Risk Management: Accepting Risks for Success

Risk management is an essential aspect of any successful business strategy. While the word “risk” might invoke thoughts of uncertainty and danger, embracing risks can actually be a catalyst for growth and success. In Projectcubicle, we are entering a field that we have mentioned before but have not been able to fully analyse in depth: Risk acceptance. In this comprehensive guide, we will delve into the world of risk management and focus on the concept of accepting risks as a strategic approach to achieving business objectives. We will explore various aspects of risk management, from understanding different types of risks to implementing effective strategies, all while maintaining an optimistic outlook.

Table of Contents

Table of Contents

| Heading | Subheadings |

|---|---|

| Introduction | – Defining Risk Management: Accepting Risks (risk acceptance) |

| – The Importance of Risk Management | |

| Types of Risks | – Financial Risks |

| – Operational Risks | |

| – Reputational Risks | |

| – Market Risks | |

| – Technological Risks | |

| Benefits of Accepting Risks | – Driving Innovation |

| – Gaining Competitive Advantage | |

| – Expanding Market Presence | |

| – Enhancing Adaptability | |

| Strategies for Accepting Risks | – Risk Identification and Assessment |

| – Risk Mitigation Planning | |

| – Scenario Analysis | |

| – Collaboration and Communication | |

| – Continuous Monitoring and Adaptation | |

| Case Studies | – Company A: Embracing Technological Risks |

| – Company B: Leveraging Market Risks | |

| FAQ’s | 1. How can accepting risks lead to innovation? |

| 2. What role does communication play in risk management? | |

| 3. Are all types of risks worth accepting (risk acceptance)? | |

| 4. How can companies minimize potential negative outcomes of risks? | |

| 5. What are some common challenges in implementing risk management strategies? | |

| 6. Can risk acceptance (risk acceptance) be applied to non-business scenarios? | |

| Conclusion | – Embracing Risks for a Brighter Future |

Introduction

Risk management can be hard

Key Point About Risk Management:

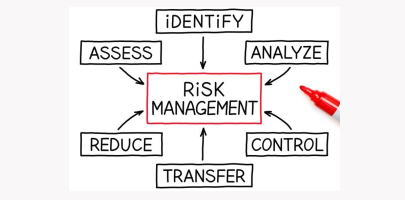

Effective risk management is crucial for any business or project. Key elements include:

- Risk Identification: Thoroughly identify potential risks that could impact your objectives, such as financial, operational, or market-related risks.

- Risk Assessment: Evaluate the likelihood and potential impact of each identified risk, allowing you to prioritize and allocate resources appropriately.

- Risk Mitigation: Develop strategies to minimize the likelihood or impact of risks, whether through process improvements, contingency plans, or diversification.

- Risk Monitoring: Continuously monitor the environment for changes that might affect identified risks, ensuring timely adjustments to your risk management strategies.

- Risk Communication: Maintain open channels of communication about risks among stakeholders, fostering transparency and informed decision-making.

- Risk Response Planning: Have well-defined plans in place to respond to specific risks if they materialize, enabling swift and effective action.

- Risk Reporting: Regularly report on the status of identified risks, mitigation efforts, and any updates to keep all relevant parties informed.

- Risk Culture: Cultivate a risk-aware culture within the organization, encouraging proactive risk identification and a willingness to address challenges head-on.

- Continuous Improvement: Regularly review and update your risk management processes based on lessons learned and changing business landscapes.

- Integration with Strategy: Integrate risk management seamlessly into your overall business strategy, ensuring alignment with long-term goals.

These elements collectively form a robust risk management framework that empowers organizations to navigate uncertainties and achieve sustainable success.

Defining Risk Management: Accepting Risks

Risk management involves identifying, assessing, and mitigating potential threats and opportunities that could impact the achievement of organizational goals. While traditional risk management focuses on minimizing risks, a paradigm shift towards accepting risks has gained momentum in the business world. Accepting risks does not mean recklessness; rather, it is a calculated approach that strategically evaluates potential benefits against possible negative outcomes.

The Importance of Risk Management

Risk management has become crucial for long-term sustainability in a rapidly evolving business landscape. Organizations that effectively manage risks are better equipped to navigate uncertainties, capitalize on emerging opportunities, and maintain a competitive edge. Accepting risks as part of a comprehensive risk management strategy enables businesses to address challenges and foster growth proactively.

