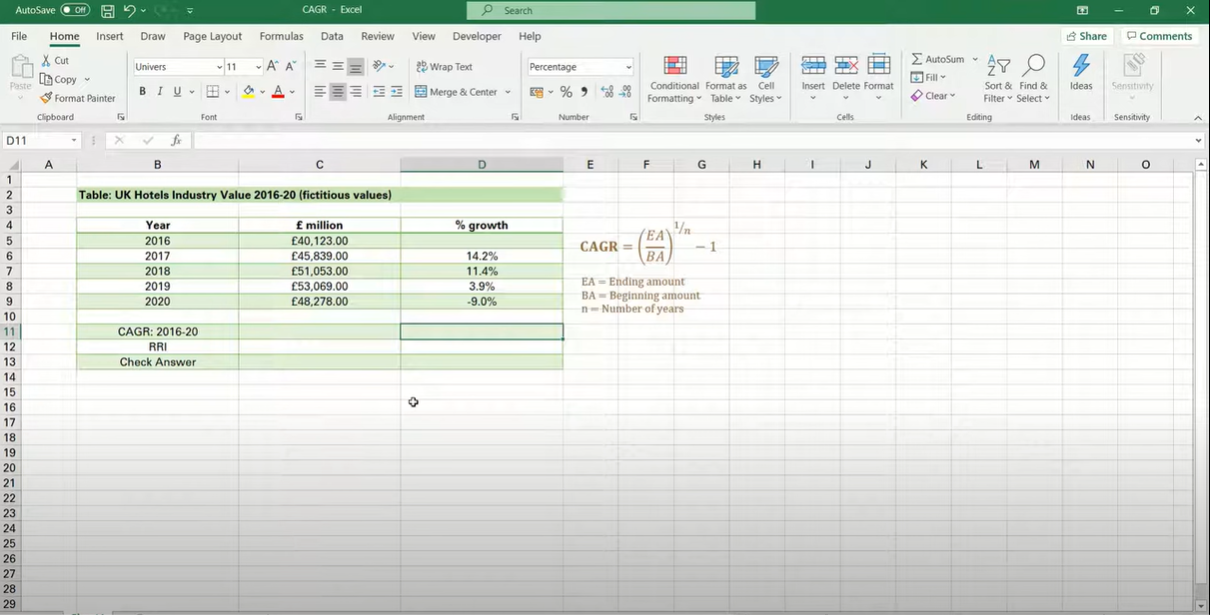

To calculate CAGR in Excel 2010, you must input the formula into an empty cell in your spreadsheet.

CAGR Formula in Excel: Understanding the Difference Between CAGR and XIRR

When evaluating investments or analyzing financial data in Excel, two common metrics used for measuring growth or returns are Compound Annual Growth Rate (CAGR) and Extended Internal Rate of Return (XIRR). While both metrics serve similar purposes, they have distinct characteristics and applications. Let’s delve into the differences between CAGR and XIRR:

1. Compound Annual Growth Rate (CAGR):

- Definition: CAGR is a measure of the annual growth rate of an investment over a specified period, considering the effect of compounding.

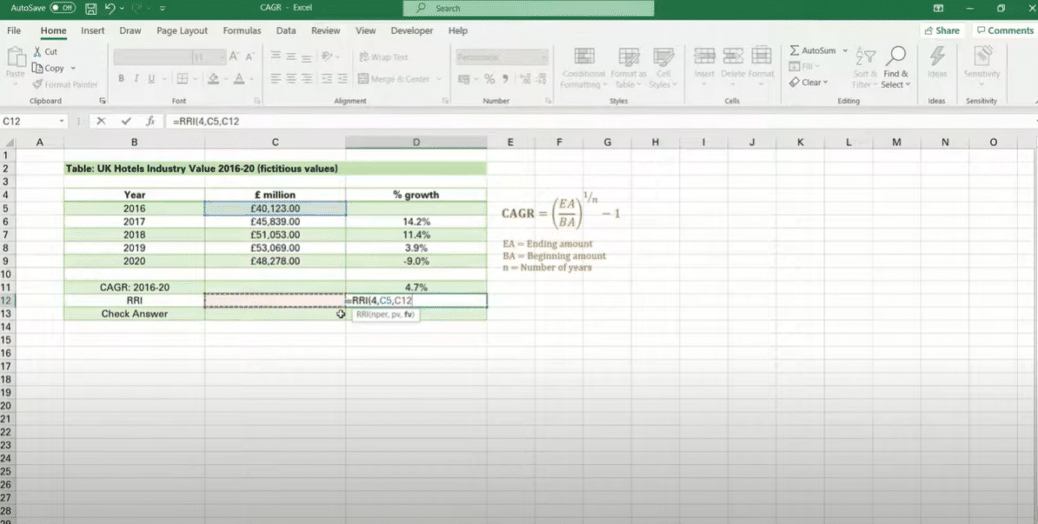

- Calculation: CAGR is calculated using the formula:

excel=((Ending Value / Beginning Value)^(1 / Number of Years)) - 1

- Usage: CAGR is typically used to evaluate the historical performance of investments with regular intervals, such as stocks, mutual funds, or business metrics, over a fixed period.

