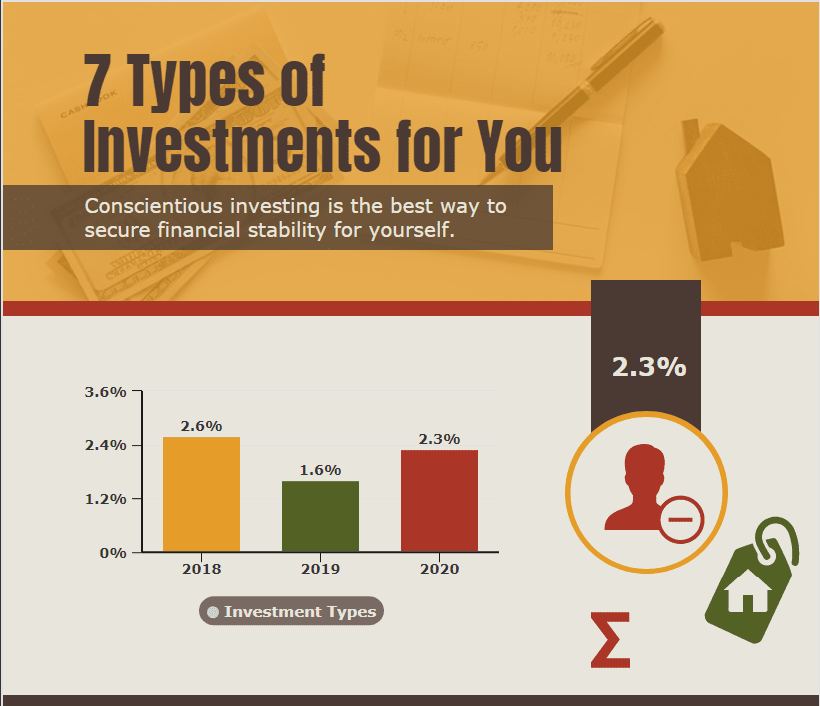

7 Types of Investments for You

Conscientious investing is the best way to secure financial stability for yourself. Since the Global Financial Crisis in 2008, people have become more fearful of investing their cash. According to Bankrate, this fear continues to grow. Surveys show that only one-third of the millennials from the population surveyed had invested in stocks since 2017. While it’s natural to feel skeptical about risking your hard-earned money, you shouldn’t let the thought of loss hold you back from saving and earning from different types of investing. Even billionaire investor Warren Buffet agrees that risks come from not knowing what you’re doing. Whether you look into stocks cryptocurrency or involve yourself in real estate, you need a mixture of knowledge, courage, and diversification to make the right choices about different types of investments.

Table of Contents

So, if you’re new to making investments and want to make sure you hit a bullseye on your first foray into this exciting world, read on:

1. Stocks – Essential Types of Investments

Stocks are the simplest types of investments. You can always start small and gradually increase the amount of money you invest. A stock represents partial ownership of a company. When you buy stock, you purchase a share of any publicly trading corporation of your choosing, such as the trillion-dollar company Apple. However, stocks can be extremely risky. While the return on investment is extremely high, there’s also a chance you may get nothing.

Factors like lack of supply and demand, wars, and a staggering economy may cost you. If you want to try your luck, make sure you learn how stocks work and gain some expertise in handling investments. A lucrative option would be to study financial analysis or investment banking to equip yourself with the necessary knowledge about stocks. If you’re looking for a fast-paced but worthwhile platform, Wiley Efficient Learning is here to help. The information you pick up as you study financial investments will support your efforts to gain maximum profit from your investments.

Knowledge about types of investing and stocks, how to invest in them, and when to invest can be crucial in determining your success with stocks. For instance, Common Stocks, also known as Ordinary Stocks, are the most popular kind. Once you invest in common stock, you get voting rights on corporate policies but lower dividends. However, if you involve yourself with preferred stock, you will get a high value in dividends before the rest of the ROI goes to common shareholders. So, weigh the risks, the amount of capital you have, and study the stock market before deciding.

2. Index funds

Index funds are investment funds that match the market’s performance by setting a benchmark such as Standard & Poor’s 500 (S&P 500) or NASDAQ 100. So, when you invest in an index fund, your cash goes into a company with the same set index benchmark. It will allow your investment portfolio to diversify into different types of investing. And save you the hassle of individually picking out shares. Most market indexes also have a great ROI. Although the S&P tends to fluctuate, you still get an over 10% return on your investments.

Index funds also don’t require active engagement. You put down your money and let the fund passively track the market. It leads to lower management costs, also called expense ratios, allowing you to save costs. To try your luck with index funds, you should regularly invest in the S&P 500 and let your money build up gradually. Charles Schwab’s S&P 500 Index fund is an excellent option. With an expense ratio of almost 0.02% and no minimum investment rate.