Risk Management: Accepting Risks for Success

Types of Risks

Financial Risks

Financial risks encompass factors that could impact an organization’s financial stability. Also, these include market fluctuations, credit risks, liquidity challenges, and investment uncertainties. By accepting certain financial risks, businesses can pursue higher returns on investments and explore new avenues for revenue generation.

Operational Risks

Operational risks pertain to internal processes, procedures, and systems. These risks could arise from inadequate employee training, system failures, or supply chain disruptions. Accepting operational risks involves identifying areas for improvement and implementing measures to enhance operational efficiency and resilience.

Reputational Risks

A company’s reputation is its most valuable asset. Reputational risks arise from negative public perception, social media backlash, or ethical controversies. By accepting reputational risks and effectively managing them, businesses can demonstrate authenticity, transparency, and a commitment to rectifying mistakes.

Market Risks

Market risks stem from changing consumer preferences, competitive pressures, and regulatory changes. Embracing market risks involves staying attuned to market dynamics, adapting products or services, and exploring new markets to maintain relevance and competitiveness.

Technological Risks

Innovation often comes with technological risks, such as adopting new software or implementing disruptive technologies. Accepting technological risks requires careful evaluation of potential benefits, aligning with business objectives, and investing in the necessary infrastructure.

Benefits of Accepting Risks

Driving Innovation

By accepting risks associated with innovation, businesses create an environment conducive to breakthroughs. These risks can lead to the development of novel products, services, or processes that set the company apart from competitors.

Gaining Competitive Advantage

Accepting calculated risks can provide a competitive advantage. Whether it’s entering an emerging market or pioneering a new business model, accepting risks can position a company as an industry leader.

Expanding Market Presence

Accepting risks can open doors to new markets and customer segments. Businesses can diversify their offerings or explore untapped regions, contributing to revenue growth and brand expansion.

Enhancing Adaptability

Accepting risks fosters adaptability and agility. Businesses that are willing to embrace change are better prepared to navigate unexpected disruptions and pivot when necessary.

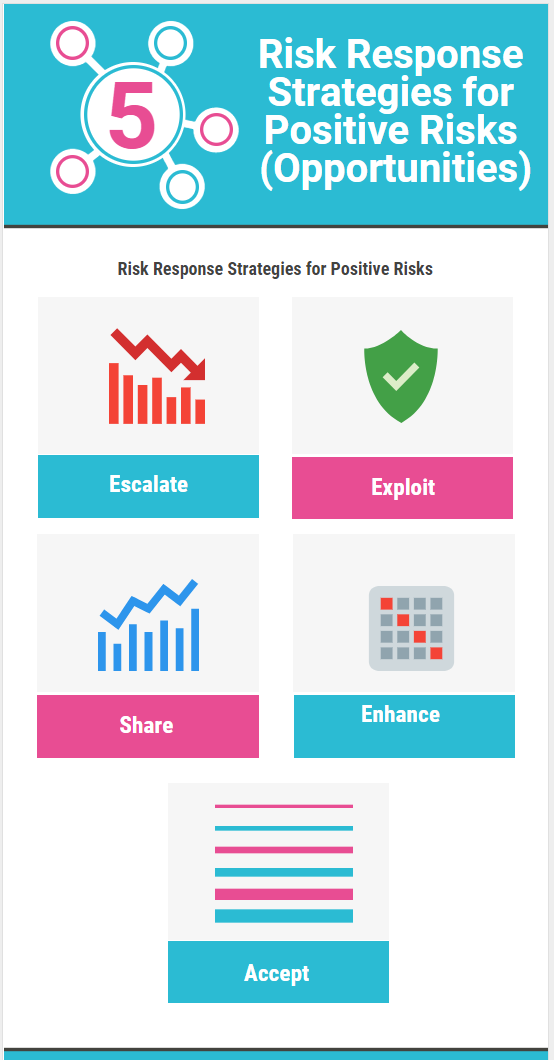

Strategies for Accepting Risks

Risk Identification and Assessment

The first step in accepting risks is identifying and assessing them. Also, this involves thoroughly analyzing potential risks, their impact, and the likelihood of occurrence. Also, quantitative and qualitative assessment methods help prioritize risks for further action.

