Exchange Rate Risk: A Comprehensive Guide from Beginner to Advanced

Introduction to Exchange Rate Risk

Exchange rate risk, often known as currency risk or foreign exchange risk, is a form of financial risk that arises when there is a fluctuation in the exchange rates of currencies. This risk is highly relevant for businesses and investors who operate internationally. For instance, let’s say a U.S. company sells goods in Europe; if the Euro weakens against the U.S. dollar, the company’s earnings in dollars may decrease even if the sales in Euros remain constant.

Table of Contents

Types of Exchange Rate Risk

There are three main types:

- Transaction risk: This risk manifests when the currency exchange rate changes between the time a business transaction is enacted and the time it is settled. For example, if a U.S. company agrees to purchase goods from a European supplier at €100,000, and the dollar weakens against the Euro, the U.S. company will end up paying more in dollars.

- Translation risk: This occurs when a company needs to consolidate its financial statements from foreign operations, typically from subsidiaries based in countries other than the home country. For instance, if a U.S.-based company has a subsidiary in Japan, the financials of that subsidiary would need to be converted to U.S. dollars for reporting purposes. If the yen strengthens against the dollar, the conversion would result in a loss.

- Economic risk: This is a longer-term form of risk that affects a company’s market value. For instance, if a country’s currency is consistently strong, it could make the country’s exports more expensive and less competitive in the global market.

Measurement and Quantification

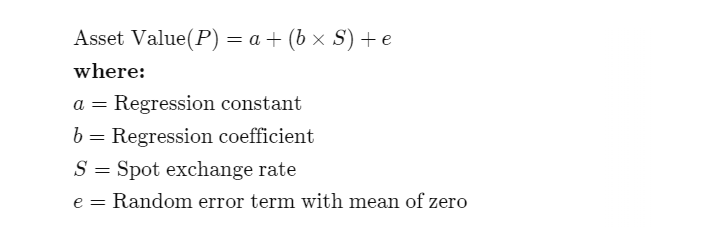

Exchange Rate Risk Calculation

Tools & Methods

- Forward Rates: One of the most common tools to manage exchange rate risk, forward rates enable you to lock in an exchange rate for a transaction that will occur in the future. For example, if you are a U.S. importer and you know you will need to pay a European supplier €100,000 in three months, you can enter into a forward contract to fix the current EUR/USD rate for that future payment.

- Value at Risk (VaR): This is a statistical technique that measures the maximum potential loss an investment portfolio could face over a specific period. For example, a VaR analysis might reveal that there is a 5% chance that a portfolio will lose more than $1 million over the next month.

- Sensitivity Analysis: This involves assessing how different changes in exchange rates will affect a company’s earnings and profitability. For instance, a company might model various scenarios where the currency increases or decreases by 10% to understand its impact on net income.

Accounting for Exchange Rate Risk

- Current Rate Method: This involves translating all assets, liabilities, income, and expenses in a foreign subsidiary’s financial statements at the current exchange rate.

- Temporal Method: This method uses different exchange rates for different items, based on their economic realities. For example, it might use historical rates for fixed assets and current rates for current assets.

Managing Exchange Rate Risk

Hedging Strategies

Forward Contracts

You can fix future currency rates with Forward Contracts. For example, expect dividends in British pounds? Use a forward contract to lock in today’s rate for future conversion to dollars.

Options

Options offer you a choice to exchange currency later, but don’t force you. Say you’re a U.S. company getting a big payment in Euros. An option lets you sell those Euros later at a fixed rate if you choose to.

Money Market Hedging

You can use Money Market Hedging to exploit differences in interest rates between two currencies. In a low-interest country? Borrow money there and lend in a high-interest country. This offsets your risk.

Futures

Futures are like forward contracts but standardized and traded on exchanges.

Natural Hedging

Balance your foreign receivables and payables. For instance, a U.S. company selling in the U.K. could use the pounds it earns to buy U.K. supplies. This natural hedge minimizes currency risk.

Diversification

Diversify to manage risk. A global company can offset losses in one market with gains in another. For example, operate in both Asia and Europe to spread your currency risk.

Real-world Implications

- Effects on International Trade: An appreciating currency can make exports expensive, affecting the trade balance.

- Impact on Foreign Investments: Changes in currency values can either erode or augment returns on foreign investments.

- Effects on Economic Policy: Governments might change economic policies to influence their currencies, affecting both companies and investors.

Best Practices

- Regular Monitoring and Forecasting: Always be aware of the market conditions and forecast the potential impacts on your currency exposure.

- Flexibility: Strategies need to be flexible to adapt to market changes, including new geopolitical events and economic policies.

- Diversify Currency Exposure: Never concentrate all your operations or investments in a single currency or region.

- Consult Experts: The world of foreign exchange is complex. Also, having a currency consultant or a financial advisor who specializes in this area can be invaluable.

- Continuous Learning: Keep abreast of market trends, new financial instruments, and emerging geopolitical events.

Scenario:

- A U.S. company agrees to pay €100,000 to a European supplier in 3 months.

- The current EUR/USD exchange rate is 1.1.

- The forward rate for EUR/USD for a 3-month contract is 1.09.

Risk Without Hedging:

Without hedging, if the EUR/USD rate goes up to 1.2 in 3 months, the U.S. company would pay:

€100,000 * 1.2 = $120,000

That’s an additional $10,000 compared to today’s rate (€100,000 * 1.1 = $110,000).

Hedging with a Forward Contract:

By using a forward contract at the rate of 1.09, the U.S. company would pay:

€100,000 * 1.09 = $109,000

Conclusion:

Using the forward contract, the company eliminates the uncertainty and ensures they pay $109,000, regardless of how the currency fluctuates. Also, they could potentially save $11,000 compared to the unhedged scenario if the EUR/USD rate goes up to 1.2.

In this example, the forward contract served as a valuable tool for managing transaction risk and safeguarding against unwanted surprises in the exchange rate.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/