3. Bonds

Bonds are loans taken out by a company that offers you security in the form of fixed income. Many corporate and government bonds get publicly traded over the counter. At the same time, a few organizations prefer selling you a bond in exchange for your money in private. So, in return for your investment, you receive an interest coupon through which a company will pay you the set interest rate over an interval. Eventually, these payments will hit the principal amount on the maturity date and cease.

Bonds are a risk-averse investment. If you are unfamiliar with stocks or index funds, you should play it safe. Most bonds charge you anywhere from 1% to over 10% of the total amount. So, you may need to pay either about $100 or slightly above $1,000 if you wish to purchase an $8,000 upward bond policy. The only factor you need to worry about is the interest rate. The bond value depreciates when interest rates go up, but this fluctuation is not typical.

4. Cryptocurrencies

While cryptocurrency is relatively new to the investment market, as of March 2022, it has a worth of over $1.6 trillion. Therefore, the idea of indulging in digital currency such as Bitcoin, Ethereum, and even Dogecoin, which started as a joke but became a stable option fast, are all your possible choices. Digital currency uses blockchain technology to keep buyers’ records and prevent tampering. However, since these blockchains are public, they operate without the bank or government supervision. So, you need to invest at your risk.

As a first-time investor, you will need to use cash, but once you become seasoned in operating the digital market, you can invest your cryptocurrency. Unfortunately, this type of investment is also prone to high fluctuations. Therefore, if you buy digital assets with a credit card, you may not only lose the investment but also find yourself indebted under heavy interest rates. But at the same time, the ROI is very profitable. Just ask Elon Musk.

5. Real Estate

Real estate is one of the oldest yet most robust types of investing. Not only is it prone to inflation, but you can also buy and sell real estate whenever you like. You have many options when it comes to this type of investment. You may choose to invest in residential houses, purchase properties for industries, or have a share in commercial areas. You can also buy poorly maintained land for a low price and, after fixing it up, sell it forward for a much heftier profit. It is also known as flipping.

But, if you don’t want to purchase, fix or worry about selling land, buy a share in Real estate investment trust funds (REIT). These function like mutual funds, where a group of investors will pool their money with yours and let you dip your fingers into more extravagant projects. So, you can be a shareholder of a hotel or own several houses and accordingly get a percentage return on your investment.

6. Retirement Plans as Types of Investments

There comes a time when you wish to sit comfortably and enjoy the fruits of different types of investing. It is precisely where retirement plans come into play. While there are many retirement plans, you should focus on the two common ones. These are as follows:

- Employer-Sponsored Plans. An employer-sponsor plan includes the 401(k), the 403(b), the 457(b), and pension plans. These plans encourage you to invest in company funds for reduced taxation and a high return on investment once you retire. For the money you contribute, the company will provide a matching contribution. For every dollar, you get 50 cents with interest.

- Individual Retirement Account (IRA). An IRA is the most common type of retirement plan. You can go into a financial body such as a bank or the brokerage firm and open an investment fund account to purchase stocks, bonds, or invest cash for retirement. The IRS will monitor your activity and limit the number of contributions you can make to your account. Unfortunately, compared to the 401k, IRA has a much lower limit. In 2021 the maximum limit for the IRA was about $6,000, while the 401(k) was upward of $20,000.

7. Commodities

You can also invest in physical products like livestock, crops, fuel like oil, or metals like gold, and precious stones like diamonds are also on the list. It transforms you into a retail investor, but there is considerable risk involved with products. You need to put in a large amount of money. And hoping that the commodity will stay in demand and not lose value.

Unfortunately, the poor political situation of a country, weather patterns, low harvest, and lack of consumer needs can make you lose money heavily. So instead of picking out commodities exclusively, you should purchase them through stocks or mutual traded funds by pooling money with investors to buy the same product.

Final Thoughts on Types of Investments

Investments enable you to secure your financial future by providing an outlet for growing your assets through different types of investments. However, the process can be risky, with several losses marking your choice. If you play it safe and invest in more than one option, you can make good money. The most common option is stock investments. Most beginners try their luck with the stock exchange, and so can you.

If you prefer low-risk choices, go for index funds and bonds as types of investing. If you’re a modern investor and want technology to provide you with an opportunity, consider cryptocurrency. The real estate market will also welcome you. Make sure before you hit retirement, you invest in a plan. If you are interested in investing in a whole new sector, consider exploring commodities. With these options in mind, you should have no trouble setting up a diverse portfolio for yourself today.

David is a dynamic, analytical, solutions-focused bilingual Financial Professional, highly regarded for devising and implementing actionable plans resulting in measurable improvements to customer acquisition and retention, revenue generation, forecasting, and new business development.