Risk Mitigation Planning

Once risks are identified, businesses need to develop mitigation plans. Also, these plans outline strategies to minimize negative outcomes while maximizing potential benefits. Strategies could include contingency plans, resource allocation, and response protocols.

Scenario Analysis

Scenario analysis involves simulating various scenarios to understand how different risks might unfold. Also, this process aids in strategic decision-making by providing insights into the potential implications of accepting specific risks.

Collaboration and Communication

Effective risk management relies on collaboration and communication across all levels of an organization. By involving diverse perspectives, businesses can make informed decisions about which risks to accept and how to manage them.

Continuous Monitoring and Adaptation

Risk management is an ongoing process. Businesses must continually monitor accepted risks, evaluate their impact, and adapt strategies accordingly. Regular reviews ensure that risk management remains aligned with changing business dynamics.

Case Studies Risk Management

Company A: Embracing Technological Risks

Company A, a traditional manufacturing firm, recognized the need to digitize its operations to remain competitive. By embracing the technological risks associated with implementing advanced automation systems, the company streamlined production, reduced costs, and improved product quality.

Company B: Leveraging Market Risks

Company B, a global retailer, decided to enter a challenging but high-potential emerging market. The company gained early market entry, established brand recognition, and secured long-term growth opportunities by accepting the market risks related to cultural differences and economic fluctuations.

FAQs

- How can accepting risks lead to innovation? Also, embracing risks encourages experimentation and creativity, pushing businesses to explore new ideas and solutions that can lead to innovative breakthroughs.

- What role does communication play in risk management? Effective communication ensures that stakeholders understand the rationale behind accepting specific risks and the measures in place to manage them.

- Are all types of risks worth accepting? Not all risks are equal. Also, businesses must assess risks based on their potential impact, alignment with goals, and the organization’s risk tolerance.

- How can companies minimize potential negative outcomes of risks? Mitigation strategies, contingency plans, and thorough risk assessment can help minimize the negative impact of accepted risks.

- What are some common challenges in implementing risk management strategies? Challenges include resistance to change, inadequate risk assessment, and difficulties in predicting the future impact of accepted risks.

- Can risk acceptance be applied to non-business scenarios? Yes, risk acceptance principles can be applied to personal decisions, social initiatives, and other contexts where potential outcomes are uncertain.

Conclusion

In the dynamic landscape of modern business, embracing risks is not only a pragmatic approach but a strategic necessity. Accepting risks empowers businesses to innovate, adapt, and flourish in the face of uncertainty. Also, by identifying, assessing, and strategically managing risks, organizations position themselves for success while demonstrating resilience and the capacity to thrive in an ever-changing world.

Hello, I’m Cansu, a professional dedicated to creating Excel tutorials, specifically catering to the needs of B2B professionals. With a passion for data analysis and a deep understanding of Microsoft Excel, I have built a reputation for providing comprehensive and user-friendly tutorials that empower businesses to harness the full potential of this powerful software.

I have always been fascinated by the intricate world of numbers and the ability of Excel to transform raw data into meaningful insights. Throughout my career, I have honed my data manipulation, visualization, and automation skills, enabling me to streamline complex processes and drive efficiency in various industries.

As a B2B specialist, I recognize the unique challenges that professionals face when managing and analyzing large volumes of data. With this understanding, I create tutorials tailored to businesses’ specific needs, offering practical solutions to enhance productivity, improve decision-making, and optimize workflows.

My tutorials cover various topics, including advanced formulas and functions, data modeling, pivot tables, macros, and data visualization techniques. I strive to explain complex concepts in a clear and accessible manner, ensuring that even those with limited Excel experience can grasp the concepts and apply them effectively in their work.

In addition to my tutorial work, I actively engage with the Excel community through workshops, webinars, and online forums. I believe in the power of knowledge sharing and collaborative learning, and I am committed to helping professionals unlock their full potential by mastering Excel.

With a strong track record of success and a growing community of satisfied learners, I continue to expand my repertoire of Excel tutorials, keeping up with the latest advancements and features in the software. I aim to empower businesses with the skills and tools they need to thrive in today’s data-driven world.

Suppose you are a B2B professional looking to enhance your Excel skills or a business seeking to improve data management practices. In that case, I invite you to join me on this journey of exploration and mastery. Let’s unlock the true potential of Excel together!

https://www.linkedin.com/in/cansuaydinim/