2. Extended Internal Rate of Return (XIRR):

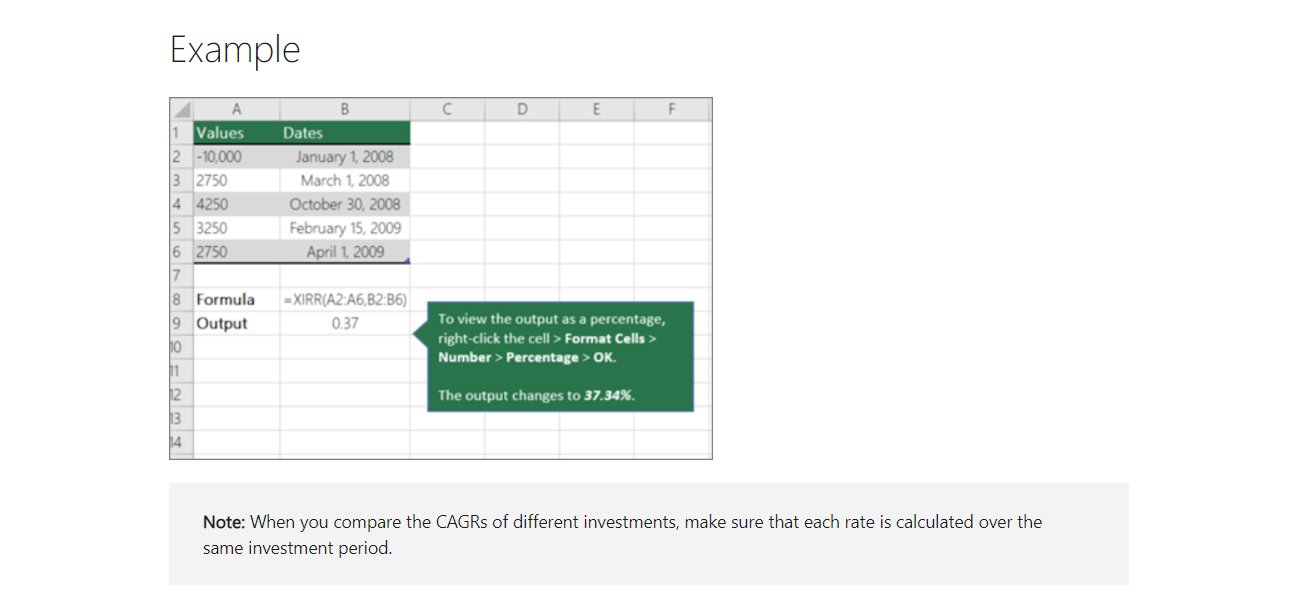

- Definition: XIRR is a metric used to calculate the annualized return rate of an investment with irregular cash flows over different periods.

- Calculation: XIRR is calculated using the XIRR function in Excel, which takes into account the dates and amounts of cash flows.

excel=XIRR(values, dates, [guess])

- Usage: XIRR is commonly employed when analyzing investments with non-uniform cash flows, such as loans, bonds, or investment portfolios with periodic contributions or withdrawals.

Key Differences:

- Regular vs. Irregular Cash Flows: CAGR assumes regular intervals for cash flows, making it suitable for investments with consistent growth patterns. In contrast, XIRR accommodates irregular cash flows, making it applicable to investments with varying contributions or withdrawals over time.

- Period of Analysis: CAGR typically measures growth over a fixed period, such as years. In contrast, XIRR calculates the annualized return rate considering the entire duration of investment, accounting for the timing and magnitude of cash flows.

- Application: While CAGR is widely used for evaluating historical performance and comparing investment options with regular intervals, XIRR is preferred for analyzing investments with complex cash flow structures or irregular contribution patterns.

Conclusion:

In summary, while both CAGR and XIRR are valuable metrics for evaluating investments and financial data in Excel, they serve different purposes and are applied in distinct scenarios. Understanding the differences between CAGR and XIRR is essential for accurately assessing investment performance and making informed financial decisions. Whether analyzing stocks, bonds, or investment portfolios, choosing the appropriate metric based on the nature of the investment is crucial for meaningful analysis and decision-making.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/