The Importance of Mobile Trading Platforms in 2024

As 2024 comes into full view, mobile trading has become the cornerstone of modern financial engagement, driven by rapid technological advancements and an ever-increasing demand for flexibility and real-time access. In particular, the landscape of forex trading has been revolutionized by mobile trading apps, transforming these platforms into indispensable global trading tools. This article delves into the current state of forex trading apps, their evolving role, and the future trajectory of mobile trading.

Table of Contents

What is the purpose of a mobile trading platform?

A mobile trading platform is a software application that allows investors to access and manage their portfolios from their smartphones or tablets. A mobile trading platform can offer various benefits, such as convenience, flexibility, speed, and security. With a mobile trading platform, investors can trade anytime and anywhere, monitor the market movements in real-time, execute orders faster, and protect their accounts with encryption and authentication features.

Pros and Cons of Trading with Mobile Apps?

Pros:

– Convenience: You can trade anytime, anywhere with your smartphone.

– Accessibility: You can access a variety of markets and instruments with a few taps.

– Flexibility: You can customize your trading platform and tools to suit your preferences and strategies.

Cons:

– Security: You may be vulnerable to cyberattacks, data breaches, or identity theft if your mobile app is not secure or updated.

– Connectivity: You may experience delays, glitches, or errors if your internet connection is unstable or slow.

– Distraction: You may be tempted to overtrade, chase losses, or ignore your trading plan if you are constantly checking your mobile app.

Forex Trading Apps: A New Era in Trading

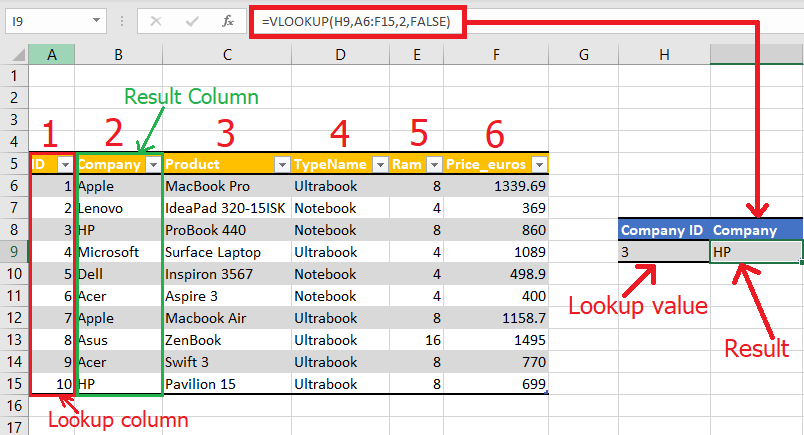

| Stock Trading App Market | |

| CAGR (2023 to 2033) | 21.1% |

| Market Value (2023) | US$ 34.98 billion |

| Key Growth Factor | Customer satisfaction is a crucial driver of market progress. |

| Opportunity | The increasing digitization across various industries presents significant growth opportunities. |

| Key Trends | The evolution of stock trading app development enables financial institutions to achieve new levels of profitability and innovation. |

The transformation brought about by forex trading apps has redefined the interaction between traders and the financial markets. These apps cater to a wide spectrum of needs, from basic trading functionalities to sophisticated analytical tools.

The stock trading and mobile trading app market is propelled by the integration of cloud-based solutions, which offer a wide range of benefits. These cloud-integrated stock trading apps provide performance analytics and insights into the financial status of the market. They excel in risk management, enabling efficient monitoring and intelligent decision-making.

Enterprises increasingly recognise the value of stock trading apps, particularly in data-driven financial decision-making. The precision and efficiency of these apps’ reports and features facilitate better decision-making.

The market’s end users, including banks, financial institutions, and accounting firms, are experiencing heightened demand for stock trading apps, which analyze market fluctuations and risks and send alerts to streamline transaction processing.

These advantageous features are driving substantial growth in the stock trading app market.

Platforms such as MetaTrader 4 and MetaTrader 5 epitomize this evolution with their comprehensive features and user-friendly interfaces, making them favourites among novices and experienced traders.

2024’s Leading Forex Trading and Mobile Trading Platforms

- MetaTrader 4 and MetaTrader 5: These platforms offer many tools, including multiple time frames, built-in indicators, and a secure trading environment catering to diverse trading strategies.

- Forex Hours: Essential for understanding optimal trading times, this app displays the opening hours of global forex markets and periods of peak activity.

- Investing.com: Offers real-time quotes for a broad range of financial instruments and an economic calendar, keeping traders updated with global economic events.

- NetDania Stock and Forex Trader: Provides real-time news and alerts, serving as a comprehensive market analysis tool.

- Forex.com: Known for its competitive spreads and robust mobile platform, it includes advanced charting options and effective portfolio management tools.

Choosing the Right Broker and App

Selecting the appropriate forex broker and app is crucial. It’s not just about the features; security, user experience, and compatibility with one’s trading style are paramount. Factors such as trading software development and updates, security measures, available trading pairs, and customer support are essential considerations.

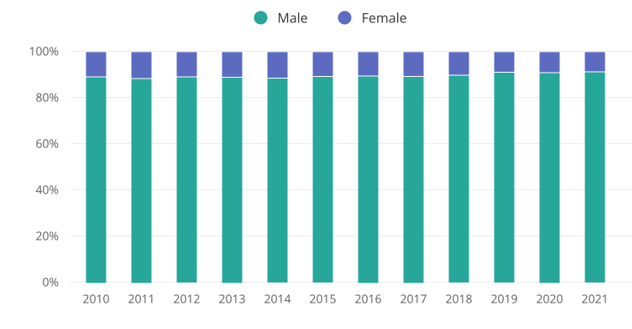

Demographic Trends and the Forex Market

Source: Zippia.com

For example, the demographic landscape of forex trading in the United States reveals a predominance of White traders, accounting for 67.1% of the total. Asian traders follow this at 12.1% Hispanic or Latino traders at 11.1%.

A closer look at the demographics over time shows a gradual diversification in the racial and ethnic makeup of forex traders. However, wage disparities remain a concern, with traders of unspecified ethnicity earning the highest average salaries, while Black or African American traders are at the lower end, averaging $97,737.

The Future is Mobile

Looking ahead, the significance of mobile trading apps in the forex arena is set to amplify. These platforms allow traders to engage with the market conveniently, quickly adapt to market changes, and access a wealth of information and tools.

In a market that operates around the clock, having the right mobile trading app is not just a luxury but a necessity for staying competitive and responsive.

Adapting to mobile trading involves more than just downloading an app. It requires a strategic shift, leveraging the benefits of mobile platforms to maintain an edge. This might include practising with demo accounts, staying updated with market news, and utilizing analytical tools for informed decision-making.

Conclusion

The forex trading landscape in 2024 is pivotal, marked by technological innovation and a shift towards mobile platforms. As traders continue to embrace these changes, choosing the right tools and staying informed about market dynamics has never been more critical.

With mobile trading apps, the world of forex trading is more accessible, efficient, and dynamic, offering unprecedented opportunities for traders worldwide. As we embrace this mobile-driven future, it’s clear that the way we approach forex trading will continue to evolve, reshaping the financial world in profound ways.

David is a dynamic, analytical, solutions-focused bilingual Financial Professional, highly regarded for devising and implementing actionable plans resulting in measurable improvements to customer acquisition and retention, revenue generation, forecasting, and new business development.